filmov

tv

VALUE ADDED TAX - DEDUCTIBLE INPUT VAT

Показать описание

Registered VAT taxpayers with both taxable and exempt supplies, the amount of input VAT claimable as input tax is restricted to the extent of value of the taxable supplies. The taxpayers are expected to use the partial exemption formula when determining the deductible VAT input for each tax period.

(VAT) Value Added Tax - Whiteboard Animation Explanation

VALUE ADDED TAX - DEDUCTIBLE INPUT VAT

WHAT DOES TAX DEDUCTIBLE ACTUALLY MEAN?

Calculate VAT figures

How to Calculate VAT in Excel | Calculate the VAT amount |Calculate Selling Price | value added tax

Value Added Tax part 21

VAT Computation: Value Added Tax in Nigeria (Finance Act 2020)

V.A.T Payable

Pre-Recorded - Virtual 10 Minute Conditioning - Core workout (08/02/2024) - 8:30 AM PT

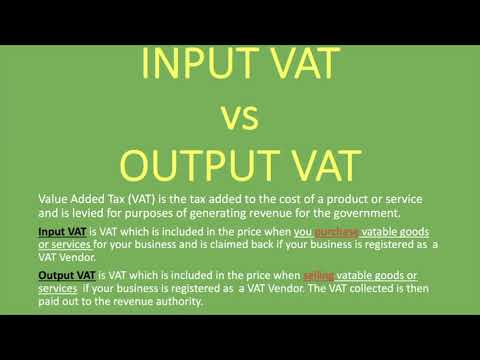

Input VAT vs Output VAT | Explained

Swedish tax regulations: Value added tax vat

VAT (Value Added Tax) In Kenya - All you need to know | Joe Gachira

Value Added Tax Summary

VALUE ADDED TAX (VAT Explained) How to compute + TIPS

VAT Accounting basis

Tax VAT non deductible

VAT CPA SEC 2 Dec 2017 4b Value Added Tax

Value Added Tax part 13

Withholding VAT

Value-Added Taxes with ABUKAI Expenses

Value Added tax VAT August 2023 Question 2c

VAT CPA SEC 2 Dec 2021 2c Value Added Tax

Taxation Lectures || Value Added Tax (Part 1) || Taxation in Ghana

Output VAT in the Philippines (Value-Added Tax)

Комментарии

0:04:35

0:04:35

0:03:43

0:03:43

0:07:41

0:07:41

0:02:06

0:02:06

0:51:16

0:51:16

0:07:31

0:07:31

0:11:09

0:11:09

0:25:56

0:25:56

0:07:46

0:07:46

0:22:38

0:22:38

0:10:01

0:10:01

0:39:00

0:39:00

0:14:45

0:14:45

0:05:51

0:05:51

0:07:55

0:07:55

0:32:11

0:32:11

0:55:17

0:55:17

0:08:47

0:08:47

0:00:32

0:00:32

0:20:14

0:20:14

0:25:55

0:25:55

0:27:29

0:27:29

0:06:02

0:06:02