filmov

tv

Why Infinite Banking is a SCAM!

Показать описание

Explore More Shows from Ramsey Network:

Ramsey Solutions Privacy Policy

Why Infinite Banking is a SCAM!

The Infinite Banking Concept explained

Infinite Banking Is A Scam | Response To Dave Ramsey

The Infinite Banking Concept Explained

Our Response To Dave Ramsey's 'Why Infinite Banking Is A Scam' | IBC Global

The TRUTH About Infinite Banking! (Is It a Scam?)

Infinite Banking Concept Explained (Honest and Unbiased)

Infinite Banking Explained in 12 Minutes by a 'Recovering CPA'

Debunking the Myths: 8 Common Misconceptions About Infinite Banking

Why Infinite Banking Is A SCAM!

Infinite Banking Simplified | Explain the IBC To A 10 Year Old

How I lost $534,000 Through Infinite Banking - The Chris Naugle

Why Most People Get Infinite Banking Wrong!

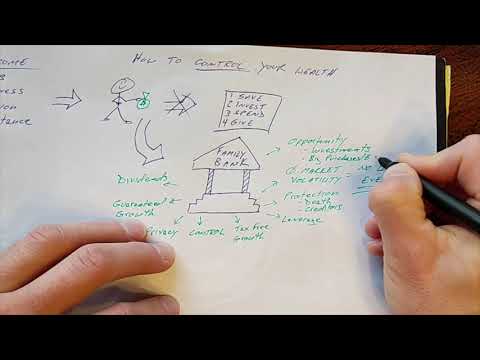

The Infinite Banking Concept Made Simple (with Illustrations)

Is Infinite Banking Really a Scam?

Infinite Banking is Ruining the Life Insurance Industry

Why Infinite Banking Concept Popularity is on the RISE

Insurance Companies Are Lying to You (Infinite Banking Exposed!)

This Is Nelson Nash: The Creator of The Infinite Banking Concept

Why Infinite Banking is a SCAM! | Reaction to Dave Ramsey’s Video | Wealth Nation

Infinite Banking: Why It Can Make You Rich?

Why Infinite Banking is the Answer | Infinite Banking with Chris Miles

The 5 Biggest Negatives of Infinite Banking

The Good & Bad of The Infinite Banking Concept

Комментарии

0:09:17

0:09:17

0:04:27

0:04:27

0:20:18

0:20:18

0:06:45

0:06:45

0:38:20

0:38:20

0:05:26

0:05:26

0:27:02

0:27:02

0:12:04

0:12:04

0:20:49

0:20:49

0:00:58

0:00:58

0:21:18

0:21:18

0:40:28

0:40:28

0:05:55

0:05:55

0:07:29

0:07:29

0:05:36

0:05:36

0:05:25

0:05:25

0:15:02

0:15:02

0:31:55

0:31:55

1:02:06

1:02:06

0:36:52

0:36:52

0:11:28

0:11:28

0:09:44

0:09:44

0:27:07

0:27:07

0:13:43

0:13:43