filmov

tv

How Does a Credit Card Work?

Показать описание

In this video, we're going to talk about how credit cards work and how you can use yours to earn rewards, build a strong credit history, and get access to better loans and credit cards in the future.

First, the basics.

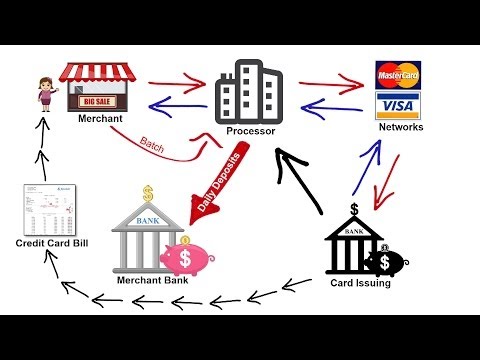

A credit card is tied to a revolving credit account at a bank. When you charge a purchase to your card, you're essentially borrowing money from that bank. The bank pays the store and you pay the bank back later.

You're allowed to borrow up to a certain amount at a time. This is known as your credit limit. Once you've reached your limit, you can't charge any more to the card until you've paid off some of your balance.

Before we go any further, let's talk about interest. When you spend money on a credit card, you will be charged interest on the amount you owe -- your balance. You won't be charged interest immediately though, as there's something called a grace period on all your credit card purchases.

At the end of each month, your credit card issuer will send you a bill. Your bill tells you your outstanding balance and the minimum amount you need to pay to avoid a late payment fee.

If you pay back your entire balance before the bill is due, you won't owe any interest. But if you don't pay back the full balance, the remainder begins to accrue interest.

How much interest you'll owe depends on how long it takes you to pay back your balance and your APR. Your APR is the annual cost of borrowing money, but your credit card issuer will actually charge you daily interest once the grace period ends.

To figure out how much interest accrues each day, just divide your APR by 365 and then multiply that by your balance.

For example, if you have a balance of $10,000 and a 26% APR, you'd divide the 26% by 365 to get about 0.071%. That's your daily interest rate.

Multiply this by your $10,000 balance and you can see that you'd accrue about $7.10 in interest that day, leaving your new balance at $10,007.10, assuming you don't charge any more to the card.

But here's where it gets dangerous. The next day, your credit card issuer applies your daily interest rate to your new balance -- in this case, $10,007.10 -- so your balance grows by $7.11 that day, bringing your total to $10,014.21.

The next day, you pay the same interest rate on this larger balance, and suddenly you owe $10,021.32. Credit card debt can also hurt your credit score, especially if you max out your credit card or spend close to your credit limit every month.

Ideally, you should only use 30% or less of your available credit to keep your credit score high. So if you only remember one rule about using a credit card, let it be this: Never charge more to the card than you know you can pay back at the end of each month.

So if credit cards can be so costly, why do we use them? There are a few reasons.

First, they're a great way to help build credit and show that you can handle borrowed money responsibly. You'll find few banks are willing to work with you unless you can prove you've borrowed money before and successfully paid it back.

The second reason is security. This is especially important for people who shop online. If an identity thief gets hold of your credit card number and makes a bunch of fraudulent purchases, all you have to do is call your credit card company, explain the problem, and it'll remove the fraudulent purchases from your bill and send you a new card. This is a lot safer than using your debit card as that's tied directly to your bank account.

But most people's favorite reason for using credit cards is the rewards. You can either get direct cash back, or gift cards to popular retailers from cash back cards. Travel rewards cards give you miles you can use toward airline and hotel purchases and sometimes other perks, like free travel vouchers.

Balance transfer cards have 0% introductory APR periods that are great for those who are trying to pay off existing credit card debt.

If you want to get the most out of your credit card, you should choose one with rewards you want that also match your spending habits. Use this card as often as you can to earn rewards faster, but never lose sight of the bill that will come at the end of the month.

A credit card can be a great tool for building your credit, shopping safely online, and getting rewarded for purchases you were going to make anyway.

Keep these tips in mind when shopping with a credit card to stay out of debt and get the most out of your card.

First, the basics.

A credit card is tied to a revolving credit account at a bank. When you charge a purchase to your card, you're essentially borrowing money from that bank. The bank pays the store and you pay the bank back later.

You're allowed to borrow up to a certain amount at a time. This is known as your credit limit. Once you've reached your limit, you can't charge any more to the card until you've paid off some of your balance.

Before we go any further, let's talk about interest. When you spend money on a credit card, you will be charged interest on the amount you owe -- your balance. You won't be charged interest immediately though, as there's something called a grace period on all your credit card purchases.

At the end of each month, your credit card issuer will send you a bill. Your bill tells you your outstanding balance and the minimum amount you need to pay to avoid a late payment fee.

If you pay back your entire balance before the bill is due, you won't owe any interest. But if you don't pay back the full balance, the remainder begins to accrue interest.

How much interest you'll owe depends on how long it takes you to pay back your balance and your APR. Your APR is the annual cost of borrowing money, but your credit card issuer will actually charge you daily interest once the grace period ends.

To figure out how much interest accrues each day, just divide your APR by 365 and then multiply that by your balance.

For example, if you have a balance of $10,000 and a 26% APR, you'd divide the 26% by 365 to get about 0.071%. That's your daily interest rate.

Multiply this by your $10,000 balance and you can see that you'd accrue about $7.10 in interest that day, leaving your new balance at $10,007.10, assuming you don't charge any more to the card.

But here's where it gets dangerous. The next day, your credit card issuer applies your daily interest rate to your new balance -- in this case, $10,007.10 -- so your balance grows by $7.11 that day, bringing your total to $10,014.21.

The next day, you pay the same interest rate on this larger balance, and suddenly you owe $10,021.32. Credit card debt can also hurt your credit score, especially if you max out your credit card or spend close to your credit limit every month.

Ideally, you should only use 30% or less of your available credit to keep your credit score high. So if you only remember one rule about using a credit card, let it be this: Never charge more to the card than you know you can pay back at the end of each month.

So if credit cards can be so costly, why do we use them? There are a few reasons.

First, they're a great way to help build credit and show that you can handle borrowed money responsibly. You'll find few banks are willing to work with you unless you can prove you've borrowed money before and successfully paid it back.

The second reason is security. This is especially important for people who shop online. If an identity thief gets hold of your credit card number and makes a bunch of fraudulent purchases, all you have to do is call your credit card company, explain the problem, and it'll remove the fraudulent purchases from your bill and send you a new card. This is a lot safer than using your debit card as that's tied directly to your bank account.

But most people's favorite reason for using credit cards is the rewards. You can either get direct cash back, or gift cards to popular retailers from cash back cards. Travel rewards cards give you miles you can use toward airline and hotel purchases and sometimes other perks, like free travel vouchers.

Balance transfer cards have 0% introductory APR periods that are great for those who are trying to pay off existing credit card debt.

If you want to get the most out of your credit card, you should choose one with rewards you want that also match your spending habits. Use this card as often as you can to earn rewards faster, but never lose sight of the bill that will come at the end of the month.

A credit card can be a great tool for building your credit, shopping safely online, and getting rewarded for purchases you were going to make anyway.

Keep these tips in mind when shopping with a credit card to stay out of debt and get the most out of your card.

Комментарии

0:01:02

0:01:02

0:05:45

0:05:45

0:07:47

0:07:47

0:03:45

0:03:45

0:01:04

0:01:04

0:03:09

0:03:09

0:13:40

0:13:40

0:08:10

0:08:10

0:05:54

0:05:54

0:21:35

0:21:35

0:02:41

0:02:41

0:00:44

0:00:44

0:07:47

0:07:47

0:35:21

0:35:21

0:11:51

0:11:51

0:01:34

0:01:34

0:14:29

0:14:29

0:00:44

0:00:44

0:00:25

0:00:25

0:03:22

0:03:22

0:02:54

0:02:54

0:06:09

0:06:09

0:05:28

0:05:28

0:01:20

0:01:20