filmov

tv

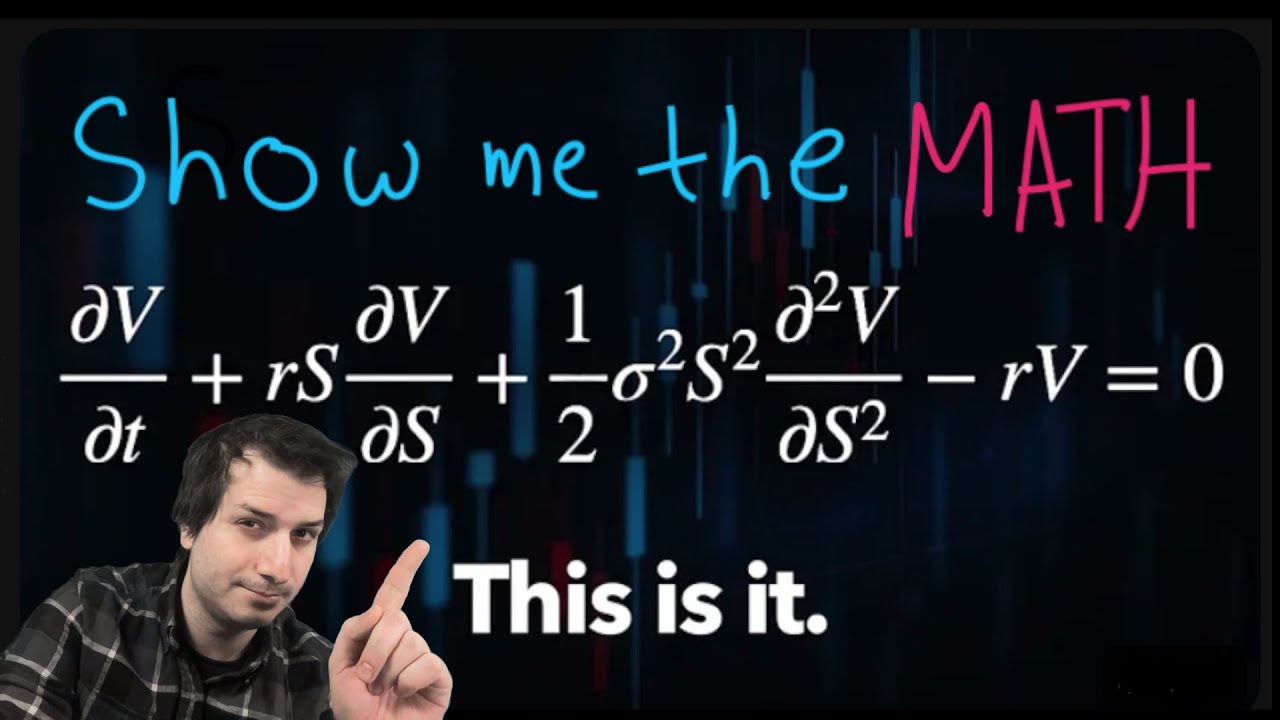

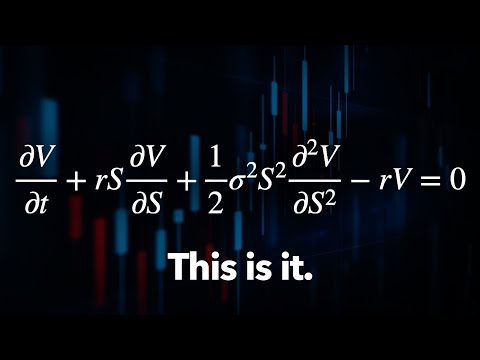

The Math of 'The Trillion Dollar Equation'

Показать описание

Here are my notes from I was a PhD student on this stuff (we were allowed to bring in short notes to the exam)

0:00 The Trillion Dollar Equation

0:18 Veritasium's Example of the Call Option

2:13 The function v(s t) for the value of the option

3:29 Veritasium's Delta hedged portfolio

4:19 Veritasium's slide by derivation

5:24 Derivation of the Black-Scholes equation from scratch

8:26 Change in portfolio value d Pi t

9:47 Approximate changes by derivatives of v a la Taylor series

15:08 Model for the stock price S t Geometric Brownian Motion

19:42 d S t squared is just a dt a la Itos Lemma

25:44 Set delta to di v di s to perfectly hedge

27:23 Equate to the risk free interest rate equation

29:10 But isnt delta a function of time? Why does this work?

The Trillion Dollar Equation

The Math of 'The Trillion Dollar Equation'

The Trillion Dollar FLAW in Financial Market Trading

The Trillion dollar mathematical equation.

man vs machine: 1 TRILLION math problems

Million, Billion, Trillion, Lakhs, Crores?😕 - Part 1 | Fun Math | Don't Memorise

The Simplest Math Problem No One Can Solve - Collatz Conjecture

👉 Million / Billion / Trillion / Arab / Kharab / Nil 🤔 !! #maths #kharab #arab #million #shorts...

Million, Billion, Trillion

One Trillion Dollars (In Seconds) Interesting Math & Money Breakdown

Meaning of Million, Billion,Trillion | Number System #shorts #maths #million #trillion #numbers

#million #billion #trillion #quadrillion#maths#important

Hey siri what’s 1 Trillion to the 10th power…💀#viral #shorts

million billion trillion conversion of number

Compounding example_ $1 in 1776 to over $5 trillion in 2021 #shorts #maths #trillion

1 Million Vs 1 Billion Vs 1 Trillion Vs 1 Quadrillion | What is a Centillion? | Epic Powers of 10

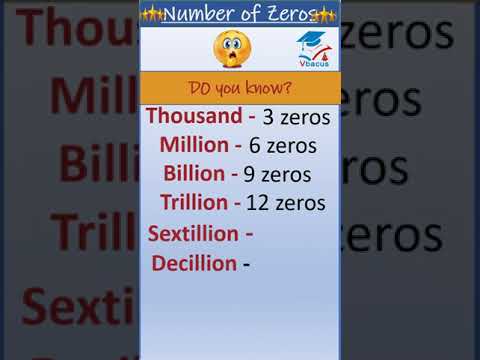

#shorts 😎How Many Zeros Are in All Numbers, Million, Billion, Trillion, Sextillion? #mathematics

Exploring Big Numbers like Billion, Trillion, Decilion. #billion #trillion #googol #math #maths

Doubles Addition Facts Song

NumberBlock from ONE to TRILLION FAST! #shorts #numberblocks #minecraft #trillion #fast

How Many Zero Are In a Trillion!#maths #youtubeshorts #shortsvideo #ytshorts #yt #mathsfact #youtube

What if you had a Trillion Dollars? + more videos | #aumsum #kids #science #education #children

Meaning of Million, Billion, Trillion #shorts #counting

Million Billion Trillion quadrillion... #mathstricks #shorts #basicmaths

Комментарии

0:31:22

0:31:22

0:30:15

0:30:15

0:07:55

0:07:55

0:06:41

0:06:41

0:01:01

0:01:01

0:01:12

0:01:12

0:22:09

0:22:09

0:00:39

0:00:39

0:00:15

0:00:15

0:00:24

0:00:24

0:00:33

0:00:33

0:00:10

0:00:10

0:00:40

0:00:40

0:00:05

0:00:05

0:00:23

0:00:23

0:09:52

0:09:52

0:00:49

0:00:49

0:00:57

0:00:57

0:01:56

0:01:56

0:00:22

0:00:22

0:00:28

0:00:28

0:05:29

0:05:29

0:00:05

0:00:05

0:00:08

0:00:08