filmov

tv

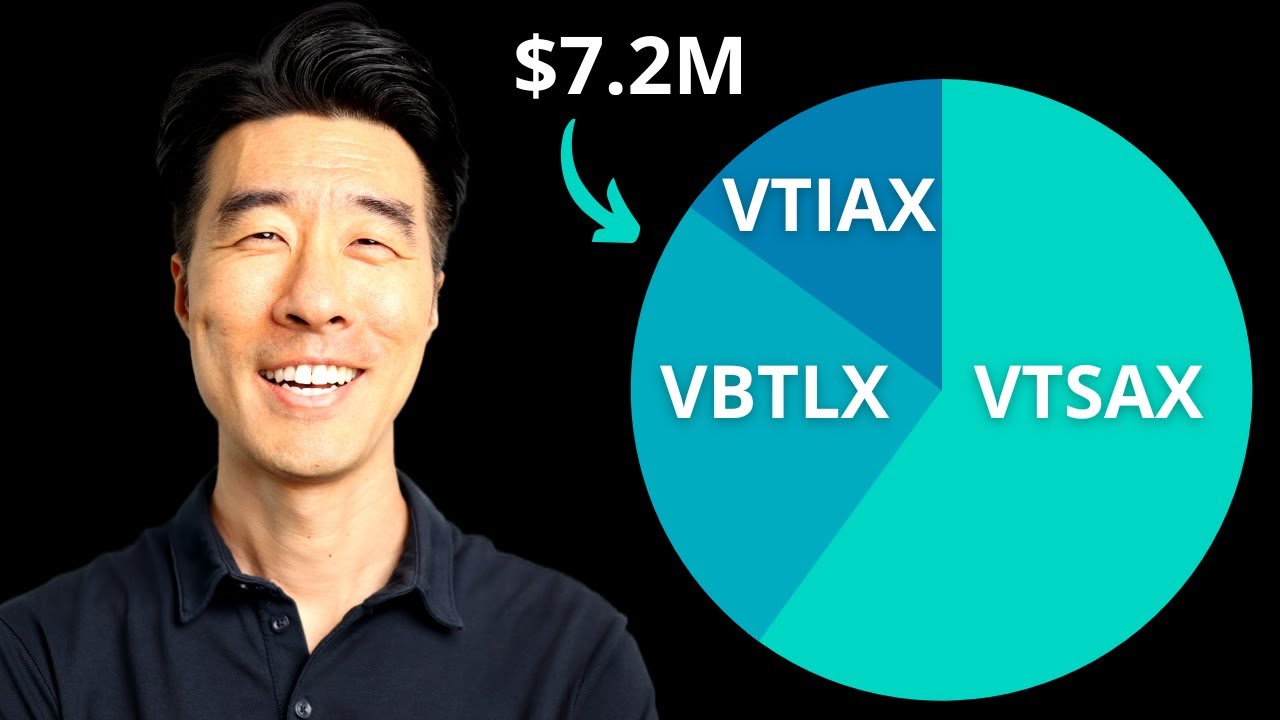

3-Fund Portfolio (The Ultimate Guide)

Показать описание

In this video, I'm going to show you how to build your ultimate 3-fund portfolio. This is an extremely effective way to invest in the stock market and I'll walk you through each step so that you can easily follow along.

Timecodes:

0:00 - Intro

0:30 - Fund Selection

6:56 - Asset Allocation

11:31 - Tax Optimization

15:41 - Summary

------------

LINKS:

DISCLAIMER: I am not a financial adviser. These videos are for educational and entertainment purposes only. I am merely sharing my personal opinion. Please seek professional help when needed.

Timecodes:

0:00 - Intro

0:30 - Fund Selection

6:56 - Asset Allocation

11:31 - Tax Optimization

15:41 - Summary

------------

LINKS:

DISCLAIMER: I am not a financial adviser. These videos are for educational and entertainment purposes only. I am merely sharing my personal opinion. Please seek professional help when needed.

3-Fund Portfolio (The Ultimate Guide)

Bogleheads 3 Fund Portfolio - The Ultimate Guide

The 3 Fund Portfolio - Simple Investing for Beginners

How to Create a 3 Fund Portfolio | A Beginner's Guide

Best 3 ETF Portfolio for Long-Term Investing (Ultimate Guide)

3 Fund Portfolio - The #1 Investment Portfolio

How To Build a 3 Fund Portfolio at Fidelity in 2024

Bogleheads 3 Fund Portfolio Review & Vanguard ETFs To Use

Mutual Fund review 2024 #mutualfund #fundreview2024 #flexicapfund2024

Why The 3 Fund Portfolio Is King

Three Fund Portfolio (The Easy Way to Invest!)

The 3-Fund Portfolio VS. The S&P 500: Which is Better?

The EASY 3 Fund Portfolio That Defeats The Pros!

Create a 3 ETF Portfolio for Long-Term Investing (Ultimate Guide)

Fidelity Index Funds For Beginners | The Ultimate Guide

The 3 Fund Portfolio: Your Path To Becoming A Millionaire

Best ETFs for European Investors (2024)

Modern 3 Fund Portfolio That Beats The Market Every Year

The Surprising Alternative to a 3 Fund Portfolio

SIMPLE 3 Fund Portfolio to CRUSH the S&P and Build Your Million Dollar Account.

How To Build A 3 Fund Portfolio (The Lazy Portfolio)

How to Build The Perfect 3-Fund Investment Portfolio

3-Fund (+1) Portfolio Strategy

THIS 3 Fidelity Index Fund Portfolio is ALL You Need

Комментарии

0:16:48

0:16:48

0:17:25

0:17:25

0:12:57

0:12:57

0:31:16

0:31:16

0:12:55

0:12:55

0:14:23

0:14:23

0:02:33

0:02:33

0:11:33

0:11:33

0:00:16

0:00:16

0:17:47

0:17:47

0:08:08

0:08:08

0:11:15

0:11:15

0:14:33

0:14:33

0:16:44

0:16:44

0:17:21

0:17:21

0:16:15

0:16:15

0:10:09

0:10:09

0:18:03

0:18:03

0:13:33

0:13:33

0:10:29

0:10:29

0:10:05

0:10:05

0:14:54

0:14:54

0:10:21

0:10:21

0:10:34

0:10:34