filmov

tv

How To Build a 3 Fund Portfolio at Fidelity in 2024

Показать описание

This video will walk you through how to build a Bogleheads 3 Fund Portfolio using Fidelity index mutual funds.

// TIMESTAMPS:

00:00 - Intro - Bogleheads 3 Fund Portfolio

00:50 - How To Build a Fidelity 3 Fund Portfolio

// SUMMARY:

Hopefully the Bogleheads 3 Fund Portfolio needs no introduction. I’ve got more details on it in a separate video here. The late John Bogle was considered the “father of index investing” and espoused the benefits of low cost indexing over more expensive active management or stock picking that are very likely to underperform the market.

The 3 Fund Portfolio is a lazy portfolio that allows investors to save big on both time and fees with its simplicity using 3 broadly diversified index funds: a total U.S. stock market fund, a total international stock market fund, and a total U.S. bond market fund. With this portfolio there’s no need to constantly monitor holdings or do any trading other than maybe rebalancing once annually.

Fidelity is at the forefront of the race to zero for fees on index funds, especially with their line of ZERO funds. They have a proven track record as a reliable broker.

Now let’s go through the exact steps to build a 3 Fund Portfolio at Fidelity.

So first we want to choose funds to use.

For U.S. stocks, we want a fund that captures the total U.S. stock market. At Fidelity we can do that with FSKAX, the Fidelity Total Market Index Fund, or if you prefer one of Fidelity’s ZERO fund with zero fees, FZROX. Just remember those ZERO funds cannot be bought or transferred outside of Fidelity.

U.S. stocks don’t consistently outperform every other country in the world, so we want to add the international stock market as well. We can do that with FSGGX, the Fidelity Global ex US Index Fund. The comparable ZERO fund here would be FZILX.

Bonds tend to be uncorrelated to stocks and offer a diversification benefit to the portfolio. Most Bogleheads prefer to use the total U.S. bond market. Fidelity’s total U.S. bond market fund is FXNAX.

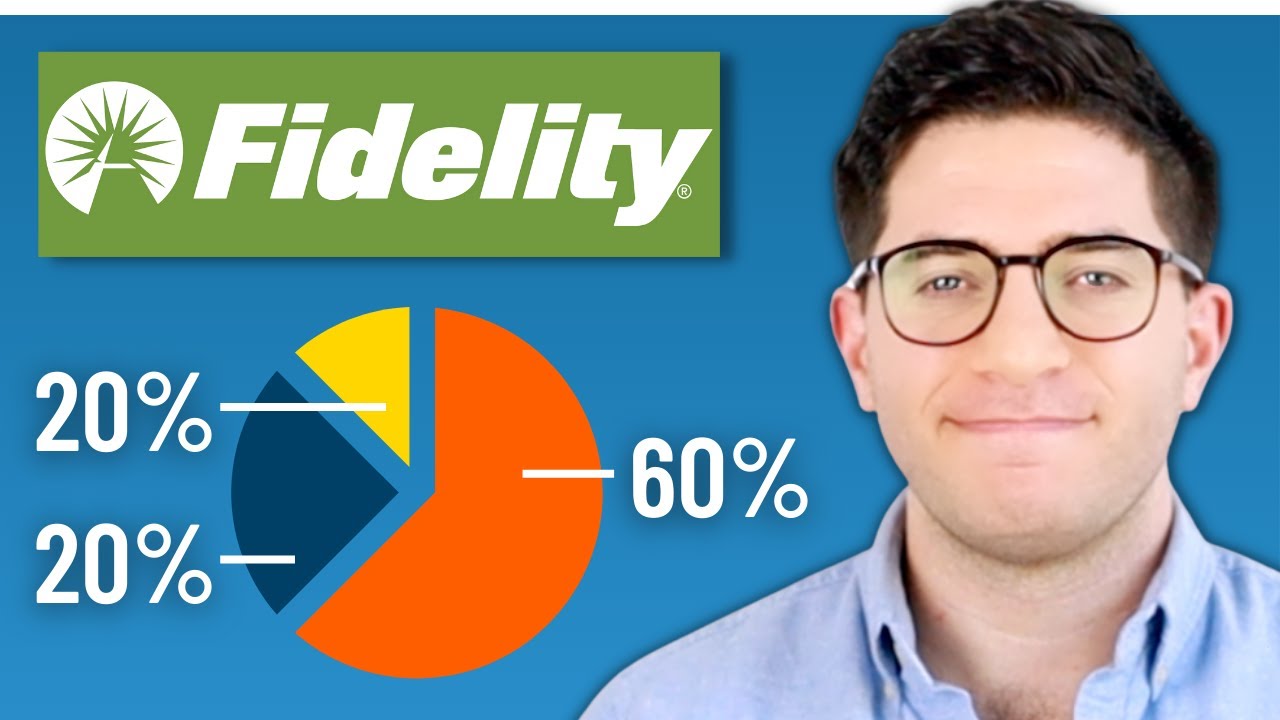

The next step is to choose your asset allocation. I've got a detailed video on asset allocation here. This is going to be based on your personal goals, time horizon, and risk tolerance. Only you can decide those things, but a reasonable one-size-fits-most allocation would be 80% stocks and 20% bonds. U.S. stocks comprise a little more than half of the global stock market, so putting it all together, our hypothetical Fidelity 3 fund portfolio might look like this:

50% U.S. stocks with FSKAX or FZROX

30% International stocks with FSGGX or FZILX

20% U.S. bonds with FXNAX

Remember to periodically rebalance your portfolio as allocations shift; annually is fine.

#fidelityinvestments #fidelity #bogleheads

// INVEST

// SOCIAL

I appreciate all the support!

Disclosure: Some of the links above are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this channel and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful.

// TIMESTAMPS:

00:00 - Intro - Bogleheads 3 Fund Portfolio

00:50 - How To Build a Fidelity 3 Fund Portfolio

// SUMMARY:

Hopefully the Bogleheads 3 Fund Portfolio needs no introduction. I’ve got more details on it in a separate video here. The late John Bogle was considered the “father of index investing” and espoused the benefits of low cost indexing over more expensive active management or stock picking that are very likely to underperform the market.

The 3 Fund Portfolio is a lazy portfolio that allows investors to save big on both time and fees with its simplicity using 3 broadly diversified index funds: a total U.S. stock market fund, a total international stock market fund, and a total U.S. bond market fund. With this portfolio there’s no need to constantly monitor holdings or do any trading other than maybe rebalancing once annually.

Fidelity is at the forefront of the race to zero for fees on index funds, especially with their line of ZERO funds. They have a proven track record as a reliable broker.

Now let’s go through the exact steps to build a 3 Fund Portfolio at Fidelity.

So first we want to choose funds to use.

For U.S. stocks, we want a fund that captures the total U.S. stock market. At Fidelity we can do that with FSKAX, the Fidelity Total Market Index Fund, or if you prefer one of Fidelity’s ZERO fund with zero fees, FZROX. Just remember those ZERO funds cannot be bought or transferred outside of Fidelity.

U.S. stocks don’t consistently outperform every other country in the world, so we want to add the international stock market as well. We can do that with FSGGX, the Fidelity Global ex US Index Fund. The comparable ZERO fund here would be FZILX.

Bonds tend to be uncorrelated to stocks and offer a diversification benefit to the portfolio. Most Bogleheads prefer to use the total U.S. bond market. Fidelity’s total U.S. bond market fund is FXNAX.

The next step is to choose your asset allocation. I've got a detailed video on asset allocation here. This is going to be based on your personal goals, time horizon, and risk tolerance. Only you can decide those things, but a reasonable one-size-fits-most allocation would be 80% stocks and 20% bonds. U.S. stocks comprise a little more than half of the global stock market, so putting it all together, our hypothetical Fidelity 3 fund portfolio might look like this:

50% U.S. stocks with FSKAX or FZROX

30% International stocks with FSGGX or FZILX

20% U.S. bonds with FXNAX

Remember to periodically rebalance your portfolio as allocations shift; annually is fine.

#fidelityinvestments #fidelity #bogleheads

// INVEST

// SOCIAL

I appreciate all the support!

Disclosure: Some of the links above are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality content on this channel and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful.

Комментарии

1:34:25

1:34:25

0:07:10

0:07:10

0:05:15

0:05:15

0:17:10

0:17:10

0:08:05

0:08:05

0:29:14

0:29:14

0:16:02

0:16:02

0:16:41

0:16:41

0:58:26

0:58:26

0:21:30

0:21:30

0:04:54

0:04:54

0:03:00

0:03:00

0:02:57

0:02:57

0:21:18

0:21:18

0:06:04

0:06:04

0:39:49

0:39:49

0:13:35

0:13:35

0:10:56

0:10:56

0:32:43

0:32:43

0:24:27

0:24:27

0:33:26

0:33:26

0:06:21

0:06:21

0:08:58

0:08:58

0:31:48

0:31:48