filmov

tv

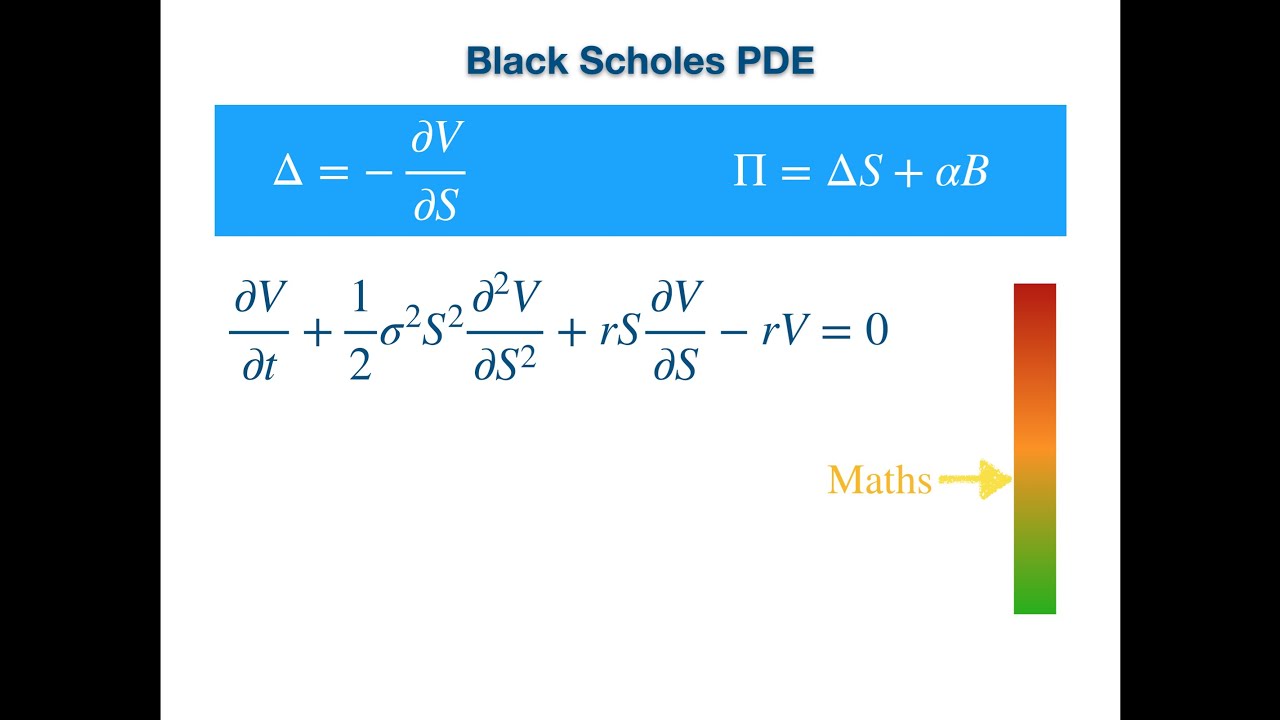

Black Scholes PDE Derivation using Delta Hedging

Показать описание

Explains the various approaches to derive the Black Scholes PDE using delta hedging and Ito's lemma

Black-Scholes PDE Derivation in 4 minutes

The Easiest Way to Derive the Black-Scholes Model

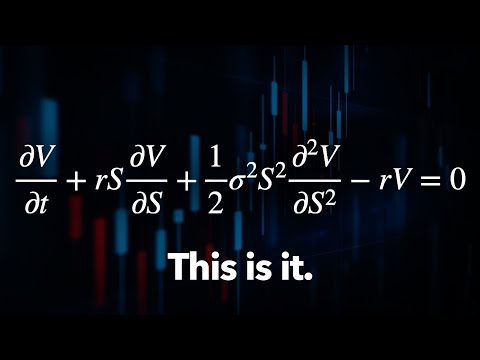

The Black Scholes PDE

Black Scholes PDE Derivation using Delta Hedging

Derivation of the Black-Scholes PDE

Introduction to the Black-Scholes formula | Finance & Capital Markets | Khan Academy

Transformation of Black Scholes PDE to Heat Equation

Derivation of Black-Scholes Equation |FULL|

The Math of 'The Trillion Dollar Equation'

Warren Buffett: Black-Scholes Formula Is Total Nonsense

Black Scholes Derivation from Heat Equation/ Diffusion Equation v2

Solving Black Scholes 1

The Trillion Dollar Equation

A simple derivation of the Black-Scholes equation

The Black-Scholes Model

Black-Scholes Equation (Financial Engineering)

Black Scholes Formula explained simply

Black Scholes Explained - A Mathematical Breakdown

Derivation of the Black-Scholes equation

Black Scholes Derivation

Introduction to Finite Difference Methods for Option Pricing

19. Black-Scholes Formula, Risk-neutral Valuation

Mastering the Black-Scholes Model: Essential Knowledge for Options Traders

1. Black Scholes - Deriving the PDE

Комментарии

0:04:30

0:04:30

0:09:53

0:09:53

0:05:56

0:05:56

0:12:45

0:12:45

0:03:58

0:03:58

0:10:24

0:10:24

0:09:38

0:09:38

0:00:12

0:00:12

0:30:15

0:30:15

0:15:54

0:15:54

0:08:21

0:08:21

0:48:36

0:48:36

0:31:22

0:31:22

0:27:31

0:27:31

0:05:07

0:05:07

0:05:59

0:05:59

0:03:40

0:03:40

0:14:03

0:14:03

0:15:04

0:15:04

0:16:55

0:16:55

0:05:48

0:05:48

0:49:52

0:49:52

0:00:59

0:00:59

0:38:44

0:38:44