filmov

tv

Deriving Black Scholes

Показать описание

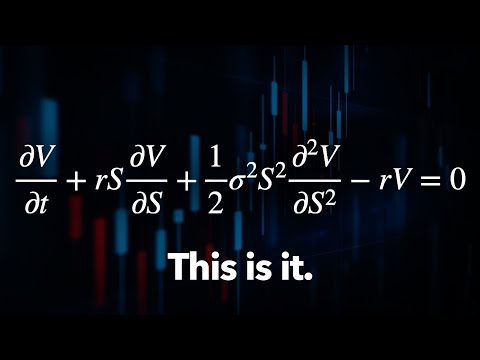

In this video, we derive the famous Black-Scholes Equation, the basis of all option pricing. I tried not to skip any steps, and tried to explain everything I was doing, so the derivation ought to be easy to follow. Let me know if I failed!

For this video, we need to know Ito's Lemma, and we need to work with Geometric Brownian motion, so it is highly advised that you go through those videos first!

Ito's Lemma:

Geometric Brownian Motion:

If you learn something, please click the Like button.

If you want to keep learning, go ahead an subscribe!

For this video, we need to know Ito's Lemma, and we need to work with Geometric Brownian motion, so it is highly advised that you go through those videos first!

Ito's Lemma:

Geometric Brownian Motion:

If you learn something, please click the Like button.

If you want to keep learning, go ahead an subscribe!

The Easiest Way to Derive the Black-Scholes Model

Introduction to the Black-Scholes formula | Finance & Capital Markets | Khan Academy

Black-Scholes PDE Derivation in 4 minutes

Deriving Black Scholes

Derivation of the Black-Scholes equation

Black Scholes Derivation

Warren Buffett: Black-Scholes Formula Is Total Nonsense

A simple derivation of the Black-Scholes equation

Deriving the Black Scholes Call Formula

Deriving the Black-Scholes Pricing Equation

19. Black-Scholes Formula, Risk-neutral Valuation

Derivation of Black-Scholes Equation |FULL|

The Trillion Dollar Equation

Black Scholes Formula explained simply

Deriving Black-Scholes Theorem on Live

Black Scholes Explained - A Mathematical Breakdown

Deriving Black-Scholes Using Ito's Lemma

Black-Scholes Equation (Financial Engineering)

Charlie Munger on Black–Scholes

Measure change approach to the derivation of Black Scholes

Unlocking the Black-Scholes Model: Visualizing the Power of Options Trading in 60 Seconds

The Math of 'The Trillion Dollar Equation'

Derivation of the Black-Scholes PDE

An intuitive explanation the Black Scholes' formula

Комментарии

0:09:53

0:09:53

0:10:24

0:10:24

0:04:30

0:04:30

0:17:24

0:17:24

0:15:04

0:15:04

0:16:55

0:16:55

0:15:54

0:15:54

0:27:31

0:27:31

0:13:34

0:13:34

0:10:41

0:10:41

0:49:52

0:49:52

0:00:12

0:00:12

0:31:22

0:31:22

0:03:40

0:03:40

0:00:12

0:00:12

0:14:03

0:14:03

0:21:06

0:21:06

0:05:59

0:05:59

0:00:39

0:00:39

0:05:44

0:05:44

0:00:59

0:00:59

0:30:15

0:30:15

0:03:58

0:03:58

0:05:48

0:05:48