filmov

tv

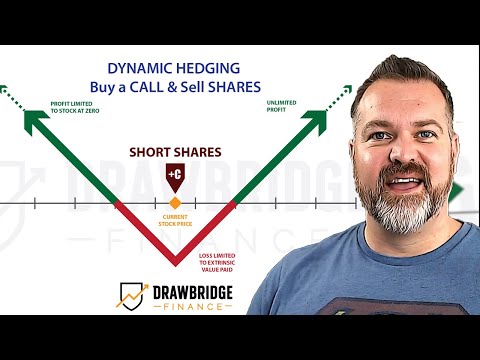

Delta Hedging Explained - Options Trading Class

Показать описание

Delta hedging, one of the most important topics in options trading risk management, involves adjusting a position to offset the delta risk associated with it. The goal of delta hedging is to reduce directional exposure without giving up too much in terms of time decay and without having to sell the underlying stock or options position.

Delta measures the sensitivity of an option's price to changes in the price of the underlying stock. A call option with a delta of 0.5 means that for every $1 increase in the stock price, the option is expected to increase by $0.50. A put option with a delta of -0.5 would decrease in value by $0.50 for every $1 increase in the stock.

Delta measures the sensitivity of an option's price to changes in the price of the underlying stock. A call option with a delta of 0.5 means that for every $1 increase in the stock price, the option is expected to increase by $0.50. A put option with a delta of -0.5 would decrease in value by $0.50 for every $1 increase in the stock.

0:14:11

0:14:11

0:14:32

0:14:32

0:09:30

0:09:30

0:10:32

0:10:32

0:12:56

0:12:56

0:19:46

0:19:46

0:05:18

0:05:18

0:12:17

0:12:17

0:36:54

0:36:54

0:10:28

0:10:28

0:01:56

0:01:56

0:19:41

0:19:41

0:47:40

0:47:40

0:10:29

0:10:29

0:12:09

0:12:09

0:14:44

0:14:44

0:14:21

0:14:21

0:05:39

0:05:39

0:08:03

0:08:03

0:13:40

0:13:40

0:12:45

0:12:45

0:13:29

0:13:29

0:17:14

0:17:14

0:19:46

0:19:46