filmov

tv

Delta Hedging: How Options Traders Actually Influence Share Prices

Показать описание

In this episode, we look at delta hedging by market makers, and how this leads to markets actually being moved by extraordinary speculative option trading. While it obviously isn't the only reason prices move, delta hedging explains how derivatives can actually impact the price of the underlying.

► Take My Options Course!

► Subscribe to my weekly email!

► Support this Channel on Patreon!

►My Recommended Source for Real Estate Investing:

►iTrust Capital 1-Month FREE with Discount Code ($29.95 Savings)

Code: HERESY

#options #greeks #markets

I am not a CPA, attorney, or licensed financial advisor and the information in these videos shall not be construed as tax, legal, or financial advice from a qualified perspective. Linked items may create a financial benefit for Heresy Financial.

► Take My Options Course!

► Subscribe to my weekly email!

► Support this Channel on Patreon!

►My Recommended Source for Real Estate Investing:

►iTrust Capital 1-Month FREE with Discount Code ($29.95 Savings)

Code: HERESY

#options #greeks #markets

I am not a CPA, attorney, or licensed financial advisor and the information in these videos shall not be construed as tax, legal, or financial advice from a qualified perspective. Linked items may create a financial benefit for Heresy Financial.

Delta Hedging Explained: Options Trading Strategies

Delta Hedging Explained | Options Trading Lesson

What is Delta Hedging || Dynamic Delta Hedging like a Quant || Profit & Loss Options Trading

Delta Hedging: How Options Traders Actually Influence Share Prices

Advanced DELTA HEDGING Technique To SAVE Your Option Trades 💰

How To Delta Hedge Your Options Portfolio? I Delta hedging

How to Delta Hedge an Options Portfolio

Delta Hedging Explained - Options Trading Class

Four Ways to Trade S&P 500!

Option DELTA HEDGING Explained With Demonstration | LIVE OPTIONS TRADING

Delta Hedging of options / Options Trading tutorial / Lesson 12

Options Delta Explained: What it is & How to Trade it

The Market Impact From Delta Hedging a Huge $10 Billion Options Trade

Delta Neutral Hedging - Neutral Options Strategies - Options Trading Strategies

Power of Delta-Hedging in stocks or index options trading

How To Delta Hedge Your Options Portfolio

Hedging Deltas: Gamma, Vanna 101

Dynamic Delta Hedging Explained In Excel

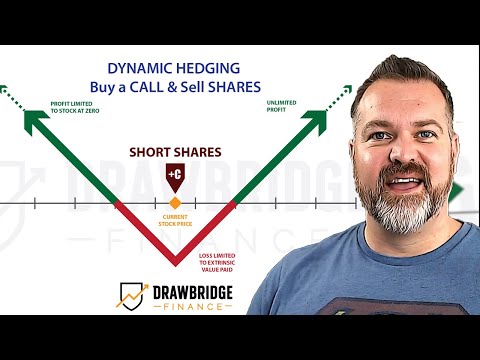

Dynamic Hedging Options - Make money if the stock moves either direction

8.6 Delta hedging - Deribit Options Course Basics

Delta Hedging My Options Portfolio (This Trick Saved Me A Fortune!)

Delta Hedging Options with Futures

Delta Hedging

Delta Hedging (to manage option positions)

Комментарии

0:14:11

0:14:11

0:14:32

0:14:32

0:10:32

0:10:32

0:14:46

0:14:46

0:19:41

0:19:41

0:10:28

0:10:28

0:09:30

0:09:30

0:09:30

0:09:30

0:12:06

0:12:06

0:12:17

0:12:17

0:07:40

0:07:40

0:16:49

0:16:49

0:12:45

0:12:45

0:05:18

0:05:18

0:10:37

0:10:37

0:13:40

0:13:40

0:12:09

0:12:09

0:12:56

0:12:56

0:19:46

0:19:46

0:05:39

0:05:39

0:04:03

0:04:03

0:21:10

0:21:10

0:47:40

0:47:40

0:01:56

0:01:56