filmov

tv

Value Added Tax (VAT) in the Philippines

Показать описание

On this video, I explained what is Value Added Tax (VAT) and demonstrated the computation of VAT Payable/Creditable Input VAT along with the journal entries.

Value-Added Tax (VAT) is a form of sales tax. It is a tax on consumption levied on the sale, barter, exchange or lease of goods or properties and services in the Philippines and on importation of goods into the Philippines. It is an indirect tax, which may be shifted or passed on to the buyer, transferee or lessee of goods, properties or services.

📚 Who are Required to File VAT Returns?

- Any person or entity who, in the course of his trade or business, sells, barters, exchanges, leases goods or properties and renders services subject to VAT, if the aggregate amount of actual gross sales or receipts exceed Three Million Pesos (Php3,000,000.00)

- A person required to register as VAT taxpayer but failed to register

- Any person, whether or not made in the course of his trade or business, who imports goods

==========================

🔗 Videos to Watch!!

===========================

References:

===========================

#vat #valueaddedtax #businesstax #tax #outputvat #inputvat #taxes #taxation #income #incometax #regularsale #zeroratedsale #exemptsale #incometaxation #train #trainlaw #philippines #philippinetaxation #philippinetax #bir #howto #learntax #learntaxation #tutorial #taxtutorial #taxationtutorial #revenue #revenueregulation #nirc #taxcode #bureauofinternalrevenue #internalrevenue #nationaltax

===========================

⌚️Time Stamps:

0:00 Intro

0:36 Concept of VAT

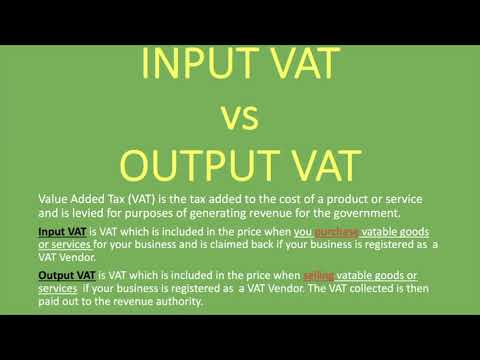

1:39 Input VAT vs. Output VAT

2:19 VAT Sales

3:30 Zero-rated Sales

4:26 Vat-exempt Sales

5:26 Mixed Sales

6:38 VAT Returns Filing

7:06 Outro

====================

📱 Social Media:

Tiktok/gerardcarpizo

=====================

Disclaimer:

This video is mainly for academic purposes and is not a substitute in doing due diligence. For highly technical tax issues, seek professional assistance or contact BIR for proper tax compliance.

Value-Added Tax (VAT) is a form of sales tax. It is a tax on consumption levied on the sale, barter, exchange or lease of goods or properties and services in the Philippines and on importation of goods into the Philippines. It is an indirect tax, which may be shifted or passed on to the buyer, transferee or lessee of goods, properties or services.

📚 Who are Required to File VAT Returns?

- Any person or entity who, in the course of his trade or business, sells, barters, exchanges, leases goods or properties and renders services subject to VAT, if the aggregate amount of actual gross sales or receipts exceed Three Million Pesos (Php3,000,000.00)

- A person required to register as VAT taxpayer but failed to register

- Any person, whether or not made in the course of his trade or business, who imports goods

==========================

🔗 Videos to Watch!!

===========================

References:

===========================

#vat #valueaddedtax #businesstax #tax #outputvat #inputvat #taxes #taxation #income #incometax #regularsale #zeroratedsale #exemptsale #incometaxation #train #trainlaw #philippines #philippinetaxation #philippinetax #bir #howto #learntax #learntaxation #tutorial #taxtutorial #taxationtutorial #revenue #revenueregulation #nirc #taxcode #bureauofinternalrevenue #internalrevenue #nationaltax

===========================

⌚️Time Stamps:

0:00 Intro

0:36 Concept of VAT

1:39 Input VAT vs. Output VAT

2:19 VAT Sales

3:30 Zero-rated Sales

4:26 Vat-exempt Sales

5:26 Mixed Sales

6:38 VAT Returns Filing

7:06 Outro

====================

📱 Social Media:

Tiktok/gerardcarpizo

=====================

Disclaimer:

This video is mainly for academic purposes and is not a substitute in doing due diligence. For highly technical tax issues, seek professional assistance or contact BIR for proper tax compliance.

Комментарии

0:04:35

0:04:35

0:07:33

0:07:33

0:04:34

0:04:34

0:04:49

0:04:49

0:18:52

0:18:52

0:20:01

0:20:01

0:01:52

0:01:52

0:15:14

0:15:14

0:00:43

0:00:43

0:12:11

0:12:11

0:06:33

0:06:33

0:08:07

0:08:07

0:25:55

0:25:55

0:12:43

0:12:43

0:07:21

0:07:21

0:01:45

0:01:45

0:27:03

0:27:03

0:01:30

0:01:30

0:07:46

0:07:46

0:27:41

0:27:41

0:42:06

0:42:06

0:07:31

0:07:31

0:00:53

0:00:53

0:06:02

0:06:02