filmov

tv

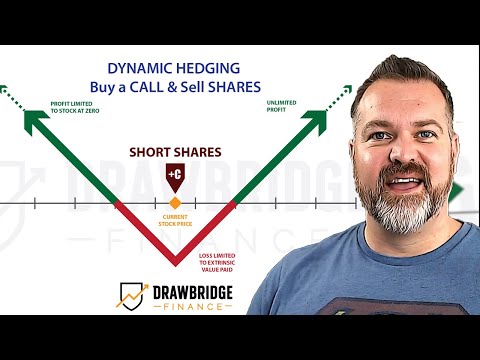

Delta Hedging Explained: Options Trading Strategies

Показать описание

Unlock the secrets of delta hedging with our comprehensive guide on options trading strategies. Discover how delta impacts option Greeks, and learn the difference between positive and negative delta to optimize your hedging techniques. Explore the dynamics of delta changes over time and with stock price fluctuations, and compare static versus dynamic hedging approaches. Gain practical insights with a detailed example of dynamic delta hedging, perfect for both novice and experienced traders looking to achieve delta neutral portfolios.

🎓 Tutor With Me: 1-On-1 Video Call Sessions Available

👨💼 Freelance Financial Modeling Services:

📚 CFA Exam Prep Discount - AnalystPrep:

📘 FRM Exam Prep Discount - AnalystPrep:

Chapters:

0:00 - Intro to Delta in Option Greeks

0:57 - Hedging: Positive Vs Negative Delta

2:22 - Option Price Change Based on Delta

3:03 - What is Delta Hedging?

3:57 - Delta Neutral Portfolios Explained

5:29 - Delta Changes Over Time

7:43 - Delta Changes With Stock Price

9:01 - Static Hedging Vs Dynamic Hedging

10:22 - Dynamic Delta Hedging Example

*Disclosure: This is not financial advice and should not be taken as such. The information contained in this video is an opinion. Some of the information could be wrong. This channel is owned and operated by Portfolio Constructs LLC. Some of the links above are affiliate links, meaning, at no additional cost to you, I will earn a commission if you click through and make a purchase.

🎓 Tutor With Me: 1-On-1 Video Call Sessions Available

👨💼 Freelance Financial Modeling Services:

📚 CFA Exam Prep Discount - AnalystPrep:

📘 FRM Exam Prep Discount - AnalystPrep:

Chapters:

0:00 - Intro to Delta in Option Greeks

0:57 - Hedging: Positive Vs Negative Delta

2:22 - Option Price Change Based on Delta

3:03 - What is Delta Hedging?

3:57 - Delta Neutral Portfolios Explained

5:29 - Delta Changes Over Time

7:43 - Delta Changes With Stock Price

9:01 - Static Hedging Vs Dynamic Hedging

10:22 - Dynamic Delta Hedging Example

*Disclosure: This is not financial advice and should not be taken as such. The information contained in this video is an opinion. Some of the information could be wrong. This channel is owned and operated by Portfolio Constructs LLC. Some of the links above are affiliate links, meaning, at no additional cost to you, I will earn a commission if you click through and make a purchase.

Комментарии

0:14:11

0:14:11

0:14:32

0:14:32

0:10:32

0:10:32

0:09:30

0:09:30

0:19:41

0:19:41

0:05:18

0:05:18

0:12:17

0:12:17

0:10:28

0:10:28

0:36:54

0:36:54

0:19:46

0:19:46

0:12:56

0:12:56

0:01:56

0:01:56

0:47:40

0:47:40

0:14:21

0:14:21

0:08:03

0:08:03

0:12:09

0:12:09

0:13:40

0:13:40

0:13:29

0:13:29

0:14:46

0:14:46

0:05:39

0:05:39

0:19:46

0:19:46

0:16:49

0:16:49

0:06:07

0:06:07

0:14:44

0:14:44