filmov

tv

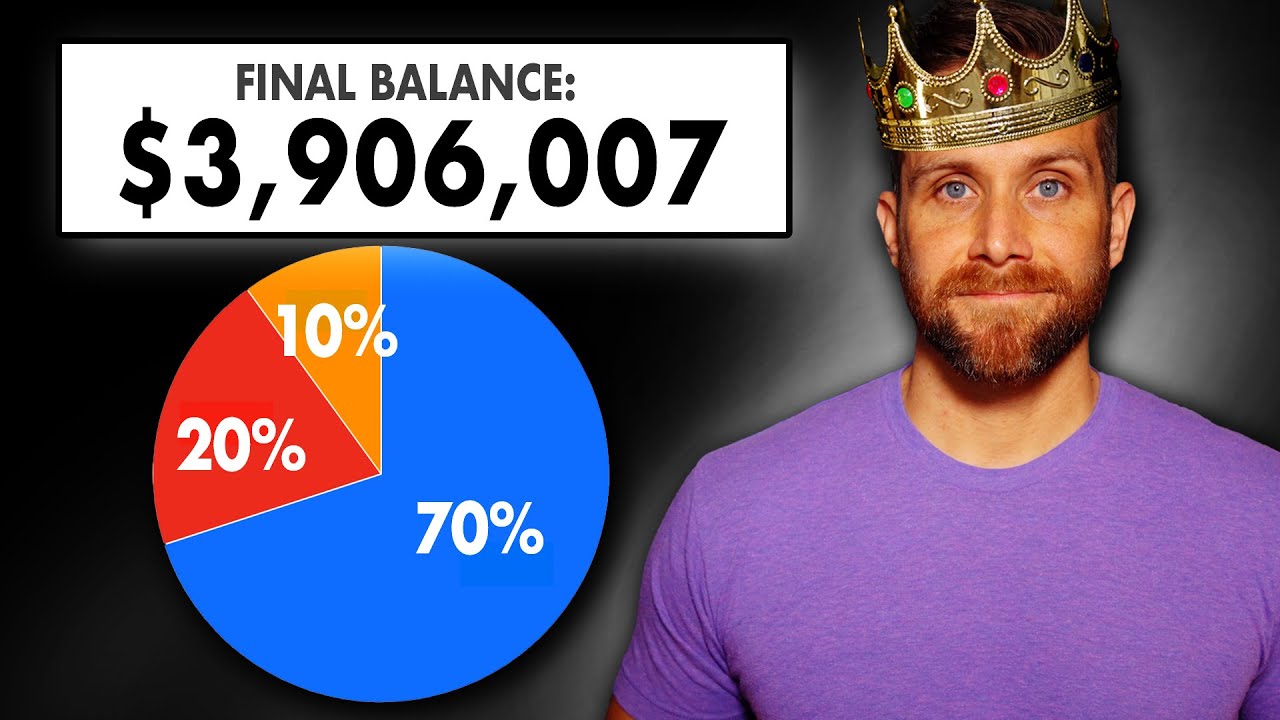

Why The 3 Fund Portfolio Is King

Показать описание

There’s a very easy “do it yourself” method to investing that not only outperforms the vast majority of retail and professional investors, but also saves you a ton of time, energy, and money along the way.

And that investing method is called...wait for it...The 3 Fund Investment Portfolio.

In this video, I’ll show you what makes the 3 fund portfolio so successful, the steps to properly create this portfolio in your own account...which aren’t always so obvious, I’ll give you a list of the funds needed to create the portfolio, and show you the actual historical returns based on a few backtested 3 fund portfolios I put together.

Check Out My Recommendations (It helps support the channel):

00:00 Intro

00:46 What Is The 3 Fund Portfolio?

01:43 Benefits Of Using Total Market Index Funds

02:15 3 Fund Portfolio Benefit #1

02:33 3 Fund Portfolio Benefit #2

05:01 3 Fund Portfolio Benefit #3

06:14 3 Fund Portfolio Benefit #4

08:09 3 Fund Portfolio Benefit #5

09:05 The 3 Funds To Invest In

11:07 3 Fund Portfolio Asset Allocation

14:33 International Asset Allocation

15:20 When To Rebalance 3 Fund Portfolio

15:42 How To Apply The 3 Fund Portfolio

Affiliate Disclaimer: Some of the above may be affiliate links. Support the channel by signing up or purchasing through those links at no additional cost to you. I appreciate you for helping me keep this channel running

Disclaimer: This video is for entertainment purposes only. Everyone's situation is different so do your own research before making any decisions with your money. If you need help then contact a Certified Financial Fiduciary before trying anything that is mentioned in this video. I prefer a Fiduciary financial advisor that charges an hourly fee as opposed to an ongoing fee based on a % of your portfolio. Always remember that incentives determine the type of advice they give you so one that charges an hourly fee is less likely to be problematic.

And that investing method is called...wait for it...The 3 Fund Investment Portfolio.

In this video, I’ll show you what makes the 3 fund portfolio so successful, the steps to properly create this portfolio in your own account...which aren’t always so obvious, I’ll give you a list of the funds needed to create the portfolio, and show you the actual historical returns based on a few backtested 3 fund portfolios I put together.

Check Out My Recommendations (It helps support the channel):

00:00 Intro

00:46 What Is The 3 Fund Portfolio?

01:43 Benefits Of Using Total Market Index Funds

02:15 3 Fund Portfolio Benefit #1

02:33 3 Fund Portfolio Benefit #2

05:01 3 Fund Portfolio Benefit #3

06:14 3 Fund Portfolio Benefit #4

08:09 3 Fund Portfolio Benefit #5

09:05 The 3 Funds To Invest In

11:07 3 Fund Portfolio Asset Allocation

14:33 International Asset Allocation

15:20 When To Rebalance 3 Fund Portfolio

15:42 How To Apply The 3 Fund Portfolio

Affiliate Disclaimer: Some of the above may be affiliate links. Support the channel by signing up or purchasing through those links at no additional cost to you. I appreciate you for helping me keep this channel running

Disclaimer: This video is for entertainment purposes only. Everyone's situation is different so do your own research before making any decisions with your money. If you need help then contact a Certified Financial Fiduciary before trying anything that is mentioned in this video. I prefer a Fiduciary financial advisor that charges an hourly fee as opposed to an ongoing fee based on a % of your portfolio. Always remember that incentives determine the type of advice they give you so one that charges an hourly fee is less likely to be problematic.

Комментарии

0:17:47

0:17:47

0:12:57

0:12:57

0:08:32

0:08:32

0:10:16

0:10:16

0:12:52

0:12:52

0:16:48

0:16:48

0:12:30

0:12:30

0:14:23

0:14:23

0:33:43

0:33:43

0:15:33

0:15:33

0:13:58

0:13:58

0:16:02

0:16:02

0:31:16

0:31:16

0:17:25

0:17:25

0:03:39

0:03:39

0:11:15

0:11:15

0:16:13

0:16:13

0:02:33

0:02:33

0:18:03

0:18:03

0:14:33

0:14:33

0:13:33

0:13:33

0:10:05

0:10:05

0:10:29

0:10:29

0:16:40

0:16:40