filmov

tv

Graph The Efficient Frontier And Capital Allocation Line In Excel

Показать описание

Graph The Efficient Frontier And Capital Allocation Line In Excel by Ryan O'Connell, CFA, FRM

Chapters:

0:00 - Download Historical Data from Yahoo Finance

0:42 - Calculate Returns from Historical Prices

1:08 - Calculate Asset's Average Return, Standard Deviation, and Covariance

2:18 - Assign Portfolio Weights

2:56 - Calculate Portfolio Expected Return

3:27 - Calculate Portfolio Standard Deviation

5:03 - Calculate Portfolio Sharpe Ratio

5:47 - Graph the Efficient Frontier

6:40 - Graph the Capital Allocation Line (CAL)

💾 Download Free Excel File:

👨💼 Freelance Financial Modeling Services:

🎓 Tutor With Me: 1-On-1 Video Call Sessions Available

*Disclosure: This is not financial advice and should not be taken as such. The information contained in this video is an opinion. Some of the information could be wrong. This channel is owned and operated by Portfolio Constructs LLC

Chapters:

0:00 - Download Historical Data from Yahoo Finance

0:42 - Calculate Returns from Historical Prices

1:08 - Calculate Asset's Average Return, Standard Deviation, and Covariance

2:18 - Assign Portfolio Weights

2:56 - Calculate Portfolio Expected Return

3:27 - Calculate Portfolio Standard Deviation

5:03 - Calculate Portfolio Sharpe Ratio

5:47 - Graph the Efficient Frontier

6:40 - Graph the Capital Allocation Line (CAL)

💾 Download Free Excel File:

👨💼 Freelance Financial Modeling Services:

🎓 Tutor With Me: 1-On-1 Video Call Sessions Available

*Disclosure: This is not financial advice and should not be taken as such. The information contained in this video is an opinion. Some of the information could be wrong. This channel is owned and operated by Portfolio Constructs LLC

Graph The Efficient Frontier And Capital Allocation Line In Excel

Use Excel to graph the efficient frontier of a three security portfolio

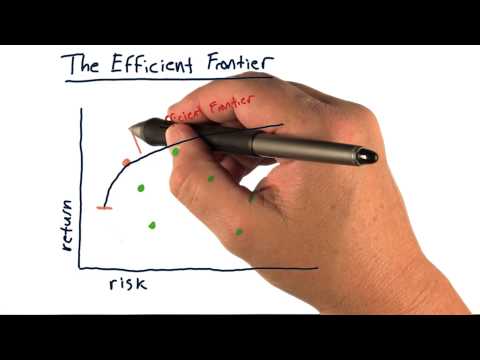

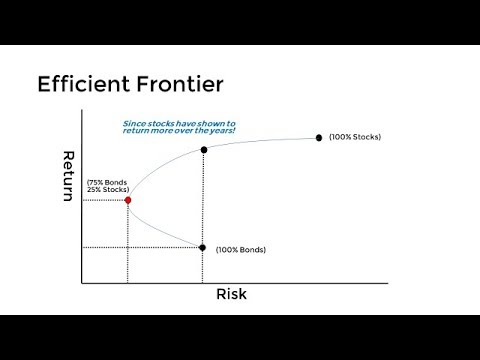

The efficient frontier

How To Graph The Efficient Frontier For A Two-Stock Portfolio In Excel

Graphing the Efficient Frontier using Random Portfolios in Excel

13. Graphing the efficient frontier for Multiple Stock portfolio in Excel #Finance

The Efficient Frontier - Explained in 3 Minutes

The Math of Drawing the Efficient Frontier

Four Stock Portfolio and Graphing Efficient Portfolio Frontier

Efficient Frontier Explained in Excel: Plotting a 3-Security Portfolio

Graphing the Efficient Frontier

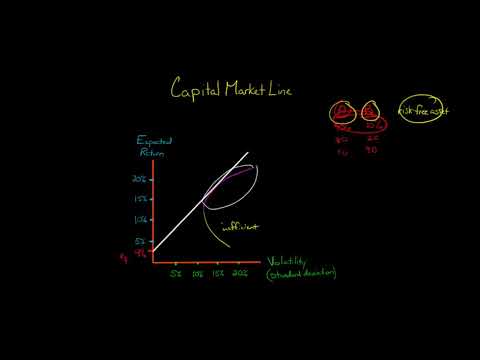

The Capital Market Line

R3-3. Efficient Frontier Graph

How to make an Efficient Frontier Using Python

Efficient Frontier and Portfolio Optimization Explained | The Ultimate Guide

Modern Portfolio Theory and the Efficient Frontier Explained

Plotting Efficient Frontier for Four Securities in Excel

Efficient Frontier in Excel: Two Asset Case

Efficient Frontier, Sharpe Ratio and Capital Market Line (CML)

Graphing the Efficient Frontier

How to plot the Efficient Frontier in Excel: Tutorial Video

FRM : How to Build Efficient Frontier in Excel - Part 1 (of 2)

Plotting portfolio frontier for two and more stocks portfolios

Efficient Frontier, Indifference Curve, Capital Allocation Line

Комментарии

0:08:47

0:08:47

0:32:47

0:32:47

0:02:54

0:02:54

0:04:27

0:04:27

0:04:11

0:04:11

0:15:32

0:15:32

0:03:05

0:03:05

0:07:00

0:07:00

0:35:01

0:35:01

0:14:43

0:14:43

0:05:51

0:05:51

0:05:45

0:05:45

0:05:23

0:05:23

0:10:06

0:10:06

0:13:05

0:13:05

0:03:49

0:03:49

0:15:38

0:15:38

0:09:33

0:09:33

0:16:05

0:16:05

0:09:22

0:09:22

0:10:31

0:10:31

0:20:07

0:20:07

0:30:34

0:30:34

0:40:21

0:40:21