filmov

tv

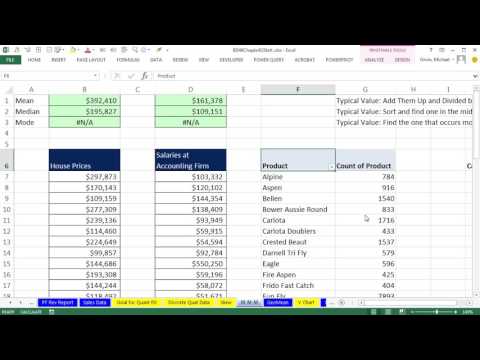

Basic Excel Business Analytics #23: Variability: Variance, Standard Deviation, Z-score and more

Показать описание

Learn about a number of important calculations for Variability:

1) (00:11) What is Variability? Synonyms: Variation, Dispersion, Spread in the data. Which Mean more fairly represents its data points? Which Mean is more reliable?

2) (02:54) Calculation of Sample Standard Deviation and Variance long hand and with the Excel functions: STDEV.s and VAR.S. How to use Standard Deviation to make a business decision.

3) (08:57) Use a 10 Year Bond Yield data Set to calculate the variability measures: Range, Variance, Standard Deviation and Coefficient of Variation.

4) (12:31) Z-Score. Formula: (Particular Value – Mean)/Standard Deviation.

5) (14:24) Second Example of Standard Deviation long hand.

6) (15:12) Look date of max and min Bond Rate using INDEX and MATCH functions.

7) (17:33) Conclusion

Download Excel File Not: After clicking on link, Use Ctrl + F (Find) and search for “Highline BI 348 Class” or for the file name as seen at the beginning of the video.

1) (00:11) What is Variability? Synonyms: Variation, Dispersion, Spread in the data. Which Mean more fairly represents its data points? Which Mean is more reliable?

2) (02:54) Calculation of Sample Standard Deviation and Variance long hand and with the Excel functions: STDEV.s and VAR.S. How to use Standard Deviation to make a business decision.

3) (08:57) Use a 10 Year Bond Yield data Set to calculate the variability measures: Range, Variance, Standard Deviation and Coefficient of Variation.

4) (12:31) Z-Score. Formula: (Particular Value – Mean)/Standard Deviation.

5) (14:24) Second Example of Standard Deviation long hand.

6) (15:12) Look date of max and min Bond Rate using INDEX and MATCH functions.

7) (17:33) Conclusion

Download Excel File Not: After clicking on link, Use Ctrl + F (Find) and search for “Highline BI 348 Class” or for the file name as seen at the beginning of the video.

Basic Excel Business Analytics #23: Variability: Variance, Standard Deviation, Z-score and more

Basic Excel Business Analytics #24: Empirical Rule, Calculating Probability NORM.DIST & NORM.S.D...

How Business Analysts Use Excel - Business Analysis Software Tutorial - With Real Data

Basic Excel Business Analytics 22 Geometric Mean Average Compounding Rate GEOMEAN RRI Function

Basic Excel Business Analytics #27: Clean & Transform Data: Formulas, Flash Fill, Power Query, T...

Basic Excel Business Analytics #20: Skew: Shape of Histogram, Shape of Quantitative Data

Basic Excel Business Analytics #02: Good Spreadsheet Model Design, Fixed Variable Cost Example

Basic Excel Business Analytics #16: Count Transactions by Hour Report & Chart

Master Univariate Analysis using Excel!

Basic Excel Business Analytics #43: Visualizing Data: Table & Chart Guidelines

Basic Excel Business Analytics #07: X-Y Scatter Chart: Fixed Cost Variable Cost Model

Basic Excel Business Analytics #21: AVERAGE, MEDIAN, MODE.MULT functions & PivotTable Mode

Basic Excel Business Analytics #64: Introduction To Monte Carlo Simulation In Excel

Basic Excel Business Analytics #14: Logical Formulas & Conditional Formatting to Visualizing Dat...

Basic Excel Business Analytics #12: Raw Data, Data, Proper Data Sets and Data Terminology

Basic Excel Business Analytics #58 Excel Solver to Maximize Contribution Margin

Excel Hacks | Excel Tutoring Excel Formula for Job Interview Excel for Fresher Excel for Beginners

Basic Excel Business Analytics #32: Power Query Import Multiple Excel Files with Multiple Sheets

The Regrets of An Accounting Major @zoeunlimited

Introduction to Data Analysis with Excel: 2-Hour Training Tutorial

How much does a TAX ANALYST make?

Basic Excel Business Analytics #26: Box & Whisker Plot. Chart Example in Excel 2016.

Basic Excel Business Analytics #25: Percentiles, Quartiles, 5 Number Summary using Excel Functions

How to calculate PERCENTAGE in excel? | Percentage Formula #shorts #excel

Комментарии

0:18:21

0:18:21

0:13:59

0:13:59

0:21:39

0:21:39

0:11:33

0:11:33

0:29:49

0:29:49

0:03:19

0:03:19

0:37:24

0:37:24

0:07:30

0:07:30

0:34:28

0:34:28

0:41:39

0:41:39

0:14:27

0:14:27

0:09:04

0:09:04

0:23:45

0:23:45

0:13:30

0:13:30

0:15:48

0:15:48

0:16:37

0:16:37

0:00:16

0:00:16

0:08:59

0:08:59

0:00:37

0:00:37

1:53:40

1:53:40

0:00:40

0:00:40

0:05:22

0:05:22

0:13:17

0:13:17

0:00:16

0:00:16