filmov

tv

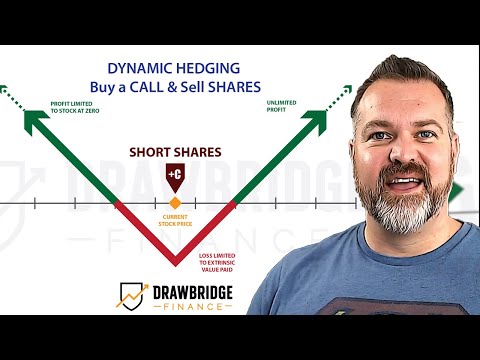

Option DELTA HEDGING Explained With Demonstration | LIVE OPTIONS TRADING

Показать описание

The most difficult aspect of options trading is managing losing positions...and there is no single correct way to do it either! One such method, however, is called delta hedging. So in this next episode of my live options trading series, I will walk you through a realtime demonstration of delta hedging a short strangle trade on SPY to slow down the trade's losses. We will also discuss other important concepts such as the option greeks (specifically Delta!) and how to roll short options to further expiration cycles!

--------------------------------------------------

🔥 START YOUR FREE 7 DAY TRIAL WITH MY DISCORD HERE 🔥

--------------------------------------------------

🔥 JOIN ME ON SKILLSHARE TOO!!! 🔥

*** Signing up for a Premium Skillshare membership with any of the links provided below will give you a 1 month FREE trial! ***

--------------------------------------------------

🔥 GET UP TO 10 FREE STOCKS WITH MOOMOO 🔥

*** Use my link below to open a brokerage account and make an initial deposit to claim your rewards! ***

Open a Moomoo brokerage account = 1 free stock

Deposit $1 into your account = 5 extra free stocks (6 total)

Deposit $100 into your account = 1 more free stock (7 total)

Deposit $2,000 into your account = 3 more free stocks (10 total)

--------------------------------------------------

🔥 OTHER GREAT DEALS TO GET FREE STOCKS OR FREE MONEY 🔥

*** Use the links below to complete a few easy steps to claim your free rewards! ***

* Get 6 free stocks with Webull! Simply open a securities brokerage account using the link below and fund the account with as little as $1.00 USD!

* Get $25 in free stock with SoFi Invest! Open an Active Investing account using the link below and fund the account with a minimum of $100.00 USD! FYI: My first name is James, so that's why it says James is referring you :)

* Get $200 of free stock with TastyWorks! Just open a securities brokerage account using the link below, which includes a

valid email address, and fund that account with a minimum of $2,000.00 USD within 60 days of opening the account.

--------------------------------------------------

🔥 WANT TO TAKE YOUR OPTIONS TRADING TO THE NEXT LEVEL? 🔥

*** Sign up for a 7 day trial on Tiblio with the link below and also get 20% off your first month! ***

--------------------------------------------------

Chapters:

0:00 Introduction

2:13 Brief Overview Of My SPY Strangle

3:43 What Is Delta Hedging?

6:28 How To Implement Delta Hedging

9:34 Next Steps With A Hedged But Losing Strangle

10:56 Get 10 FREE Stocks With Moomoo

11:57 Wrapping Up

#bearmarket #optionselling #thinkorswim

--------------------------------------------------

🔥 START YOUR FREE 7 DAY TRIAL WITH MY DISCORD HERE 🔥

--------------------------------------------------

🔥 JOIN ME ON SKILLSHARE TOO!!! 🔥

*** Signing up for a Premium Skillshare membership with any of the links provided below will give you a 1 month FREE trial! ***

--------------------------------------------------

🔥 GET UP TO 10 FREE STOCKS WITH MOOMOO 🔥

*** Use my link below to open a brokerage account and make an initial deposit to claim your rewards! ***

Open a Moomoo brokerage account = 1 free stock

Deposit $1 into your account = 5 extra free stocks (6 total)

Deposit $100 into your account = 1 more free stock (7 total)

Deposit $2,000 into your account = 3 more free stocks (10 total)

--------------------------------------------------

🔥 OTHER GREAT DEALS TO GET FREE STOCKS OR FREE MONEY 🔥

*** Use the links below to complete a few easy steps to claim your free rewards! ***

* Get 6 free stocks with Webull! Simply open a securities brokerage account using the link below and fund the account with as little as $1.00 USD!

* Get $25 in free stock with SoFi Invest! Open an Active Investing account using the link below and fund the account with a minimum of $100.00 USD! FYI: My first name is James, so that's why it says James is referring you :)

* Get $200 of free stock with TastyWorks! Just open a securities brokerage account using the link below, which includes a

valid email address, and fund that account with a minimum of $2,000.00 USD within 60 days of opening the account.

--------------------------------------------------

🔥 WANT TO TAKE YOUR OPTIONS TRADING TO THE NEXT LEVEL? 🔥

*** Sign up for a 7 day trial on Tiblio with the link below and also get 20% off your first month! ***

--------------------------------------------------

Chapters:

0:00 Introduction

2:13 Brief Overview Of My SPY Strangle

3:43 What Is Delta Hedging?

6:28 How To Implement Delta Hedging

9:34 Next Steps With A Hedged But Losing Strangle

10:56 Get 10 FREE Stocks With Moomoo

11:57 Wrapping Up

#bearmarket #optionselling #thinkorswim

Комментарии

0:14:32

0:14:32

0:14:11

0:14:11

0:10:32

0:10:32

0:12:17

0:12:17

0:12:56

0:12:56

0:09:30

0:09:30

0:19:46

0:19:46

0:14:44

0:14:44

0:36:54

0:36:54

0:19:41

0:19:41

0:05:18

0:05:18

0:10:28

0:10:28

0:14:21

0:14:21

0:08:44

0:08:44

0:12:09

0:12:09

0:19:46

0:19:46

0:03:56

0:03:56

0:05:39

0:05:39

0:06:00

0:06:00

0:16:49

0:16:49

0:08:03

0:08:03

0:13:29

0:13:29

0:01:56

0:01:56

0:17:14

0:17:14