filmov

tv

Options Hedging Strategy for Delta Hedging Credit Spreads

Показать описание

Options Hedging Strategy for Delta Hedging Credit Spreads

Video Summary:

This video showed an options hedging strategy buying SPX and SPY put credit spreads meant to hedge your options portfolio from a market crash. Sometimes referred to as delta hedging or crisis alpha, this strategy is meant to be a low cost way to protect your long trades during market corrections to minimize large drawdowns.

Use this link to learn more about eDeltaPro which is the software used for backtesting in this video.

Thanks for watching.

Eric

More Videos:

More Resources and Referral Links:

#spx #optionstrading #stockmarket

Video Summary:

This video showed an options hedging strategy buying SPX and SPY put credit spreads meant to hedge your options portfolio from a market crash. Sometimes referred to as delta hedging or crisis alpha, this strategy is meant to be a low cost way to protect your long trades during market corrections to minimize large drawdowns.

Use this link to learn more about eDeltaPro which is the software used for backtesting in this video.

Thanks for watching.

Eric

More Videos:

More Resources and Referral Links:

#spx #optionstrading #stockmarket

Delta Hedging Explained: Options Trading Strategies

Delta Hedging Explained | Options Trading Lesson

Options Hedging Strategy for Delta Hedging Credit Spreads

Delta Neutral Hedging - Neutral Options Strategies - Options Trading Strategies

What is Delta Hedging || Dynamic Delta Hedging like a Quant || Profit & Loss Options Trading

Hedging Options with Theta and Delta

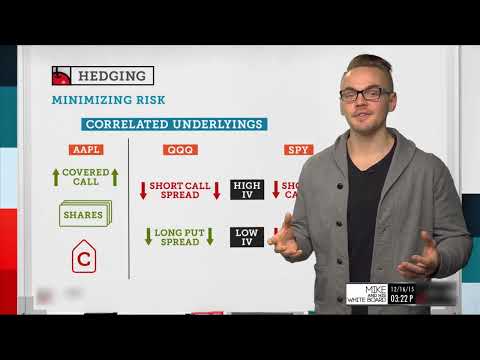

How to Hedge Your Positions | Options Trading Concepts

Risk Management: Short Option - Delta Hedge - Simple

Anatomy of an options trade | Building an options strategy

Power of Delta-Hedging in stocks or index options trading

What is a Gamma Hedge?

Risk Free Delta Neutral Strategy || Full Hedge Selling Strategy || No Loss Hedging #optionhedging

You Need To Learn About Delta Hedging

Dynamic Delta Hedging Explained In Excel

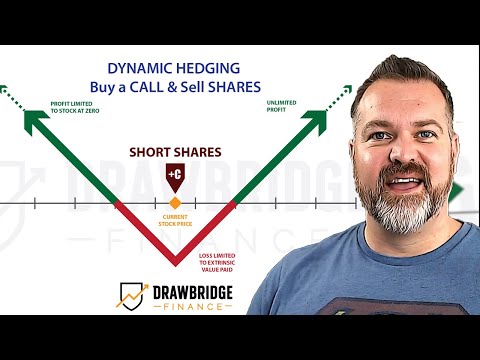

Dynamic Hedging Options - Make money if the stock moves either direction

Delta Hedging My Options Portfolio (This Trick Saved Me A Fortune!)

The Delta Hedging Trading Strategy

Delta Hedging Strategies For Better Profits Or Reduced Loss I Options Trading

#How to use Hedging Strategy

8.6 Delta hedging - Deribit Options Course Basics

3000% in 2 Weeks with this Options Strategy 🚀💰

LIVE TRADING WITH DELTA NEUTRAL STRATEGY

Delta Hedging (to manage option positions)

Delta Neutral Option Strategy - Short Straddle with Delta Hedging

Комментарии

0:14:11

0:14:11

0:14:32

0:14:32

0:23:37

0:23:37

0:05:18

0:05:18

0:10:32

0:10:32

0:11:24

0:11:24

0:13:53

0:13:53

0:03:56

0:03:56

1:01:20

1:01:20

0:10:37

0:10:37

0:12:17

0:12:17

0:12:22

0:12:22

0:00:37

0:00:37

0:12:56

0:12:56

0:19:46

0:19:46

0:04:03

0:04:03

0:08:35

0:08:35

0:17:30

0:17:30

0:00:16

0:00:16

0:05:39

0:05:39

0:00:59

0:00:59

0:00:41

0:00:41

0:01:56

0:01:56

0:08:30

0:08:30