filmov

tv

How Credit Cards Work In The U.S. | CNBC Marathon

Показать описание

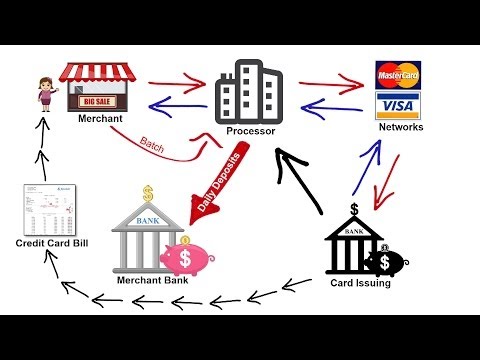

CNBC Marathon takes a look at how credit cards work in the U.S., including major industry players like Visa, Amex, and Discover.

$6.7 trillion. That is how much Americans spent using their debit or credit cards in 2019. More than 60% of those purchases were made using cards from Visa, a company that has long dominated the payment card industry. As payment cards become more essential in our daily lives, Visa has quickly grown to become one of the most valuable companies in America. So how exactly does Visa make money and why does it dominate the payment card industry?

Clarification: The 10% mentioned in the video at 12:30 refers to 10% of the average 2.2% of the swipe fee charged to merchants.

And armed with impressive rewards and a loyal customer base, Amex has achieved impressive growth over the years. The company’s revenue has increased over 32% since 2017 and shares of the company have shown resilience and growth in a tumultuous market. Yet Amex is far from dominating the credit card industry compared to the likes of Visa and Mastercard. So what is the secret to Amex’s success and where is it headed next?

Credit scores, which represent how likely a person is to pay his or her bills, affects almost every aspect of an American’s financial life. One key benefit built into the credit scoring system is its nondiscriminatory practice of using just numbers to determine a person’s creditworthiness. “Credit scoring when it was first developed was an advancement,” said Chi Chi Wu, staff attorney at the National Consumer Law Center. “It is better than having some banker sit across from you and judge you and read the information in your credit report, because they bring a lot of their subjective analysis and their own life experience into the analysis.” But despite the good intentions of credit report companies, many experts argue that the current system is still discriminatory.

Lastly, Discover is one of the largest credit card issuers in the U.S. and consistently tops a customer satisfaction survey. However, the stock has mostly underperformed that of the S&P 500 and its credit card competitors. So how does Discover stack up to its competitors and what’s unique about its business model? Watch the video to find out.

Chapters:

00:00 — Introduction

00:38 — How Visa Became The Most Popular Card In The U.S. (Published October 2021)

14:42 — Why Wealthy Americans Love AmEx (Published January 2023)

27:05 — How Credit Scores Work (Published October 2022)

41:10 — How Discover Won Over The U.S. Middle Class (Published February 2020)

About CNBC: From 'Wall Street' to 'Main Street' to award winning original documentaries and Reality TV series, CNBC has you covered. Experience special sneak peeks of your favorite shows, exclusive video and more.

Connect with CNBC News Online

#CNBC

How Credit Cards Work In The U.S. | CNBC Marathon

$6.7 trillion. That is how much Americans spent using their debit or credit cards in 2019. More than 60% of those purchases were made using cards from Visa, a company that has long dominated the payment card industry. As payment cards become more essential in our daily lives, Visa has quickly grown to become one of the most valuable companies in America. So how exactly does Visa make money and why does it dominate the payment card industry?

Clarification: The 10% mentioned in the video at 12:30 refers to 10% of the average 2.2% of the swipe fee charged to merchants.

And armed with impressive rewards and a loyal customer base, Amex has achieved impressive growth over the years. The company’s revenue has increased over 32% since 2017 and shares of the company have shown resilience and growth in a tumultuous market. Yet Amex is far from dominating the credit card industry compared to the likes of Visa and Mastercard. So what is the secret to Amex’s success and where is it headed next?

Credit scores, which represent how likely a person is to pay his or her bills, affects almost every aspect of an American’s financial life. One key benefit built into the credit scoring system is its nondiscriminatory practice of using just numbers to determine a person’s creditworthiness. “Credit scoring when it was first developed was an advancement,” said Chi Chi Wu, staff attorney at the National Consumer Law Center. “It is better than having some banker sit across from you and judge you and read the information in your credit report, because they bring a lot of their subjective analysis and their own life experience into the analysis.” But despite the good intentions of credit report companies, many experts argue that the current system is still discriminatory.

Lastly, Discover is one of the largest credit card issuers in the U.S. and consistently tops a customer satisfaction survey. However, the stock has mostly underperformed that of the S&P 500 and its credit card competitors. So how does Discover stack up to its competitors and what’s unique about its business model? Watch the video to find out.

Chapters:

00:00 — Introduction

00:38 — How Visa Became The Most Popular Card In The U.S. (Published October 2021)

14:42 — Why Wealthy Americans Love AmEx (Published January 2023)

27:05 — How Credit Scores Work (Published October 2022)

41:10 — How Discover Won Over The U.S. Middle Class (Published February 2020)

About CNBC: From 'Wall Street' to 'Main Street' to award winning original documentaries and Reality TV series, CNBC has you covered. Experience special sneak peeks of your favorite shows, exclusive video and more.

Connect with CNBC News Online

#CNBC

How Credit Cards Work In The U.S. | CNBC Marathon

Комментарии

0:01:02

0:01:02

0:05:45

0:05:45

0:51:26

0:51:26

0:03:45

0:03:45

0:02:41

0:02:41

0:11:51

0:11:51

0:07:47

0:07:47

0:08:10

0:08:10

0:01:21

0:01:21

0:11:52

0:11:52

0:00:44

0:00:44

1:30:41

1:30:41

0:08:34

0:08:34

0:05:28

0:05:28

0:00:32

0:00:32

0:08:13

0:08:13

0:02:49

0:02:49

0:07:46

0:07:46

0:06:09

0:06:09

0:16:33

0:16:33

0:05:20

0:05:20

0:11:43

0:11:43

0:14:29

0:14:29

0:08:07

0:08:07