filmov

tv

Output VAT in the Philippines (Value-Added Tax)

Показать описание

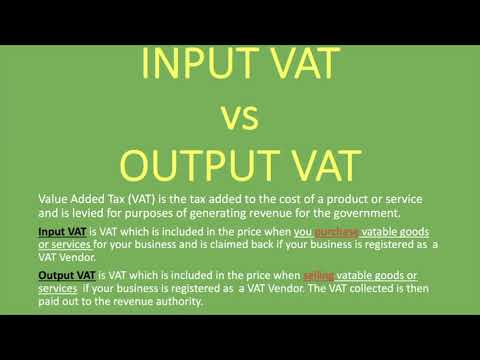

Output Value-Added Tax (VAT) is the VAT that a VAT registered entity shifts to its consumers. The VAT that a business shifts to is output VAT, representing the VAT applied to the goods or services it provides.

📖 On sale of goods and properties - twelve percent (12%) of the gross selling price or gross value in money of the goods or properties sold, bartered or exchanged

📖 On sale of services and use or lease of properties - twelve percent (12%) of gross receipts derived from the sale or exchange of services, including the use or lease of properties

📖 On importation of goods - twelve percent (12%) based on the total value used by the Bureau of Customs in determining tariff and customs duties, plus customs duties, excise taxes, if any, and other charges, such as tax to be paid by the importer prior to the release of such goods from customs custody; provided, that where the customs duties are determined on the basis of quantity or volume of the goods, the VAT shall be based on the landed cost plus excise taxes, if any.

📖 On export sales and other zero-rated sales - 0%

===========================

🔗 Mentioned Links:

===========================

⏰ Time Stamps:

0:00 Intro`

0:26 VAT Registration

2:05 Output VAT Defined

2:26 VATable Transaction

2:59 Zero-rated Sales

3:59 Vat-exempt Sales

5:15 Outro

===========================

#vat #outputvat #tax #bir #valueaddedtax #businesstax #tax #outputvat #inputvat #taxes #taxation #income #incometax #regularsale #zeroratedsale #exemptsale #incometaxation #train #trainlaw #philippines #philippinetaxation #philippinetax #bir #howto #learntax #learntaxation #tutorial #taxtutorial #taxationtutorial #revenue #revenueregulation #nirc #taxcode #bureauofinternalrevenue #internalrevenue #nationaltax #accounting #finance

===========================

📚 Social Media

========================

🗣 Disclaimer:

This video is mainly for academic purposes and is not a substitute in doing your due diligence. For highly technical tax issues, you are advised to seek professional assistance or contact BIR for proper tax compliance

📖 On sale of goods and properties - twelve percent (12%) of the gross selling price or gross value in money of the goods or properties sold, bartered or exchanged

📖 On sale of services and use or lease of properties - twelve percent (12%) of gross receipts derived from the sale or exchange of services, including the use or lease of properties

📖 On importation of goods - twelve percent (12%) based on the total value used by the Bureau of Customs in determining tariff and customs duties, plus customs duties, excise taxes, if any, and other charges, such as tax to be paid by the importer prior to the release of such goods from customs custody; provided, that where the customs duties are determined on the basis of quantity or volume of the goods, the VAT shall be based on the landed cost plus excise taxes, if any.

📖 On export sales and other zero-rated sales - 0%

===========================

🔗 Mentioned Links:

===========================

⏰ Time Stamps:

0:00 Intro`

0:26 VAT Registration

2:05 Output VAT Defined

2:26 VATable Transaction

2:59 Zero-rated Sales

3:59 Vat-exempt Sales

5:15 Outro

===========================

#vat #outputvat #tax #bir #valueaddedtax #businesstax #tax #outputvat #inputvat #taxes #taxation #income #incometax #regularsale #zeroratedsale #exemptsale #incometaxation #train #trainlaw #philippines #philippinetaxation #philippinetax #bir #howto #learntax #learntaxation #tutorial #taxtutorial #taxationtutorial #revenue #revenueregulation #nirc #taxcode #bureauofinternalrevenue #internalrevenue #nationaltax #accounting #finance

===========================

📚 Social Media

========================

🗣 Disclaimer:

This video is mainly for academic purposes and is not a substitute in doing your due diligence. For highly technical tax issues, you are advised to seek professional assistance or contact BIR for proper tax compliance

Комментарии

0:06:02

0:06:02

0:07:21

0:07:21

0:07:46

0:07:46

0:03:31

0:03:31

0:08:10

0:08:10

0:09:47

0:09:47

0:06:03

0:06:03

0:00:49

0:00:49

0:58:27

0:58:27

0:09:16

0:09:16

0:04:35

0:04:35

0:13:13

0:13:13

0:01:27

0:01:27

0:14:22

0:14:22

0:01:12

0:01:12

0:03:05

0:03:05

0:15:12

0:15:12

0:07:41

0:07:41

0:03:00

0:03:00

0:09:20

0:09:20

0:13:22

0:13:22

1:11:09

1:11:09

0:19:23

0:19:23

0:06:08

0:06:08