filmov

tv

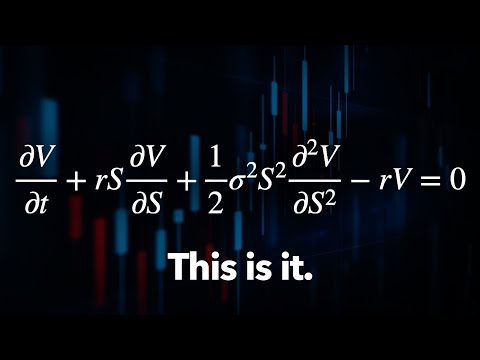

Black Scholes Option Pricing Model Explained In Excel

Показать описание

Get ready to dive deep into financial modeling with 'Black Scholes Option Pricing Model Explained In Excel'. This step-by-step tutorial will take you through the entire process, from declaring the Black Scholes inputs, to calculating the critical D1 and D2 values, all the way to valuing both Call and Put options. Plus, we'll delve into the crucial implications of the Black Scholes Model to give you a comprehensive understanding of this invaluable tool. Join us and enhance your skill set, whether you're a beginner or just need a refresher on the Black Scholes model in Excel

🎓 Tutor With Me: 1-On-1 Video Call Sessions Available

👨💼 My Freelance Financial Modeling Services:

💾 Download Free Excel File:

Chapters:

0:00 - Declare the Black Scholes Inputs

1:46 - How to Calculate D1

2:54 - How to Calculate D2

3:24 - Value a Call Option

5:36 - Value a Put Option

7:51 - Implications of the Black Scholes Model

*Disclosure: This is not financial advice and should not be taken as such. The information contained in this video is an opinion. Some of the information could be wrong. This channel is owned and operated by Portfolio Constructs LLC

🎓 Tutor With Me: 1-On-1 Video Call Sessions Available

👨💼 My Freelance Financial Modeling Services:

💾 Download Free Excel File:

Chapters:

0:00 - Declare the Black Scholes Inputs

1:46 - How to Calculate D1

2:54 - How to Calculate D2

3:24 - Value a Call Option

5:36 - Value a Put Option

7:51 - Implications of the Black Scholes Model

*Disclosure: This is not financial advice and should not be taken as such. The information contained in this video is an opinion. Some of the information could be wrong. This channel is owned and operated by Portfolio Constructs LLC

Комментарии

0:10:24

0:10:24

0:09:23

0:09:23

0:15:54

0:15:54

0:14:03

0:14:03

0:10:40

0:10:40

0:13:39

0:13:39

0:49:52

0:49:52

0:03:40

0:03:40

0:31:22

0:31:22

0:08:29

0:08:29

0:14:12

0:14:12

0:04:55

0:04:55

0:09:53

0:09:53

1:11:57

1:11:57

0:20:59

0:20:59

0:31:31

0:31:31

0:12:22

0:12:22

0:06:25

0:06:25

0:19:31

0:19:31

0:08:37

0:08:37

0:18:50

0:18:50

0:36:48

0:36:48

0:00:59

0:00:59

1:20:29

1:20:29