filmov

tv

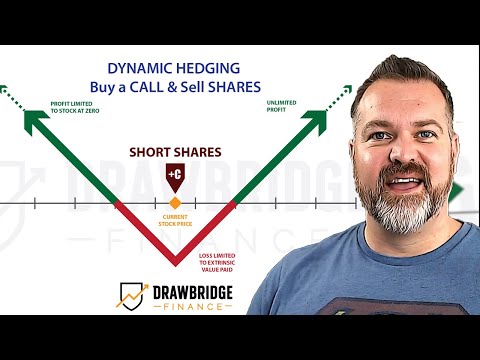

Dynamic Hedging Options - Make money if the stock moves either direction

Показать описание

Dynamic Hedging is a way to potentially make money if the stock moves down or massively takes off! It's super simple to execute and involves the shorting shares while simultaneously owning a long call. If the stock moves back and forth I make money off of the movement.

▬ Discount to Seeking Alpha Only $99/annually ▬▬▬▬▬▬▬▬▬

▬ BROKERAGES I USE ▬▬▬▬▬▬▬▬▬

▬ CONTENTS ▬▬▬▬▬▬▬▬▬▬

0:00 Intro into Dynamic Hedging

0:56 Download the Dynamic Hedging Record Keeper

1:39 Dynamic Hedging VS Straddle

2:48 Buying a Straddle in IBKR

3:29 Trading Checklist

5:29 Seeking Alpha Quant Rating

6:37 Entering a Dynamic Hedge in IBKR

8:47 Managing the Dynamic Hedge

9:26 How to record Trades

11:10 Calculate Position Delta

12:40 Risks of the Trade

13:05 Recording stock transactions

14:07 Daily Updates

17:40 Closing the Trade

▬ GREAT FINANCIAL BOOKS ▬▬▬▬▬▬▬▬▬

▬ Trading Computer ▬▬▬▬▬▬▬▬▬

▬ Cameras ▬▬▬▬▬▬▬▬▬

▬ Live Stream Gear: Video ▬▬▬▬▬▬▬▬▬

▬ Live Stream Gear: Audio ▬▬▬▬▬▬▬▬▬

—— As an Amazon Associate I earn from qualifying purchases ——

My primary investment strategy is long term high yield dividend investing, index funds and reducing risk and exposure using options. I have been actively trading the stock market for over 25 years and have built most of my wealth by reinvesting my dividends and following my 14 Personal Rules of investing. I actively trade options on both the American and Canadian Stock exchanges using options strategies and buying and holding high yield dividend paying stocks.

I generate monthly income in two ways. Averaging more than an annual 7% return by collecting dividends on high yield dividend stocks that I hold. The second income stream comes from the selling of option premium and taking advantage of theta decay. I love trading strangles, Iron condors and diagonal spread for maximizing returns. Delta neutral strategies allows me to make money in both bull and bear markets and limits my risk. Both of these strategies are suitable for passive income and create a stable predictable safe passive monthly income.

Let’s Get Rich Together

Levi Woods

Disclaimer: I am not a financial planner and am not offering investment advice. This is an opinion channel only and should not be taken as any form of financial advice. I receive a small commission from the purchase of any item from using the links listed above. There are financial risks involved in taking on any monetary transaction that I discuss in my videos.

#optionstrading #stockmarket #LetsGetRichTogether

▬ Discount to Seeking Alpha Only $99/annually ▬▬▬▬▬▬▬▬▬

▬ BROKERAGES I USE ▬▬▬▬▬▬▬▬▬

▬ CONTENTS ▬▬▬▬▬▬▬▬▬▬

0:00 Intro into Dynamic Hedging

0:56 Download the Dynamic Hedging Record Keeper

1:39 Dynamic Hedging VS Straddle

2:48 Buying a Straddle in IBKR

3:29 Trading Checklist

5:29 Seeking Alpha Quant Rating

6:37 Entering a Dynamic Hedge in IBKR

8:47 Managing the Dynamic Hedge

9:26 How to record Trades

11:10 Calculate Position Delta

12:40 Risks of the Trade

13:05 Recording stock transactions

14:07 Daily Updates

17:40 Closing the Trade

▬ GREAT FINANCIAL BOOKS ▬▬▬▬▬▬▬▬▬

▬ Trading Computer ▬▬▬▬▬▬▬▬▬

▬ Cameras ▬▬▬▬▬▬▬▬▬

▬ Live Stream Gear: Video ▬▬▬▬▬▬▬▬▬

▬ Live Stream Gear: Audio ▬▬▬▬▬▬▬▬▬

—— As an Amazon Associate I earn from qualifying purchases ——

My primary investment strategy is long term high yield dividend investing, index funds and reducing risk and exposure using options. I have been actively trading the stock market for over 25 years and have built most of my wealth by reinvesting my dividends and following my 14 Personal Rules of investing. I actively trade options on both the American and Canadian Stock exchanges using options strategies and buying and holding high yield dividend paying stocks.

I generate monthly income in two ways. Averaging more than an annual 7% return by collecting dividends on high yield dividend stocks that I hold. The second income stream comes from the selling of option premium and taking advantage of theta decay. I love trading strangles, Iron condors and diagonal spread for maximizing returns. Delta neutral strategies allows me to make money in both bull and bear markets and limits my risk. Both of these strategies are suitable for passive income and create a stable predictable safe passive monthly income.

Let’s Get Rich Together

Levi Woods

Disclaimer: I am not a financial planner and am not offering investment advice. This is an opinion channel only and should not be taken as any form of financial advice. I receive a small commission from the purchase of any item from using the links listed above. There are financial risks involved in taking on any monetary transaction that I discuss in my videos.

#optionstrading #stockmarket #LetsGetRichTogether

Комментарии

0:19:46

0:19:46

0:10:32

0:10:32

0:06:00

0:06:00

0:09:36

0:09:36

0:14:11

0:14:11

0:19:46

0:19:46

0:12:56

0:12:56

0:05:48

0:05:48

0:07:20

0:07:20

0:03:07

0:03:07

0:10:28

0:10:28

0:10:40

0:10:40

0:05:18

0:05:18

0:05:45

0:05:45

0:14:32

0:14:32

0:03:14

0:03:14

0:12:40

0:12:40

0:08:03

0:08:03

0:19:41

0:19:41

0:03:56

0:03:56

0:12:37

0:12:37

0:18:40

0:18:40

0:08:26

0:08:26

0:13:53

0:13:53