filmov

tv

How To Delta Hedge Your Options Portfolio? I Delta hedging

Показать описание

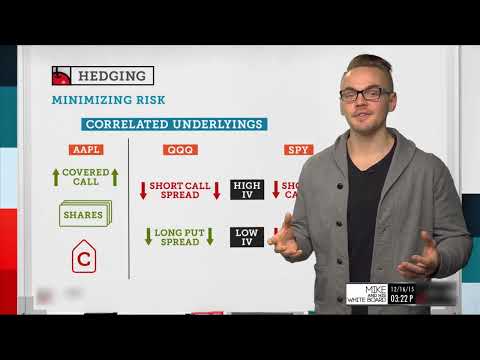

In this lesson, I want to talk to you about delta, and more specifically, how to delta hedge your portfolio. First of all, what is delta? What is this so called delta that we speak of? There's a couple different ways that we use delta to trade. At Market Rush, there's really two specific ways that we reference delta. The first of which, is delta as the probability of an option expiring in the money.

WATCH NEXT:

What is stock

What Are the types of Stock

Basic concept about stock market

What Is IPO

#stockmarket #beginners #stock #learningstockmarket #IPO #hedging #hedgingstrategy #deltahedging #hedgingstrategies

thanks for watching

if you liked do subscribe❤

WATCH NEXT:

What is stock

What Are the types of Stock

Basic concept about stock market

What Is IPO

#stockmarket #beginners #stock #learningstockmarket #IPO #hedging #hedgingstrategy #deltahedging #hedgingstrategies

thanks for watching

if you liked do subscribe❤

Delta Hedging Explained: Options Trading Strategies

Delta Hedging Explained | Options Trading Lesson

How To Delta Hedge Your Options Portfolio? I Delta hedging

What is Delta Hedging || Dynamic Delta Hedging like a Quant || Profit & Loss Options Trading

How to Delta Hedge an Options Portfolio

Dynamic Delta Hedging Explained In Excel

How To Delta Hedge Your Options Portfolio

Dynamic option delta hedge (FRM T4-14)

Black Swan Hedge: Your Ultimate Market Protector!

How to Hedge Your Positions | Options Trading Concepts

Delta hedging

Delta Neutral & How To Stay That Way

Delta Neutral Hedging - Neutral Options Strategies - Options Trading Strategies

Advanced DELTA HEDGING Technique To SAVE Your Option Trades 💰

Risk Management: Short Option - Delta Hedge - Simple

How to delta hedge

Backtesting Using Delta Neutral Hedging

Options Hedging Strategy for Delta Hedging Credit Spreads

Delta Hedging Explained - Options Trading Class

Risk Management: Long Option - Delta Hedge - Simple

How To Hedge Your Defi Portfolio and Minimize Risk (Delta Neutral)

Delta Hedging My Options Portfolio (This Trick Saved Me A Fortune!)

8.6 Delta hedging - Deribit Options Course Basics

Deltahedging in der Praxis

Комментарии

0:14:11

0:14:11

0:14:32

0:14:32

0:10:28

0:10:28

0:10:32

0:10:32

0:09:30

0:09:30

0:12:56

0:12:56

0:13:40

0:13:40

0:19:46

0:19:46

0:12:04

0:12:04

0:13:53

0:13:53

0:07:04

0:07:04

0:08:44

0:08:44

0:05:18

0:05:18

0:19:41

0:19:41

0:03:56

0:03:56

0:02:36

0:02:36

0:07:09

0:07:09

0:23:37

0:23:37

0:09:30

0:09:30

0:07:45

0:07:45

0:09:05

0:09:05

0:04:03

0:04:03

0:05:39

0:05:39

0:14:04

0:14:04