filmov

tv

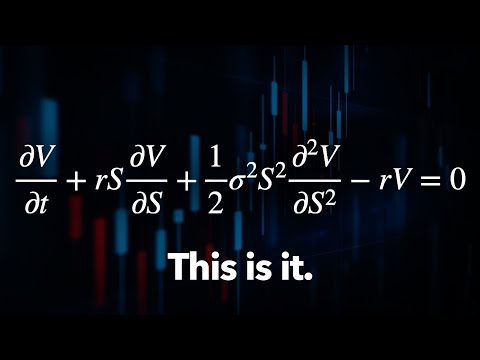

The Black-Scholes Model

Показать описание

★★ Save 10% on All Quant Next Courses with the Coupon Code: QuantNextYoutube10 ★★

★★ For students and graduates, we offer a 50% discount on all courses, please contact us if you are interested ★★

In this video, we give an introduction to the famous Black-Scholes model and derive its Partial Differential Equation (PDE) by replication. We will see that any European contingent claim satisfies this equation, with closed-form analytical solutions in some cases, and we have in this framework a hedging strategy offsetting the risk in the portfolio.

0:00 Introduction

0:32 Model Assumptions

1:15 Risky Asset - Geometric Brownian Motion

1:53 Risk Free Asset

2:09 European Contingent Claim

2:26 Self-Financing Portfolio

3:02 Derivation of the Black-Scholes Equation

4:35 Boundary Conditions and Black-Scholes Formula for European Calls and Puts

#optionpricing, #quantitativefinance, #financeeducation, #derivatives, #quant, #quantnext

★★ For students and graduates, we offer a 50% discount on all courses, please contact us if you are interested ★★

In this video, we give an introduction to the famous Black-Scholes model and derive its Partial Differential Equation (PDE) by replication. We will see that any European contingent claim satisfies this equation, with closed-form analytical solutions in some cases, and we have in this framework a hedging strategy offsetting the risk in the portfolio.

0:00 Introduction

0:32 Model Assumptions

1:15 Risky Asset - Geometric Brownian Motion

1:53 Risk Free Asset

2:09 European Contingent Claim

2:26 Self-Financing Portfolio

3:02 Derivation of the Black-Scholes Equation

4:35 Boundary Conditions and Black-Scholes Formula for European Calls and Puts

#optionpricing, #quantitativefinance, #financeeducation, #derivatives, #quant, #quantnext

0:10:24

0:10:24

0:15:54

0:15:54

0:14:03

0:14:03

0:10:40

0:10:40

0:49:52

0:49:52

0:31:22

0:31:22

0:09:23

0:09:23

0:09:53

0:09:53

0:03:40

0:03:40

0:08:29

0:08:29

0:13:41

0:13:41

0:12:22

0:12:22

0:13:39

0:13:39

0:05:48

0:05:48

0:20:59

0:20:59

0:00:59

0:00:59

0:18:04

0:18:04

0:04:55

0:04:55

0:19:31

0:19:31

0:04:20

0:04:20

0:30:15

0:30:15

0:24:18

0:24:18

0:17:07

0:17:07

0:00:59

0:00:59