filmov

tv

PFT - VALUE ADDED TAX [ VAT]

Показать описание

PFT - VALUE ADDED TAX [ VAT]

PFT VAT

VAT CPA SEC 2 Dec 2021 2c Value Added Tax

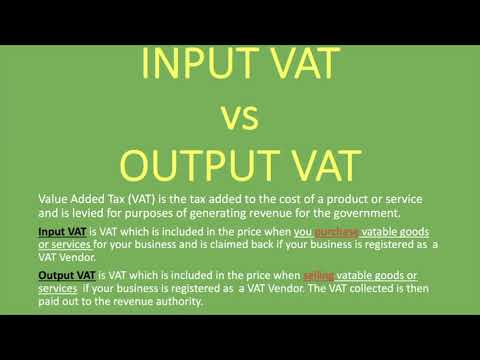

VALUE ADDED TAX - DEDUCTIBLE INPUT VAT

Value added tax (VAT)

V.A.T Payable

VAT Value Added Tax explained

VAT CPA December 2022 Question 2(b)

Value Added Tax Summary

ANALYSIS: Value Added Tax

Input VAT vs Output VAT | Explained

VAT Value Added Tax Explained - The Basics

ATD - PRINCIPLES OF PFT - VAT LESSON 8

A TAX { VAT }

VAT Registration Explained By A Real Accountant - Value Added Tax UK

PFT { TURNOVER TAX

VALUE ADDED TAX (LESSON 1) For ICAN ADVANCED TAXATION

VAT (Value Added Tax) In Kenya - All you need to know | Joe Gachira

VAT - PUBLIC FINANCE & TAXATION BLOCK REVISION QUESTION 5

Webinar: European Value Added Tax (VAT) and Ecommerce

Value Added Tax – VAT (part 2) - ACCA Taxation (FA 2022) TX-UK lectures

Value Added Tax (VAT) and Taxation in Poland. Investment and Business in Poland

What is VAT (Value Added Tax) ? Part 06

VAT Aug 24

Комментарии

0:42:06

0:42:06

1:39:34

1:39:34

0:25:55

0:25:55

0:27:03

0:27:03

0:04:49

0:04:49

0:11:09

0:11:09

0:07:33

0:07:33

0:19:50

0:19:50

0:39:00

0:39:00

0:06:02

0:06:02

0:07:46

0:07:46

0:12:11

0:12:11

0:16:32

0:16:32

1:37:02

1:37:02

0:06:56

0:06:56

1:05:11

1:05:11

0:29:39

0:29:39

0:10:01

0:10:01

0:19:45

0:19:45

0:41:41

0:41:41

0:18:15

0:18:15

0:03:40

0:03:40

0:34:31

0:34:31

2:08:59

2:08:59