filmov

tv

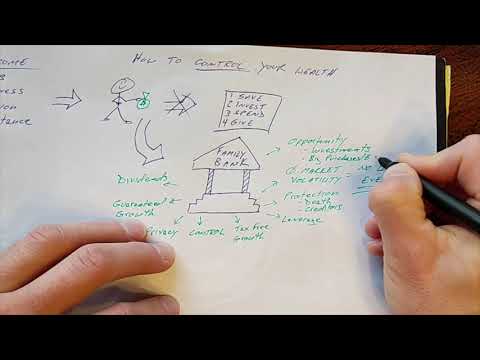

Infinite Banking Is A Scam | Response To Dave Ramsey

Показать описание

My response to Dave Ramsey calling whole life insurance and infinite banking a scam.

#lifeinsurance #daveramsey #infinitebanking

=================================

=========================

Caleb Guilliams

====================

*This video is for entertainment purposes only and is not financial or legal advice.

Financial Advice Disclaimer: All content on this channel is for education, discussion and illustrative purposes only and should not be construed as professional financial advice or recommendation. Should you need such advice, consult a licensed financial or tax advisor. No guarantee is given regarding the accuracy of information on this channel. Neither host or guests can be held responsible for any direct or incidental loss incurred by applying any of the information offered.

Affiliate Disclosure: Some of the links on this channel and in video descriptions are affiliate links. At no additional cost to you, we receive a commission if a purchase is made after clicking the link.

#lifeinsurance #daveramsey #infinitebanking

=================================

=========================

Caleb Guilliams

====================

*This video is for entertainment purposes only and is not financial or legal advice.

Financial Advice Disclaimer: All content on this channel is for education, discussion and illustrative purposes only and should not be construed as professional financial advice or recommendation. Should you need such advice, consult a licensed financial or tax advisor. No guarantee is given regarding the accuracy of information on this channel. Neither host or guests can be held responsible for any direct or incidental loss incurred by applying any of the information offered.

Affiliate Disclosure: Some of the links on this channel and in video descriptions are affiliate links. At no additional cost to you, we receive a commission if a purchase is made after clicking the link.

Комментарии

0:09:17

0:09:17

0:20:18

0:20:18

0:05:26

0:05:26

0:09:34

0:09:34

0:05:36

0:05:36

0:31:55

0:31:55

0:38:20

0:38:20

0:00:58

0:00:58

0:49:39

0:49:39

0:11:18

0:11:18

0:40:28

0:40:28

0:19:02

0:19:02

0:04:55

0:04:55

0:27:02

0:27:02

0:13:04

0:13:04

0:13:29

0:13:29

0:27:07

0:27:07

0:26:50

0:26:50

0:04:27

0:04:27

0:36:52

0:36:52

0:29:03

0:29:03

0:03:53

0:03:53

1:06:09

1:06:09

0:09:26

0:09:26