filmov

tv

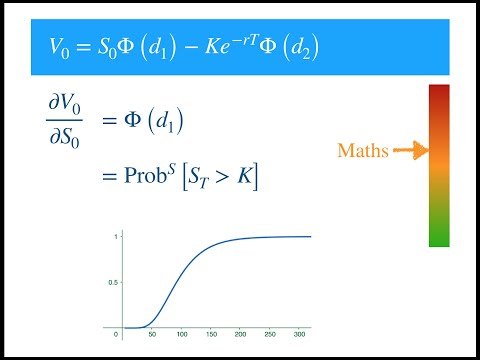

Deriving the Black-Scholes Pricing Equation

Показать описание

This video is part of my series on the Black-Scholes model.

Disclaimer: I do not know, why we use the normal pdf - shouldn't we use the lognormal pdf as the random variable is lognormal? If anybody knows, please leave me a comment.

Disclaimer: I do not know, why we use the normal pdf - shouldn't we use the lognormal pdf as the random variable is lognormal? If anybody knows, please leave me a comment.

Introduction to the Black-Scholes formula | Finance & Capital Markets | Khan Academy

Deriving the Black-Scholes Pricing Equation

The Easiest Way to Derive the Black-Scholes Model

Warren Buffett: Black-Scholes Formula Is Total Nonsense

Deriving the Black Scholes Call Formula

Black-Scholes PDE Derivation in 4 minutes

Black Scholes Explained - A Mathematical Breakdown

Derivation of Black-Scholes Equation |FULL|

19. Black-Scholes Formula, Risk-neutral Valuation

Black Scholes Formula explained simply

Measure change approach to the derivation of Black Scholes

Deriving Black Scholes

Deriving Black-Scholes Theorem on Live

Derivation of the Black-Scholes equation

Black Scholes Derivation

Charlie Munger on Black–Scholes

Unlocking the Black-Scholes Model: Visualizing the Power of Options Trading in 60 Seconds

An intuitive explanation the Black Scholes' formula

Black Scholes Option Pricing Model Explained In Excel

Gamma of Black Scholes Price: Derivation and Intuitive Explanation

Mastering the Black-Scholes Model: Essential Knowledge for Options Traders

Delta of Black Scholes Price: Derivation and Intuitive Explanation

Options Pricing Full Derivation (European call and put using Black Scholes formula)

Derivation Of the Black-Scholes Equation (SDE)

Комментарии

0:10:24

0:10:24

0:10:41

0:10:41

0:09:53

0:09:53

0:15:54

0:15:54

0:13:34

0:13:34

0:04:30

0:04:30

0:14:03

0:14:03

0:00:12

0:00:12

0:49:52

0:49:52

0:03:40

0:03:40

0:05:44

0:05:44

0:17:24

0:17:24

0:00:12

0:00:12

0:15:04

0:15:04

0:16:55

0:16:55

0:00:39

0:00:39

0:00:59

0:00:59

0:05:48

0:05:48

0:09:23

0:09:23

0:08:33

0:08:33

0:00:59

0:00:59

0:11:38

0:11:38

0:40:22

0:40:22

0:03:24

0:03:24