filmov

tv

VAT Value Added Tax Explained - The Basics

Показать описание

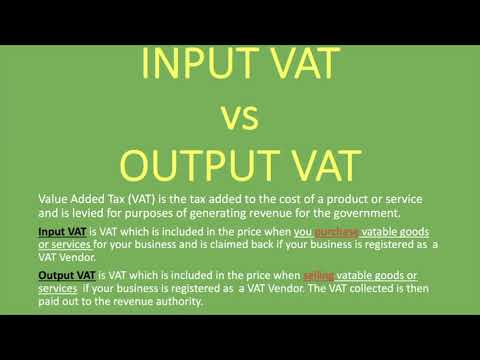

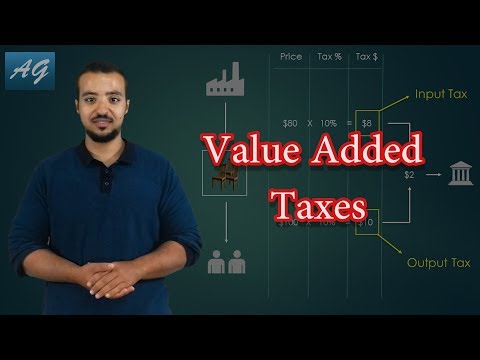

🔴 What is VAT? When do you register for VAT, when must you starting charging VAT? VAT Value Added Tax tends to throw out alot of questions. It is simple in principle but can get quite complex in practice. In this VAT explained video we’re taking a look at the basics of VAT, the stuff you need to know to get started. We’ll go over some special VAT schemes as well as the points in your business journey where you must start paying VAT, and in turn, must start charging VAT value added tax to your clients/customers.

View Our VAT Value Added Tax Page for Tables & Additional Resources Mentioned in This Video:

Accounting & Tax Academy Free Membership Site →

⏱️ Time Stamps:

0:41 - What Is VAT?

3:00 - When Must You Register For VAT?

6:06 - When Must You Start Charging VAT?

7:07 - Special VAT Schemes

9:45 - How To Report and File VAT Returns

The current VAT Threshold is £85,000 for the UK as of the date of this video. This means that if your annual VAT taxable turnover exceeds this amount on what is known as a 12 month rolling basis then you are legally required to register for and start charging VAT. You are also able to register for VAT voluntarily, before hitting the VAT threshold if this works out for your business in terms of the numbers. In our professional experience, it's well worth getting a VAT evaluation from an accountant you trust to see if you could be saving money by voluntarily registering for VAT. Remember as a business, every time you make a purchase of goods or services, the chances are you will be or have paid up to 20% of VAT (in the UK) on that purchase. Being VAT registered allows your business to claim back the 20% of VAT it has incurred. And in the early days or even along your business journey, this can accumulate into a sizeable amount of cash.

Knowing when to register for VAT can be tricky. You need to know your numbers, because if your business exceeds the current VAT Value Added Tax threshold and you don't register in time, you can be fined by HMRC.

Once your business has registered for VAT, it must start charging VAT to clients and customers. Not all vatable supplies are charged at 20% in the UK. This VAT explained video will highlight the other rates and for what group of goods and services they are applied.

There are some special VAT schemes in the UK. The most popular and common scheme is the standard rated VAT scheme. There is also the flat rate scheme, cash accounting scheme, annual accounting scheme and VAT Moss (VAT mini one stop shop).

Finally, reporting and submitting VAT returns is covered in the final section of this VAT explained video. It is imperative that VAT returns and submitted on time, and accurately as HMRC impose various penalties, fines and surcharges for improper VAT calculations and submissions.

Are you VAT registered? Let us know in the comments your experience with paying & charging Value Added Tax!

★☆★ OUR MISSION ★☆★

Me & my team are dedicated to helping and empowering YOU to 'Know Your Numbers' so you can make calculated and informed decisions in your business, company and personal finances towards your definition of success.

★☆★ OUR PHILOSOPHY ★☆★

If you take care of your numbers (finances), your numbers will take care of you, your family and those you value the most.

🔴 DISCLAIMER

Our videos are for general guidance, education and empowerment in helping you understand accounting, tax and your numbers. They in no way constitute specific advice to your specific circumstances. Me & my team would be delighted to help you with your specific queries or accounting requirements through a formal engagement.

#VAT #ValueAddedTax #VATExplained

View Our VAT Value Added Tax Page for Tables & Additional Resources Mentioned in This Video:

Accounting & Tax Academy Free Membership Site →

⏱️ Time Stamps:

0:41 - What Is VAT?

3:00 - When Must You Register For VAT?

6:06 - When Must You Start Charging VAT?

7:07 - Special VAT Schemes

9:45 - How To Report and File VAT Returns

The current VAT Threshold is £85,000 for the UK as of the date of this video. This means that if your annual VAT taxable turnover exceeds this amount on what is known as a 12 month rolling basis then you are legally required to register for and start charging VAT. You are also able to register for VAT voluntarily, before hitting the VAT threshold if this works out for your business in terms of the numbers. In our professional experience, it's well worth getting a VAT evaluation from an accountant you trust to see if you could be saving money by voluntarily registering for VAT. Remember as a business, every time you make a purchase of goods or services, the chances are you will be or have paid up to 20% of VAT (in the UK) on that purchase. Being VAT registered allows your business to claim back the 20% of VAT it has incurred. And in the early days or even along your business journey, this can accumulate into a sizeable amount of cash.

Knowing when to register for VAT can be tricky. You need to know your numbers, because if your business exceeds the current VAT Value Added Tax threshold and you don't register in time, you can be fined by HMRC.

Once your business has registered for VAT, it must start charging VAT to clients and customers. Not all vatable supplies are charged at 20% in the UK. This VAT explained video will highlight the other rates and for what group of goods and services they are applied.

There are some special VAT schemes in the UK. The most popular and common scheme is the standard rated VAT scheme. There is also the flat rate scheme, cash accounting scheme, annual accounting scheme and VAT Moss (VAT mini one stop shop).

Finally, reporting and submitting VAT returns is covered in the final section of this VAT explained video. It is imperative that VAT returns and submitted on time, and accurately as HMRC impose various penalties, fines and surcharges for improper VAT calculations and submissions.

Are you VAT registered? Let us know in the comments your experience with paying & charging Value Added Tax!

★☆★ OUR MISSION ★☆★

Me & my team are dedicated to helping and empowering YOU to 'Know Your Numbers' so you can make calculated and informed decisions in your business, company and personal finances towards your definition of success.

★☆★ OUR PHILOSOPHY ★☆★

If you take care of your numbers (finances), your numbers will take care of you, your family and those you value the most.

🔴 DISCLAIMER

Our videos are for general guidance, education and empowerment in helping you understand accounting, tax and your numbers. They in no way constitute specific advice to your specific circumstances. Me & my team would be delighted to help you with your specific queries or accounting requirements through a formal engagement.

#VAT #ValueAddedTax #VATExplained

Комментарии

0:04:35

0:04:35

0:07:33

0:07:33

0:04:34

0:04:34

0:12:11

0:12:11

0:04:49

0:04:49

0:38:03

0:38:03

0:06:56

0:06:56

0:06:01

0:06:01

0:00:50

0:00:50

0:11:09

0:11:09

0:07:46

0:07:46

0:15:14

0:15:14

0:12:10

0:12:10

0:20:01

0:20:01

0:12:37

0:12:37

0:10:01

0:10:01

0:11:09

0:11:09

0:12:43

0:12:43

0:42:06

0:42:06

0:06:02

0:06:02

0:27:03

0:27:03

0:31:04

0:31:04

0:09:00

0:09:00

0:39:00

0:39:00