filmov

tv

Efficient Frontier and Portfolio Optimization Explained | The Ultimate Guide

Показать описание

In this comprehensive video, "Efficient Frontier and Portfolio Optimization Explained | The Ultimate Guide," Ryan O'Connell, CFA, FRM, breaks down the essentials of efficient frontier and portfolio optimization, with modern portfolio theory explained in detail. Starting with an overview of risk and return for a single stock, the video then explores risk and return in a two-asset portfolio. Ryan explains the efficient frontier for a two-asset portfolio and dives into the intricacies of portfolio optimization. The Sharpe Ratio and Capital Allocation Line (CAL) are also thoroughly explained, providing a complete guide to optimizing your investment strategy. Whether you're a beginner or an experienced investor, this ultimate guide will enhance your understanding of efficient frontier and portfolio optimization.

🎓 Tutor With Me: 1-On-1 Video Call Sessions Available

Chapters:

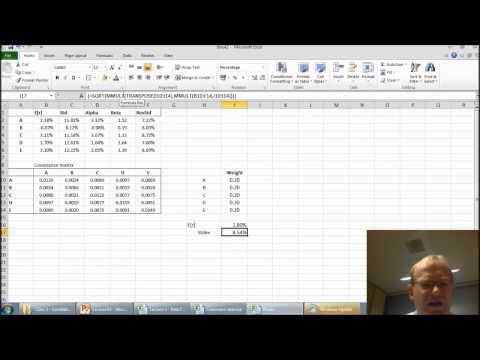

0:00 - Risk & Return: Single Stock

1:50 - Risk & Return: Two Asset Portfolio

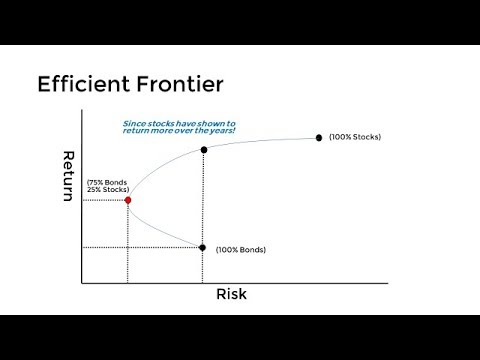

4:16 - Efficient Frontier: Two Asset Portfolio

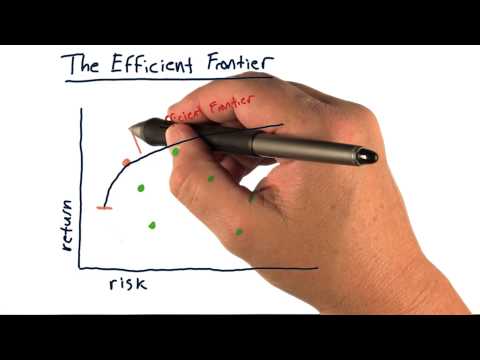

5:09 - The Efficient Frontier Explained

7:53 - Portfolio Optimization Explained

9:35 - Sharpe Ratio Explained

10:20 - Capital Allocation Line (CAL) Explained

*Disclosure: This is not financial advice and should not be taken as such. The information contained in this video is an opinion. Some of the information could be wrong. This channel is owned and operated by Portfolio Constructs LLC. Some of the links above are affiliate links, meaning, at no additional cost to you, I will earn a commission if you click through and make a purchase.

🎓 Tutor With Me: 1-On-1 Video Call Sessions Available

Chapters:

0:00 - Risk & Return: Single Stock

1:50 - Risk & Return: Two Asset Portfolio

4:16 - Efficient Frontier: Two Asset Portfolio

5:09 - The Efficient Frontier Explained

7:53 - Portfolio Optimization Explained

9:35 - Sharpe Ratio Explained

10:20 - Capital Allocation Line (CAL) Explained

*Disclosure: This is not financial advice and should not be taken as such. The information contained in this video is an opinion. Some of the information could be wrong. This channel is owned and operated by Portfolio Constructs LLC. Some of the links above are affiliate links, meaning, at no additional cost to you, I will earn a commission if you click through and make a purchase.

Комментарии

0:13:05

0:13:05

0:02:54

0:02:54

0:14:43

0:14:43

0:08:47

0:08:47

0:03:05

0:03:05

0:03:49

0:03:49

0:09:12

0:09:12

0:03:26

0:03:26

0:24:15

0:24:15

0:05:16

0:05:16

0:01:56

0:01:56

0:32:47

0:32:47

0:11:50

0:11:50

0:15:26

0:15:26

0:04:13

0:04:13

0:16:31

0:16:31

0:07:51

0:07:51

1:24:55

1:24:55

0:08:46

0:08:46

1:28:38

1:28:38

0:06:22

0:06:22

0:21:35

0:21:35

0:28:00

0:28:00

0:15:32

0:15:32