filmov

tv

Input VAT vs Output VAT | Explained

Показать описание

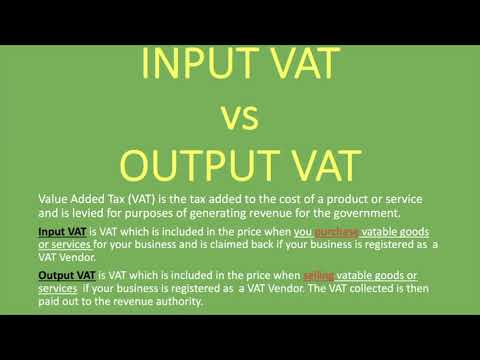

In this video, we explain Input VAT, Output VAT, and the difference between Input VAT and Output VAT. We also explain why Input VAT is an asset account and Output VAT a liability account. We explain what a VAT vendor is (who can charge and claim VAT) and when VAT is owed to and from the Revenue Authority (SARS).

Check out other straightforward examples and business-related topics on our channel.

We also offer one-on-one tutorials at reasonable rates as well as other accounting and tax services. Email us and/or visit our website or FaceBook page for more info.

Connect with us:

Check out other straightforward examples and business-related topics on our channel.

We also offer one-on-one tutorials at reasonable rates as well as other accounting and tax services. Email us and/or visit our website or FaceBook page for more info.

Connect with us:

Input VAT vs Output VAT | Explained

Input VAT vs Output VAT: What's the Difference?

Output VAT vs Input VAT

(VAT) Value Added Tax - Whiteboard Animation Explanation

Value Added Tax (VAT) in the Philippines

Input and Output Vat

Output VAT in the Philippines (Value-Added Tax)

INPUT VAT VS OUTPUT VAT

GCC VAT MALAYALAM/ GULF VAT MALAYALAM(INPUT TAX AND OUTPUT TAX)

V.A.T Payable

Input VAT Explained: Actual, Transitional, Presumptive and Standard Input Tax

Determining the VAT portion and VAT input and output

VAT - Input Tax

VAT: How to calculate VAT as a business owner

Accounting: VAT

Calculate VAT figures

Learn how to compute 12% VAT in 3 minutes. Gross, Net, Inclusive, Exclusive.

VAT (Value Added Tax) In Kenya - All you need to know | Joe Gachira

VAT Inclusive & VAT Exclusive | Calculation Examples

Accounting for VAT Payable | Input and Output VAT

Posting journal totals to the VAT Input and VAT Output account

COMPUTATION OF INPUT AND OUTPUT VAT...

VAT definitions: Output Tax and Input Tax

VAT Output tax

Комментарии

0:07:46

0:07:46

0:08:10

0:08:10

0:03:05

0:03:05

0:04:35

0:04:35

0:07:21

0:07:21

0:08:32

0:08:32

0:06:02

0:06:02

0:13:22

0:13:22

0:08:08

0:08:08

0:11:09

0:11:09

0:09:47

0:09:47

0:06:08

0:06:08

0:14:37

0:14:37

0:03:34

0:03:34

0:11:40

0:11:40

0:07:41

0:07:41

0:03:31

0:03:31

0:10:01

0:10:01

0:11:09

0:11:09

0:14:22

0:14:22

0:12:05

0:12:05

0:13:50

0:13:50

0:00:49

0:00:49

0:16:41

0:16:41