filmov

tv

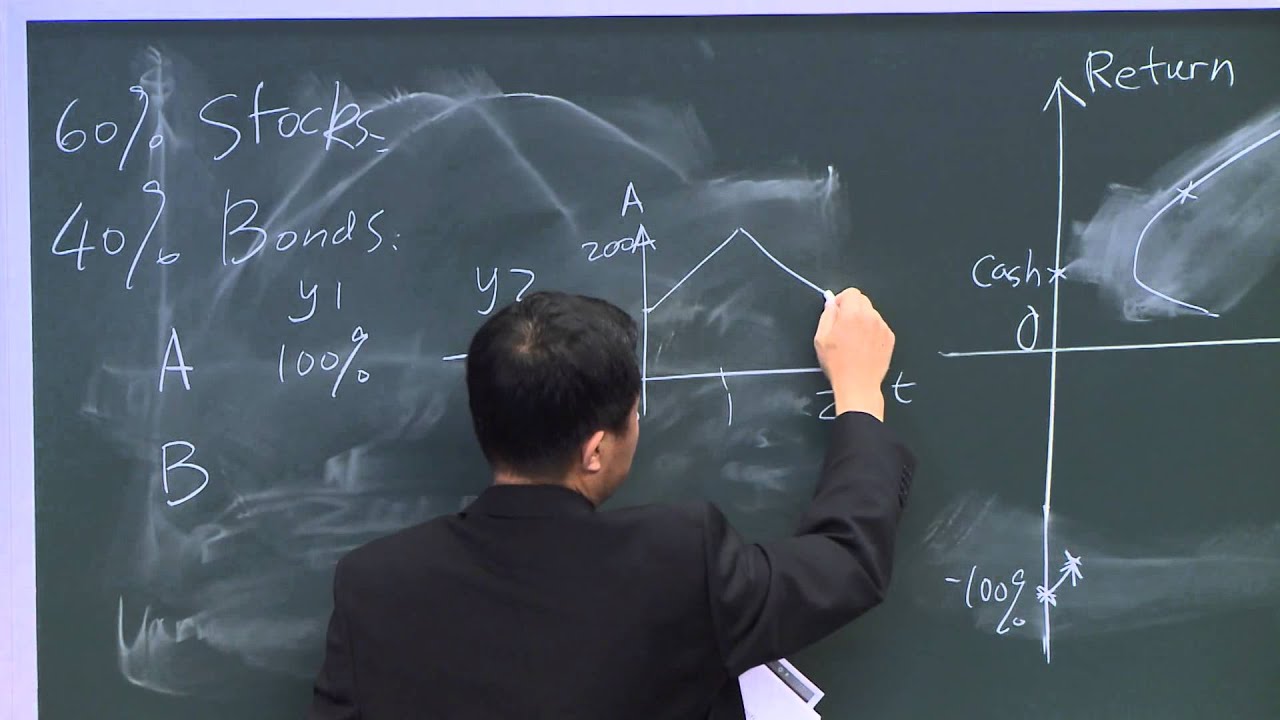

16. Portfolio Management

Показать описание

MIT 18.S096 Topics in Mathematics with Applications in Finance, Fall 2013

Instructor: Jake Xia

This lecture focuses on portfolio management, including portfolio construction, portfolio theory, risk parity portfolios, and their limitations.

License: Creative Commons BY-NC-SA

Instructor: Jake Xia

This lecture focuses on portfolio management, including portfolio construction, portfolio theory, risk parity portfolios, and their limitations.

License: Creative Commons BY-NC-SA

16. Portfolio Management

What is Project Portfolio Management? PM in Under 5

What do Portfolio Managers do? - Project Management Training

Applied Portfolio Management - Class 1 - Risk & Return

Portfolio Manager Interview Questions | Do You Dare To Take The Quiz?

What is Portfolio Management vs. Project Management?

Lean Portfolio Management in SAFe: Connecting Strategy to Execution

Project Portfolio Management | Project Portfolio | Project Management Training | Invensis Learning

Groww | Bank nifty | less Capital more profit 🔥💹 | 16 August 2024 | Friday

CFA® Level I Portfolio Management - Portfolio Construction: Strategic vs Tactical Asset Allocation

How Government Companies are Growing like anything 🚀 by Green Portfolio

Managing Bond Portfolios PT1

5 Steps of Project Portfolio Management

The Regrets of An Accounting Major @zoeunlimited

CFA® Level I Portfolio Management - Portfolio Management Process

A $16B hedge fund CIO gives an easy explanation of quantitative trading

Project Portfolio Management Defined

Project Portfolio Management [A BEGINNER'S GUIDE]

Agile Portfolio Management

Agile Portfolio Management

4. What is an Asset Management Company (AMC)

SigFig Robo-Advisor Review | Investment Management and Free Portfolio Tracker

Portfolio diversification explained - Portfolio management #shib #shorts #crypto #bitcoin

Introduction to Portfolio Management - with Murali Kulathumani

Комментарии

1:28:38

1:28:38

0:04:47

0:04:47

0:03:05

0:03:05

1:14:52

1:14:52

0:03:43

0:03:43

0:05:04

0:05:04

0:57:51

0:57:51

0:27:25

0:27:25

0:00:11

0:00:11

0:05:49

0:05:49

0:01:00

0:01:00

0:13:44

0:13:44

0:00:23

0:00:23

0:00:37

0:00:37

0:04:19

0:04:19

0:00:57

0:00:57

0:06:06

0:06:06

0:06:34

0:06:34

1:16:39

1:16:39

0:03:45

0:03:45

0:03:15

0:03:15

0:08:48

0:08:48

0:00:50

0:00:50

0:47:09

0:47:09