filmov

tv

Portfolio Optimization in Excel: Step by Step Tutorial

Показать описание

"Portfolio Optimization in Excel: Step by Step Tutorial" is your ultimate resource for mastering portfolio management techniques using Excel. This tutorial will walk you through step-by-step instructions on how to maximize returns and minimize risk, leveraging data-driven strategies for smarter investment decisions. Whether you're a novice investor or a seasoned portfolio manager, this video will provide you with the tools and insights needed to optimize your portfolio effectively.

👨💼 My Freelance Financial Modeling Services:

🎓 Tutor With Me: 1-On-1 Video Call Sessions Available

Chapters:

0:00 - Intro to "Portfolio Optimization in Excel"

0:48 - Inputs Required to Find the Optimal Portfolio

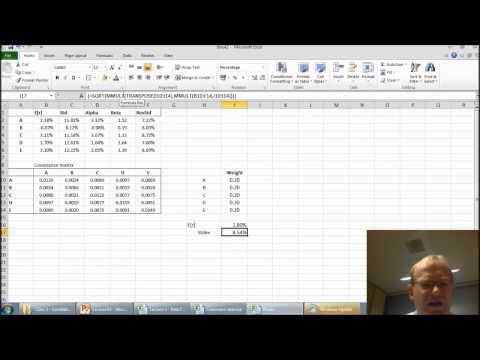

1:18 - Calculating the Expected Return of Individual Securities

5:49 - Calculating the Standard Deviation of Individual Securities

7:16 - Assigning Minimum & Maximum Weights

8:02 - Creating the Covariance Matrix

10:29 - Calculate Portfolio Standard Deviation

11:36 - Calculate Portfolio Expected Return

12:10 - Find the Risk Free Rate of Return

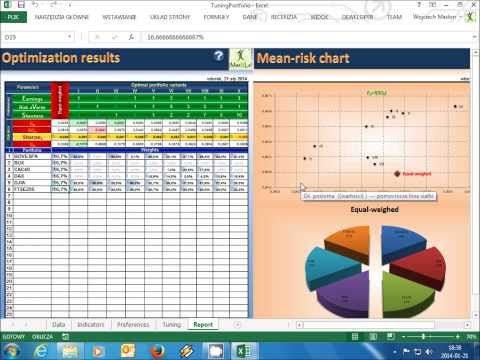

12:35 - Find the Optimal Portfolio in Excel

*Disclosure: This is not financial advice and should not be taken as such. The information contained in this video is an opinion. Some of the information could be wrong. This channel is owned and operated by Portfolio Constructs LLC

👨💼 My Freelance Financial Modeling Services:

🎓 Tutor With Me: 1-On-1 Video Call Sessions Available

Chapters:

0:00 - Intro to "Portfolio Optimization in Excel"

0:48 - Inputs Required to Find the Optimal Portfolio

1:18 - Calculating the Expected Return of Individual Securities

5:49 - Calculating the Standard Deviation of Individual Securities

7:16 - Assigning Minimum & Maximum Weights

8:02 - Creating the Covariance Matrix

10:29 - Calculate Portfolio Standard Deviation

11:36 - Calculate Portfolio Expected Return

12:10 - Find the Risk Free Rate of Return

12:35 - Find the Optimal Portfolio in Excel

*Disclosure: This is not financial advice and should not be taken as such. The information contained in this video is an opinion. Some of the information could be wrong. This channel is owned and operated by Portfolio Constructs LLC

Комментарии

0:15:26

0:15:26

0:08:46

0:08:46

0:17:10

0:17:10

0:11:57

0:11:57

0:19:35

0:19:35

0:17:02

0:17:02

0:07:28

0:07:28

0:21:51

0:21:51

0:19:00

0:19:00

0:17:36

0:17:36

0:06:22

0:06:22

0:17:46

0:17:46

0:02:18

0:02:18

0:14:25

0:14:25

0:14:43

0:14:43

0:32:47

0:32:47

0:19:22

0:19:22

0:03:27

0:03:27

0:07:02

0:07:02

0:02:41

0:02:41

0:31:12

0:31:12

0:15:53

0:15:53

0:09:54

0:09:54

0:08:47

0:08:47