filmov

tv

VAT Value Added Tax explained

Показать описание

What is VAT? How does VAT work? VAT, or Value Added Tax, is a system of indirect taxation. In this quick VAT tutorial, I will walk you through the concept and definition of how VAT works, run you through a VAT example with a Value Added Tax calculation, and discuss the different VAT categories in use. How does VAT work? What is reverse charge VAT? Find out in this Finance Storyteller video.

⏱️TIMESTAMPS⏱️

0:00 Introduction to VAT

0:20 Basics of a VAT system

1:25 Value Added Tax example

3:43 VAT categories and rates

5:13 Reverse charge VAT

VAT, or Value Added Tax, is a system of indirect taxation. In this quick #VAT tutorial, I will walk you through the concept and definition of how VAT works, run you through a VAT example with a Value Added Tax calculation, and discuss the different VAT categories in use.

VAT is used in around 140 countries in the world. These are the basics of a VAT system:

VAT is a system of indirect taxation on the sale of goods and services to final consumers, in other words VAT is a tax on consumption.

VAT is collected in stages through what is called “the chain of supply”, as you see in the picture on the right. I will illustrate this “chain of supply” concept with numbers in the next part of the video.

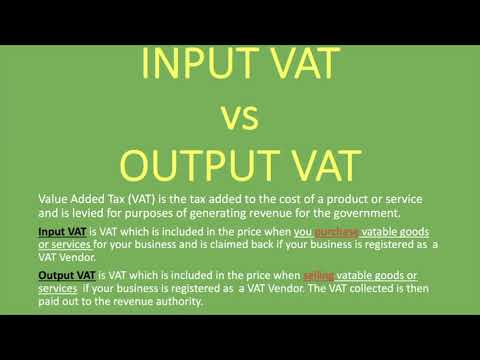

VAT registered businesses charge VAT on their sales (this is called output tax) and recover VAT on their purchases and expenses (this is called input tax), and settle the difference with country tax authorities. VAT is not a cost to businesses themselves, they collect and pay it “on behalf of the government”.

VAT rates and rules are subject to change, so check with your local country tax authorities or tax advisor for any country-specific applications of the general idea, and any exceptions to the rule.

The European Union is very well known for having a well-functioning VAT system. Please be aware that although many VAT related legislation is largely standardized across the EU member states, the standard rates differ widely, and what goes into the standard versus the reduced rate category can also differ from country to country.

In this globalizing world with lots of cross-border transactions, how does VAT work in an international context? How about the Dutch training company of your Finance Storyteller that delivers training services in other EU countries? How should he apply VAT?

The main rule is that the place of supply of business-to-business services provided between two VAT-entrepreneurs within the EU, will be the country where the recipient of the services is established.

So does that mean that this training services company has to register for VAT in all EU countries where it supplies its services?

For most companies, fortunately not!

There is solution for this situation and it is called “Reverse charge” VAT!

In reverse charge VAT, there is no VAT on the invoice itself.

The recipient of the invoice self-assesses local country VAT in their monthly or quarterly VAT filing, and deducts that same amount in that VAT filing, effectively leading to a VAT charge of zero, but with two line items.

Both supplier and customer file a separate form of cross-border transactions, detailing “counterpart” VAT number and amount.

That’s how reverse charge VAT works! It greatly simplifies my administrative life.

Here’s what your Accounts Payable staff should look out for when receiving “reverse charge VAT” invoices.

The VAT amount on the invoice should be zero.

The VAT number of the supplier and the VAT number of the (correct) invoiced legal entity are mentioned.

The supplier has mentioned “Reverse charge” (in English) / “Umkehrung der Steuerschuldnerschaft” (in German) / “Autoliquidation” (in French) or “BTW verlegd” (in Dutch) on the invoice.

Philip de Vroe (The Finance Storyteller) aims to make strategy, finance and leadership enjoyable and easier to understand. Learn the business vocabulary to join the conversation with your CEO at your company. Understand how financial statements work in order to make better stock market investment decisions. Philip delivers training in various formats: YouTube videos, classroom sessions, webinars, and business simulations. Connect with me through Linked In!

⏱️TIMESTAMPS⏱️

0:00 Introduction to VAT

0:20 Basics of a VAT system

1:25 Value Added Tax example

3:43 VAT categories and rates

5:13 Reverse charge VAT

VAT, or Value Added Tax, is a system of indirect taxation. In this quick #VAT tutorial, I will walk you through the concept and definition of how VAT works, run you through a VAT example with a Value Added Tax calculation, and discuss the different VAT categories in use.

VAT is used in around 140 countries in the world. These are the basics of a VAT system:

VAT is a system of indirect taxation on the sale of goods and services to final consumers, in other words VAT is a tax on consumption.

VAT is collected in stages through what is called “the chain of supply”, as you see in the picture on the right. I will illustrate this “chain of supply” concept with numbers in the next part of the video.

VAT registered businesses charge VAT on their sales (this is called output tax) and recover VAT on their purchases and expenses (this is called input tax), and settle the difference with country tax authorities. VAT is not a cost to businesses themselves, they collect and pay it “on behalf of the government”.

VAT rates and rules are subject to change, so check with your local country tax authorities or tax advisor for any country-specific applications of the general idea, and any exceptions to the rule.

The European Union is very well known for having a well-functioning VAT system. Please be aware that although many VAT related legislation is largely standardized across the EU member states, the standard rates differ widely, and what goes into the standard versus the reduced rate category can also differ from country to country.

In this globalizing world with lots of cross-border transactions, how does VAT work in an international context? How about the Dutch training company of your Finance Storyteller that delivers training services in other EU countries? How should he apply VAT?

The main rule is that the place of supply of business-to-business services provided between two VAT-entrepreneurs within the EU, will be the country where the recipient of the services is established.

So does that mean that this training services company has to register for VAT in all EU countries where it supplies its services?

For most companies, fortunately not!

There is solution for this situation and it is called “Reverse charge” VAT!

In reverse charge VAT, there is no VAT on the invoice itself.

The recipient of the invoice self-assesses local country VAT in their monthly or quarterly VAT filing, and deducts that same amount in that VAT filing, effectively leading to a VAT charge of zero, but with two line items.

Both supplier and customer file a separate form of cross-border transactions, detailing “counterpart” VAT number and amount.

That’s how reverse charge VAT works! It greatly simplifies my administrative life.

Here’s what your Accounts Payable staff should look out for when receiving “reverse charge VAT” invoices.

The VAT amount on the invoice should be zero.

The VAT number of the supplier and the VAT number of the (correct) invoiced legal entity are mentioned.

The supplier has mentioned “Reverse charge” (in English) / “Umkehrung der Steuerschuldnerschaft” (in German) / “Autoliquidation” (in French) or “BTW verlegd” (in Dutch) on the invoice.

Philip de Vroe (The Finance Storyteller) aims to make strategy, finance and leadership enjoyable and easier to understand. Learn the business vocabulary to join the conversation with your CEO at your company. Understand how financial statements work in order to make better stock market investment decisions. Philip delivers training in various formats: YouTube videos, classroom sessions, webinars, and business simulations. Connect with me through Linked In!

Комментарии

0:04:35

0:04:35

0:07:33

0:07:33

0:04:34

0:04:34

0:12:11

0:12:11

0:04:49

0:04:49

0:08:29

0:08:29

0:15:14

0:15:14

0:10:01

0:10:01

0:03:02

0:03:02

0:01:34

0:01:34

0:00:17

0:00:17

0:07:31

0:07:31

0:06:01

0:06:01

0:18:52

0:18:52

0:03:31

0:03:31

0:20:01

0:20:01

0:07:21

0:07:21

0:07:46

0:07:46

0:11:09

0:11:09

0:06:56

0:06:56

0:12:10

0:12:10

0:31:04

0:31:04

0:06:02

0:06:02

1:31:49

1:31:49