filmov

tv

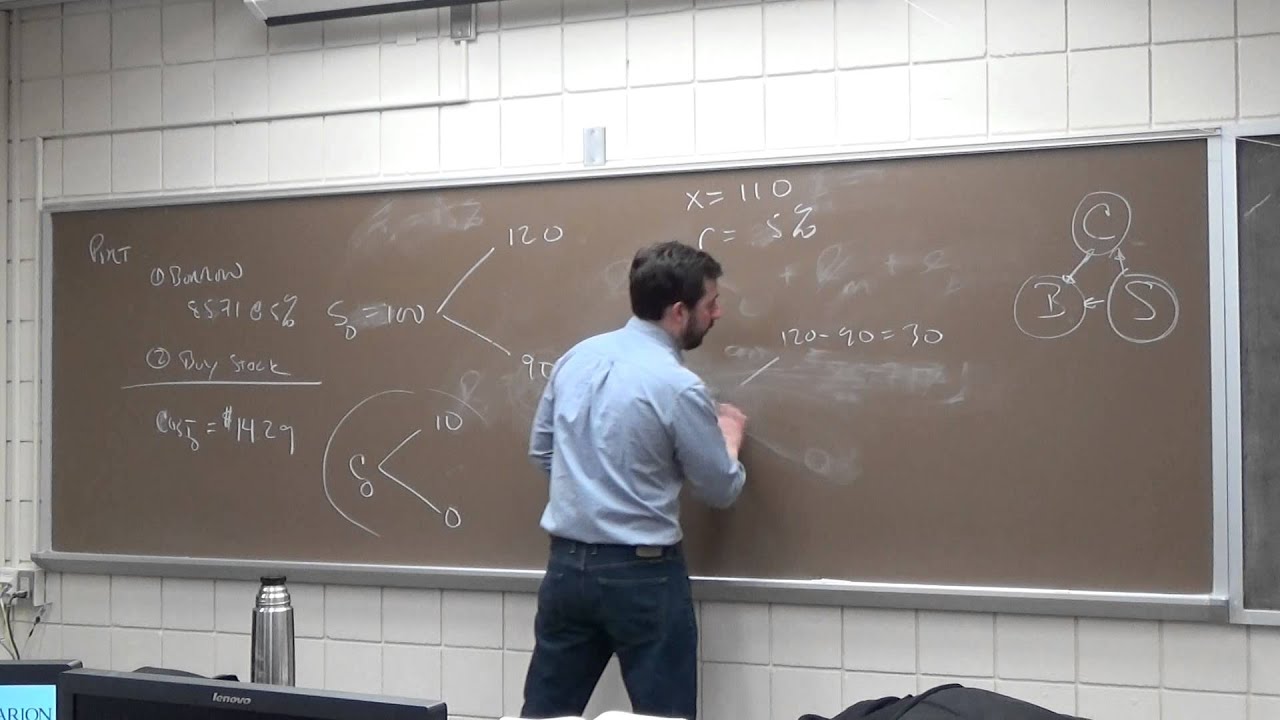

FIN 376: Binomial Option Pricing and Delta Hedging

Показать описание

Introduction to the binomial option pricing model, delta hedging, and risk-neutral valuation.

FIN 376: Binomial Option Pricing and Delta Hedging

FIN 376: Arbitrage Mispricing in Simple Binomial Option Model

Binomial Options Pricing Model Explained

Binomial Option Pricing Model (Calculations for CFA® and FRM® Exams)

What is the Binomial Option Pricing Model?

Option Pricing Binomial Model

The Cox-Ross-Rubinstein Binomial Option Pricing Model

CFA Level 2 | Derivatives: Valuing an American Call Option (Binomial Option Pricing Model)

Binomial Option Pricing Model - Introduction

CFA Level 1 | Derivatives: Binomial Option Pricing Model

FIN 376- THE PRICING OF BOND

Introduction to Binomial Option Pricing 1/3

One Period Binomial: Financial Engineering Method

CM2 - American Option Pricing: Binomial Model Actuarial Science - CM2 (Earlier CT8)

One-Step Binomial Tree made EASY

Pricing Options Using the Binomial Tree (Risk Neutral Valuation Approach)

How to Price Options using a Binomial Tree (The Portfolio Approach)

Binomial Option Pricing (Interest Rate) - CFA Tutor

Pricing Options Using Multi Step Binomial Trees

Lec 13 - The Multi Period Binomial Model

Binomial Option Pricing Part 1

Binomial Option Pricing Model (Perfect Hedge Approach) | FRM Part 1

Binomial Tree (Three-Step) Simplified

Binomial Option Pricing Model - Super Stocks Market Concepts

Комментарии

0:17:14

0:17:14

0:07:42

0:07:42

0:16:51

0:16:51

0:21:40

0:21:40

0:15:39

0:15:39

0:14:11

0:14:11

0:06:22

0:06:22

0:24:47

0:24:47

0:08:39

0:08:39

0:30:47

0:30:47

0:02:10

0:02:10

0:13:46

0:13:46

0:09:32

0:09:32

0:09:08

0:09:08

0:11:21

0:11:21

0:09:51

0:09:51

0:14:12

0:14:12

0:05:03

0:05:03

0:16:13

0:16:13

0:17:29

0:17:29

0:28:18

0:28:18

0:28:12

0:28:12

0:14:34

0:14:34

0:00:10

0:00:10