filmov

tv

What are Mortgages? | by Wall Street Survivor

Показать описание

How to understand your mortgage.

Investing Tips of the Month:

Mortgages exist to solve a problem. Most people want to buy their own home, but a house costs hundreds of thousands of dollars, and you likely don’t have that kind of cash lying around in the crevices of your sofa. You’d have to work and save for decades to get that much money, and in the meantime you could easily end up paying out more in rent than the cost of the house you wanted to buy.

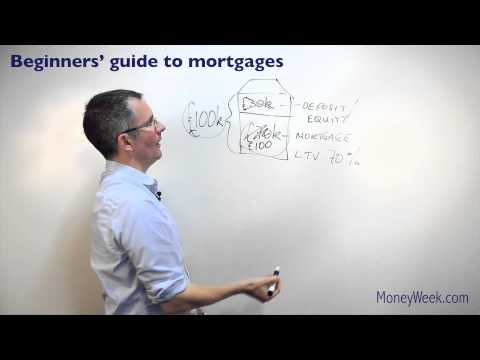

So to enable people to buy a house before they are too old to remember why they wanted it in the first place, we have the mortgage system. A mortgage is just a type of loan, pure and simple. If the house you want to buy costs $100,000, then you could pay $10,000 from your savings (that’s called the downpayment), and borrow the remaining $90,000 from the bank.

So if it’s that simple – just a housing loan that you pay back over time – why all the fuss and complexity around mortgages? Well, mortgages come in more flavors than Ben & Jerry’s ice cream, and not all of them taste good. You’ve got ARMs and balloon mortgages, fixed-rate loans and interest-only loans, bridge loans and refis and reverse mortgages.

AFFILIATE DISCLOSURE: Some of the links on this webpage are affiliate links, meaning, at no additional cost to you, Wall Street Survivor may earn a commission if you sign up with one of our affiliates. However, this does not impact our opinions and comparisons.

Investing Tips of the Month:

Mortgages exist to solve a problem. Most people want to buy their own home, but a house costs hundreds of thousands of dollars, and you likely don’t have that kind of cash lying around in the crevices of your sofa. You’d have to work and save for decades to get that much money, and in the meantime you could easily end up paying out more in rent than the cost of the house you wanted to buy.

So to enable people to buy a house before they are too old to remember why they wanted it in the first place, we have the mortgage system. A mortgage is just a type of loan, pure and simple. If the house you want to buy costs $100,000, then you could pay $10,000 from your savings (that’s called the downpayment), and borrow the remaining $90,000 from the bank.

So if it’s that simple – just a housing loan that you pay back over time – why all the fuss and complexity around mortgages? Well, mortgages come in more flavors than Ben & Jerry’s ice cream, and not all of them taste good. You’ve got ARMs and balloon mortgages, fixed-rate loans and interest-only loans, bridge loans and refis and reverse mortgages.

AFFILIATE DISCLOSURE: Some of the links on this webpage are affiliate links, meaning, at no additional cost to you, Wall Street Survivor may earn a commission if you sign up with one of our affiliates. However, this does not impact our opinions and comparisons.

Комментарии

0:02:57

0:02:57

0:03:30

0:03:30

0:18:07

0:18:07

0:19:43

0:19:43

0:02:22

0:02:22

0:06:02

0:06:02

0:13:50

0:13:50

0:09:41

0:09:41

0:00:35

0:00:35

0:01:14

0:01:14

0:08:25

0:08:25

0:00:59

0:00:59

0:00:42

0:00:42

0:00:58

0:00:58

0:11:49

0:11:49

0:09:15

0:09:15

0:00:28

0:00:28

0:05:15

0:05:15

0:01:44

0:01:44

0:00:15

0:00:15

0:17:26

0:17:26

0:01:20

0:01:20

0:00:54

0:00:54

0:06:41

0:06:41