filmov

tv

Learn how to compute 12% VAT in 3 minutes. Gross, Net, Inclusive, Exclusive.

Показать описание

Learn how to compute 12% VAT in the Philippines. What formula to use and what is Gross of VAT, Net of VAT. How to remember which is Inclusive or exclusive. Taxation tips for Accounting students, graduates, reviewees. Vat in Official receipts, Resibo. CPA board exam quick review tutorial.

Learn how to compute 12% VAT in 3 minutes. Gross, Net, Inclusive, Exclusive.

Calculate VAT figures

How to calculate VAT - Simple Method VAT Calculation

How I learned to Calculate Extremely Fast

How to Calculate VAT in Excel | Calculate the VAT amount |Calculate Selling Price | value added tax

How to Calculate the Circumference of a Circle

Finger Mathematics - How to calculate Faster than a calculator Mental maths - 10

How to calculate VAT in excel |calculate VAT in excel | value added tax | excel formulas

INTEGRATION//Trick to calculate Integration #shorts #maths #cbse// CLASS-12TH

GCSE Maths - How to Calculate Simple Interest #95

How to Calculate Faster than a Calculator - Mental Maths #1

How to Calculate Faster than a Calculator - Mental Maths #2| Addition and Subtraction

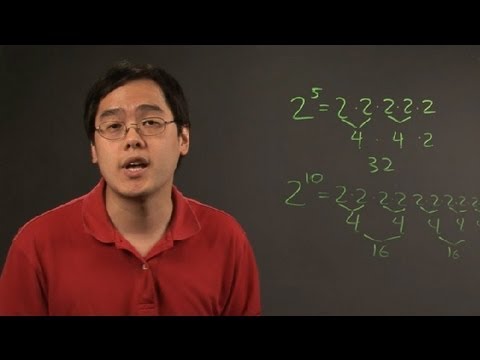

How to Compute a Number With a Very High Exponent : Trigonometry & Other Math

How To Calculate 10 Percent Discount on Calculator

Calculate hours between two times

Mathematics: How to Calculate Commission (examples)

Math Help : How to Calculate an Average

How to Calculate Percentages of Total in Excel

Final Exam Grade Needed (How to Calculate)

How To Calculate The Number of Days Between Two Dates In Excel

Percentage Trick | Calculate percentage in Mind | percentages made easy | zero math | in english

How to Calculate the Cost Price Easy Trick

Calculate 12th Mark Percentage in Tamil | TMM Tamilan

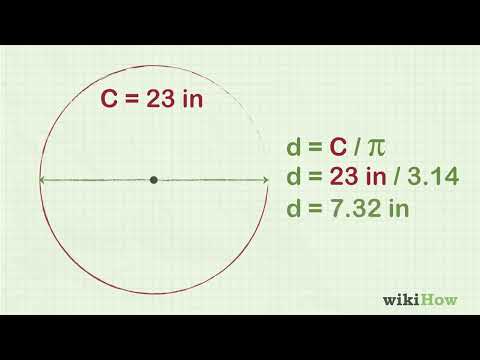

How to Calculate the Diameter of a Circle

Комментарии

0:03:31

0:03:31

0:07:41

0:07:41

0:02:48

0:02:48

0:05:18

0:05:18

0:02:06

0:02:06

0:00:59

0:00:59

0:13:33

0:13:33

0:02:03

0:02:03

0:01:01

0:01:01

0:04:05

0:04:05

0:05:42

0:05:42

0:08:00

0:08:00

0:01:49

0:01:49

0:01:51

0:01:51

0:00:45

0:00:45

0:12:07

0:12:07

0:01:44

0:01:44

0:01:13

0:01:13

0:01:48

0:01:48

0:01:18

0:01:18

0:06:32

0:06:32

0:05:32

0:05:32

0:01:28

0:01:28

0:02:19

0:02:19