filmov

tv

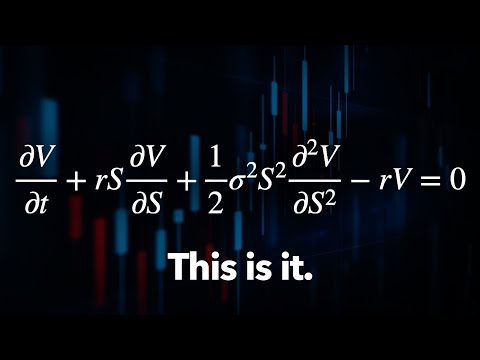

Black-Scholes Equation (Financial Engineering)

Показать описание

Hello everyone, this is a revision video of how to derive the Black-Scholes Equation ( a partial differential equation) for option pricing. Please let me know in the comments session any topics in financial Engineering you will like me to create. Also don’t forget to like, comment and subscribe if you are new to my channel. Please remember to click the post notification bell so you don’t miss any videos from me. Thank you very much.

The Trillion Dollar Equation

Black-Scholes Equation (Financial Engineering)

19. Black-Scholes Formula, Risk-neutral Valuation

Is the Black Scholes Actually Used in the Real World

20. Option Price and Probability Duality

Black Scholes Proof

Black Scholes Proof

Mathematical Finance L 11: Convergence to the Black-Scholes formula

Pricing Options with Mathematical Models | CaltechX on edX | Course About Video

Itos Lemma Explained

Black Scholes for Call Options

Financial Modeling: Black Scholes Model

Brownian Motion / Wiener Process Explained

Black Scholes Analysis for dummies - Understanding Nd2

Derivation Of the Black-Scholes Equation (SDE)

The Black–Scholes/Merton Derivatives Symposium: 46 Years and Counting: Real Options

Black Scholes PDEs in Computational Finance -Dr. Natesan Srinivasan

Heat Equation & The Black Scholes Model

Black-Scholes Option Pricing (How to Lead the Formula - Revealed)

Financial Engineering for EVERYONE! (Patreon Request) - Stefanica

What are the deficiencies of the Black-Scholes model? Why is the BS model still used?

Paul Wilmott on Quantitative Finance, Chapter 8, Black-Scholes with Borrowing

Black-Scholes Model: Merton Jump-Diffusion Call Option Pricing Formula and Implementation

Jeff Bezos Quit Being A Physicist

Комментарии

0:31:22

0:31:22

0:05:59

0:05:59

0:49:52

0:49:52

0:08:29

0:08:29

1:20:29

1:20:29

0:23:15

0:23:15

0:23:04

0:23:04

1:23:38

1:23:38

0:02:44

0:02:44

0:07:01

0:07:01

0:06:22

0:06:22

0:05:00

0:05:00

0:07:13

0:07:13

0:19:02

0:19:02

0:03:24

0:03:24

0:43:28

0:43:28

1:11:24

1:11:24

0:06:52

0:06:52

0:15:55

0:15:55

0:20:29

0:20:29

0:05:37

0:05:37

0:08:58

0:08:58

0:06:35

0:06:35

0:00:56

0:00:56