filmov

tv

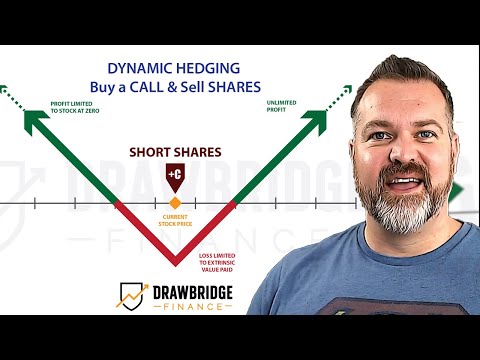

Dynamic Delta Hedging Explained In Excel

Показать описание

Explore the fundamentals of Dynamic Delta Hedging in this detailed tutorial, "Dynamic Delta Hedging Explained In Excel." Begin with an introduction to the delta hedging problem, and advance through practical steps such as time to maturity calculations and delta calculation using the Black Scholes model. Discover how to maintain a delta-neutral portfolio by adjusting your hedge weekly through trading shares, and understand how to calculate the costs associated with these strategies. This guide employs an example from John C. Hull's "Options, Futures, and Other Derivatives" to provide a clear application context in financial markets.

🎓 Tutor With Me: 1-On-1 Video Call Sessions Available

💾 Download Free Excel File:

📚 CFA Exam Prep Discount - AnalystPrep:

📘 FRM Exam Prep Discount - AnalystPrep:

Chapters:

0:00 - Dynamic Delta Hedging Problem Introduction

2:40 - Time to Maturity Calculations

3:19 - Calculate Delta Using Black Scholes

7:17 - Trade Shares to Hedge Weekly

9:33 - Calculate the Cost of the Hedge

*Disclosure: This is not financial advice and should not be taken as such. The information contained in this video is an opinion. Some of the information could be wrong. This channel is owned and operated by Portfolio Constructs LLC. Some of the links above are affiliate links, meaning, at no additional cost to you, I will earn a commission if you click through and make a purchase.

🎓 Tutor With Me: 1-On-1 Video Call Sessions Available

💾 Download Free Excel File:

📚 CFA Exam Prep Discount - AnalystPrep:

📘 FRM Exam Prep Discount - AnalystPrep:

Chapters:

0:00 - Dynamic Delta Hedging Problem Introduction

2:40 - Time to Maturity Calculations

3:19 - Calculate Delta Using Black Scholes

7:17 - Trade Shares to Hedge Weekly

9:33 - Calculate the Cost of the Hedge

*Disclosure: This is not financial advice and should not be taken as such. The information contained in this video is an opinion. Some of the information could be wrong. This channel is owned and operated by Portfolio Constructs LLC. Some of the links above are affiliate links, meaning, at no additional cost to you, I will earn a commission if you click through and make a purchase.

Комментарии

0:12:56

0:12:56

0:14:11

0:14:11

0:10:32

0:10:32

0:19:46

0:19:46

0:14:32

0:14:32

0:19:46

0:19:46

0:06:55

0:06:55

0:06:00

0:06:00

0:06:34

0:06:34

0:12:09

0:12:09

0:03:56

0:03:56

0:07:26

0:07:26

0:25:38

0:25:38

0:05:18

0:05:18

0:09:36

0:09:36

0:10:28

0:10:28

0:04:14

0:04:14

0:14:44

0:14:44

0:19:41

0:19:41

0:12:22

0:12:22

0:05:39

0:05:39

0:08:03

0:08:03

0:21:24

0:21:24

0:10:29

0:10:29