filmov

tv

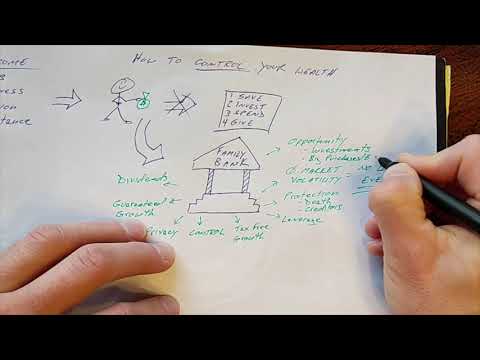

The Infinite Banking Concept Explained

Показать описание

What is infinite banking? It is often misunderstood and not easily comprehended. We’ll break down exactly what infinite banking is and how it works.

Bring confidence to your wealth building with simplified strategies from The Money Guy. Learn how to apply financial tactics that go beyond common sense and help you reach your money goals faster. Make your assets do the heavy lifting so you can quit worrying and start living a more fulfilled life.

Bring confidence to your wealth building with simplified strategies from The Money Guy. Learn how to apply financial tactics that go beyond common sense and help you reach your money goals faster. Make your assets do the heavy lifting so you can quit worrying and start living a more fulfilled life.

The Infinite Banking Concept explained

The Infinite Banking Concept EXPLAINED! And How To Get Started | Chris Naugle

The Infinite Banking Concept Explained

The Infinite Banking Concept Made Simple (with Illustrations)

The Infinite Banking System Explained (Full Breakdown!)

Why Infinite Banking is a SCAM!

Infinite Banking Concept Explained (Honest and Unbiased)

Infinite Banking Explained in 12 Minutes by a 'Recovering CPA'

Unlocking Financial Freedom: Expert Secrets from Michael Baker

This Is Nelson Nash: The Creator of The Infinite Banking Concept

Infinite Banking Concept: The Pros and Cons You Need to Know

The Infinite Banking Concept Explained (How to, Where to, When to) | Chris Naugle

What is the INFINITE BANKING Concept? #velocitybanking #IBC

Using The Infinite Banking Concept To Pay Off Debt, Buy Cars, & Plan For Retirement

How The Infinite Banking Concept Works

Infinite Banking Concept Explained

The Infinite Banking Concept, Explained

Infinite Banking Simplified | Explain the IBC To A 10 Year Old

The Infinite Banking Concept - Short Explanation

The Infinite Banking Concept - Short Explanation

Infinite Banking For Beginners | Wealth Nation

Using The Infinite Banking Concept To Pay Off Debt, Buy Cars, & Plan For Retirement

How I lost $534,000 Through Infinite Banking - The Chris Naugle

Heated Debate Between Infinite Banker and Dave Ramsey

Комментарии

0:04:27

0:04:27

0:23:07

0:23:07

0:06:45

0:06:45

0:07:29

0:07:29

0:21:22

0:21:22

0:09:17

0:09:17

0:27:02

0:27:02

0:12:04

0:12:04

0:59:26

0:59:26

1:02:06

1:02:06

0:05:38

0:05:38

0:09:09

0:09:09

0:05:15

0:05:15

2:22:21

2:22:21

0:19:23

0:19:23

0:24:50

0:24:50

0:00:16

0:00:16

0:21:18

0:21:18

0:19:55

0:19:55

0:19:43

0:19:43

0:12:50

0:12:50

0:50:29

0:50:29

0:40:28

0:40:28

0:09:34

0:09:34