filmov

tv

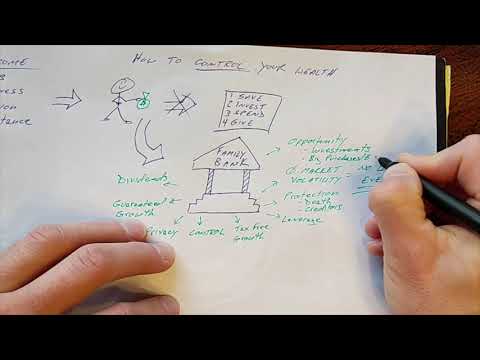

Why Infinite Banking is Scam: The Honest Insurance Guy

Показать описание

"The Honest Insurance Guy" series was created simply to bring full information to the table and scrutinize some of the statements being put out there by insurance agents and financial professionals. Subscribe for more content, and more truth!

Infinite banking is essentially the act of putting your money into an insurance policy to "borrow" from the insurance company and create cash flow. This is a redundant step, this video is not intended to start beef nor drama but to bring full disclosure to what could be a poor mistake. That is I'm doing bringing full information to the table so we can make informed decisions. As an insurance producer myself I have full incentive to also practice this thing but a believer I truly feel that this is a half truth lie designed to have individuals buy unnecessary amount of insurance enriching many insurance agents and companies along the way.

Psalms 112: 5

Proverbs 12: 22

#wealthnation #infinitebanking #Insurance # LifeInsurance #Scam #daveramsey #daveramsey #debtfreecommunity #debtfreejourney #debtfree #budgeting #financialfreedom #budget #daveramseybabysteps #babystep #personalfinance #babysteps #financialpeace #debtfreeliving #debtisdumb #money #financialindependence #debtsnowball #debt #debtfreegoals #frugal #frugalliving #cashenvelopes #debtfreedom #cashisking #goals #savemoney #dfc #financialliteracy #finance #bhfyp #finance #business #money #investing #investment #entrepreneur #financialfreedom #wealth #success #stocks #trading #stockmarket #invest #bitcoin #motivation #forex #realestate #investor #accounting #cryptocurrency #covid #wallstreet #personalfinance #entrepreneurship #marketing #financialliteracy #smallbusiness #crypto #credit #bhfyp

Infinite banking is essentially the act of putting your money into an insurance policy to "borrow" from the insurance company and create cash flow. This is a redundant step, this video is not intended to start beef nor drama but to bring full disclosure to what could be a poor mistake. That is I'm doing bringing full information to the table so we can make informed decisions. As an insurance producer myself I have full incentive to also practice this thing but a believer I truly feel that this is a half truth lie designed to have individuals buy unnecessary amount of insurance enriching many insurance agents and companies along the way.

Psalms 112: 5

Proverbs 12: 22

#wealthnation #infinitebanking #Insurance # LifeInsurance #Scam #daveramsey #daveramsey #debtfreecommunity #debtfreejourney #debtfree #budgeting #financialfreedom #budget #daveramseybabysteps #babystep #personalfinance #babysteps #financialpeace #debtfreeliving #debtisdumb #money #financialindependence #debtsnowball #debt #debtfreegoals #frugal #frugalliving #cashenvelopes #debtfreedom #cashisking #goals #savemoney #dfc #financialliteracy #finance #bhfyp #finance #business #money #investing #investment #entrepreneur #financialfreedom #wealth #success #stocks #trading #stockmarket #invest #bitcoin #motivation #forex #realestate #investor #accounting #cryptocurrency #covid #wallstreet #personalfinance #entrepreneurship #marketing #financialliteracy #smallbusiness #crypto #credit #bhfyp

Комментарии

0:09:17

0:09:17

0:05:26

0:05:26

0:20:18

0:20:18

0:38:20

0:38:20

0:09:34

0:09:34

0:05:36

0:05:36

0:11:18

0:11:18

0:00:58

0:00:58

0:13:22

0:13:22

0:27:02

0:27:02

0:31:55

0:31:55

0:40:28

0:40:28

0:13:29

0:13:29

0:04:55

0:04:55

0:03:53

0:03:53

0:19:02

0:19:02

0:27:07

0:27:07

0:13:04

0:13:04

0:36:52

0:36:52

0:06:45

0:06:45

0:05:55

0:05:55

0:26:50

0:26:50

1:06:09

1:06:09

0:04:27

0:04:27