filmov

tv

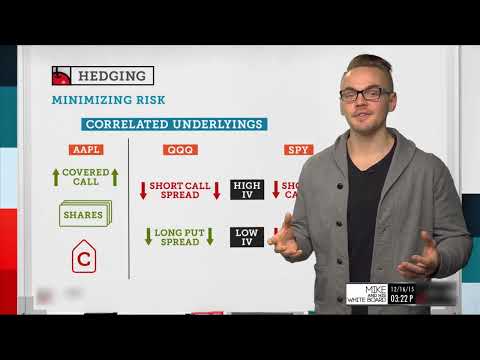

Hedging Options with Theta and Delta

Показать описание

The greatest rival of option traders is volatility, so Frank and Pete show you how to reduce the effect vol has on your portfolio by hedging with theta and delta. The guys go deep on portfolio theta and stock movement to show you how much exposure you should take in Small Exchange products per unit of theta from options.

Learn how to hedge against fluctuations in volatility with futures contracts from the Small Exchange.

The Small Exchange is making markets more accessible to more people with products that mix the efficiency of futures with the simplicity of stocks. The Smalls offer easily adoptable solutions to risk management and speculative needs of the modern trader in markets ranging from stocks and bonds to currencies and commodities.

Follow Small Exchange:

© 2020 Small Exchange, Inc. All rights reserved. Small Exchange, Inc. is a Designated Contract Market registered with the U.S. Commodity Futures Trading Commission. The information in this advertisement is current as of the date noted, is for informational purposes only, and does not contend to address the financial objectives, situation, or specific needs of any individual investor. Trading futures involves the risk of loss, including the possibility of loss greater than your initial investment.

Learn how to hedge against fluctuations in volatility with futures contracts from the Small Exchange.

The Small Exchange is making markets more accessible to more people with products that mix the efficiency of futures with the simplicity of stocks. The Smalls offer easily adoptable solutions to risk management and speculative needs of the modern trader in markets ranging from stocks and bonds to currencies and commodities.

Follow Small Exchange:

© 2020 Small Exchange, Inc. All rights reserved. Small Exchange, Inc. is a Designated Contract Market registered with the U.S. Commodity Futures Trading Commission. The information in this advertisement is current as of the date noted, is for informational purposes only, and does not contend to address the financial objectives, situation, or specific needs of any individual investor. Trading futures involves the risk of loss, including the possibility of loss greater than your initial investment.

Комментарии

0:11:24

0:11:24

0:30:39

0:30:39

0:05:18

0:05:18

0:28:00

0:28:00

0:24:30

0:24:30

0:10:47

0:10:47

0:31:04

0:31:04

0:34:31

0:34:31

0:10:26

0:10:26

0:32:22

0:32:22

0:14:25

0:14:25

0:07:31

0:07:31

0:12:42

0:12:42

0:13:53

0:13:53

0:24:53

0:24:53

0:28:48

0:28:48

0:05:34

0:05:34

0:13:12

0:13:12

0:51:47

0:51:47

0:00:45

0:00:45

0:25:09

0:25:09

0:14:03

0:14:03

0:00:26

0:00:26

0:11:43

0:11:43