filmov

tv

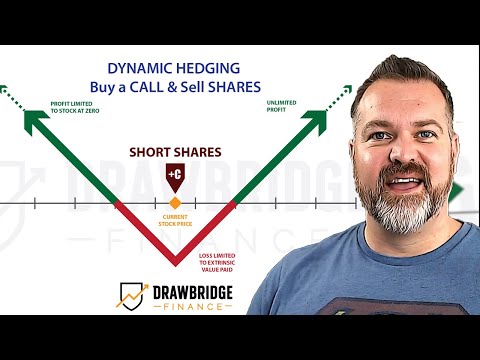

Dynamic option delta hedge (FRM T4-14)

Показать описание

to be notified of future tutorials on expert finance and data science, including the Financial Risk Manager (FRM), the Chartered Financial Analyst (CFA), and R Programming!

For other videos in our Financial Risk Manager (FRM) series, visit these playlists:

Texas Instruments BA II+ Calculator

Risk Foundations (FRM Topic 1)

Quantitative Analysis (FRM Topic 2)

Financial Markets and Products: Intro to Derivatives (FRM Topic 3, Hull Ch 1-7)

Financial Markets and Products: Option Trading Strategies (FRM Topic 3, Hull Ch 10-12)

FM&P: Intro to Derivatives: Exotic options (FRM Topic 3)

Valuation and Risk Models (FRM Topic 4)

Coming Soon ....

Market Risk (FRM Topic 5)

Credit Risk (FRM Topic 6)

Operational Risk (FRM Topic 7)

Investment Risk (FRM Topic 8)

Current Issues (FRM Topic 9)

For videos in our Chartered Financial Analyst (CFA) series, visit these playlists:

Chartered Financial Analyst (CFA) Level 1 Volume 1

#bionicturtle #risk #financialriskmanager #FRM #finance #expertfinance

Комментарии

0:19:46

0:19:46

0:12:56

0:12:56

0:14:11

0:14:11

0:10:32

0:10:32

0:19:46

0:19:46

0:14:44

0:14:44

0:03:56

0:03:56

0:14:32

0:14:32

0:12:40

0:12:40

0:07:26

0:07:26

0:06:55

0:06:55

0:19:41

0:19:41

0:07:50

0:07:50

0:06:00

0:06:00

0:32:22

0:32:22

0:06:34

0:06:34

0:12:37

0:12:37

0:10:28

0:10:28

0:22:29

0:22:29

0:05:18

0:05:18

0:49:42

0:49:42

0:03:59

0:03:59

0:09:30

0:09:30

0:09:36

0:09:36