filmov

tv

Mortgages explained UK

Показать описание

Your need-to-know guide to mortgages - the basics, interest charges and different mortgage schemes.

(Links may contain paid promotion.)

00:00 Introduction

00:39 The mortgage essentials

02:26 Interest charges

03:31 Types of mortgages and schemes

04:32 Mortgage jargon explained

#mortgagesuk #homeowner #propertyuk

(Links may contain paid promotion.)

00:00 Introduction

00:39 The mortgage essentials

02:26 Interest charges

03:31 Types of mortgages and schemes

04:32 Mortgage jargon explained

#mortgagesuk #homeowner #propertyuk

First Time Buyer Mortgage UK // What You Need to Know

Mortgages explained UK

What are Mortgages? | by Wall Street Survivor

How to Buy a House | First Time Buyer Mortgage UK

Applying for a Mortgage in 2024 & 2025 | A Beginners Guide to the UK Mortgage Market

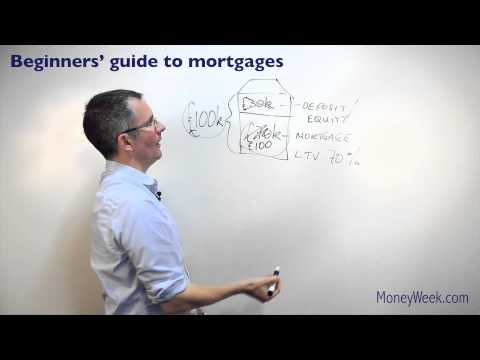

Beginners' guide to mortgages - MoneyWeek investment tutorials

Mortgages Application Process || Explained in 3 Minutes || UK || 2023

The Truth About UK Mortgages: Is It ACTUALLY Worth It?

UK Mortgage Expert: The Key Things You Need To Know

Income needed for mortgages 💰 | UK

Mortgages EXPLAINED In 30 Seconds (UK 2023) | Guide On Mortgages - Everything You Need To Know

UK Mortgages Explained - A Beginner's Guide to Home Buying in 2023

The Ultimate Buy-To-Let Mortgage Breakdown (2024)

Martin Lewis Shares His Advice on Mortgages | Good Morning Britain

How Mortgages Work In The Uk

Understanding Buy-to-Let MORTGAGES in Simple Terms

NEW 7 TIPS FOR FIRST TIME BUYERS UK FOR BEGINNERS

Mortgage Overpayments Explained - Should you Overpay on Your Mortgage?

How to REMORTGAGE to buy a SECOND PROPERTY | Property Investment UK

Home Mortgages 101 (For First Time Home Buyers)

Property refinancing for beginners

How to Buy Your First House // The Complete First Time Buyers Guide

First Time Buyers Scheme | All Mortgage Schemes Explained! (2024)

What is a mortgage?

Комментарии

0:04:44

0:04:44

0:06:02

0:06:02

0:02:57

0:02:57

0:07:19

0:07:19

0:19:48

0:19:48

0:13:50

0:13:50

0:03:02

0:03:02

0:16:13

0:16:13

0:53:24

0:53:24

0:00:05

0:00:05

0:00:32

0:00:32

0:10:00

0:10:00

0:12:02

0:12:02

0:07:05

0:07:05

0:03:55

0:03:55

0:15:13

0:15:13

0:13:38

0:13:38

0:02:23

0:02:23

0:10:20

0:10:20

0:19:43

0:19:43

0:07:50

0:07:50

0:44:00

0:44:00

0:06:54

0:06:54

0:01:42

0:01:42