filmov

tv

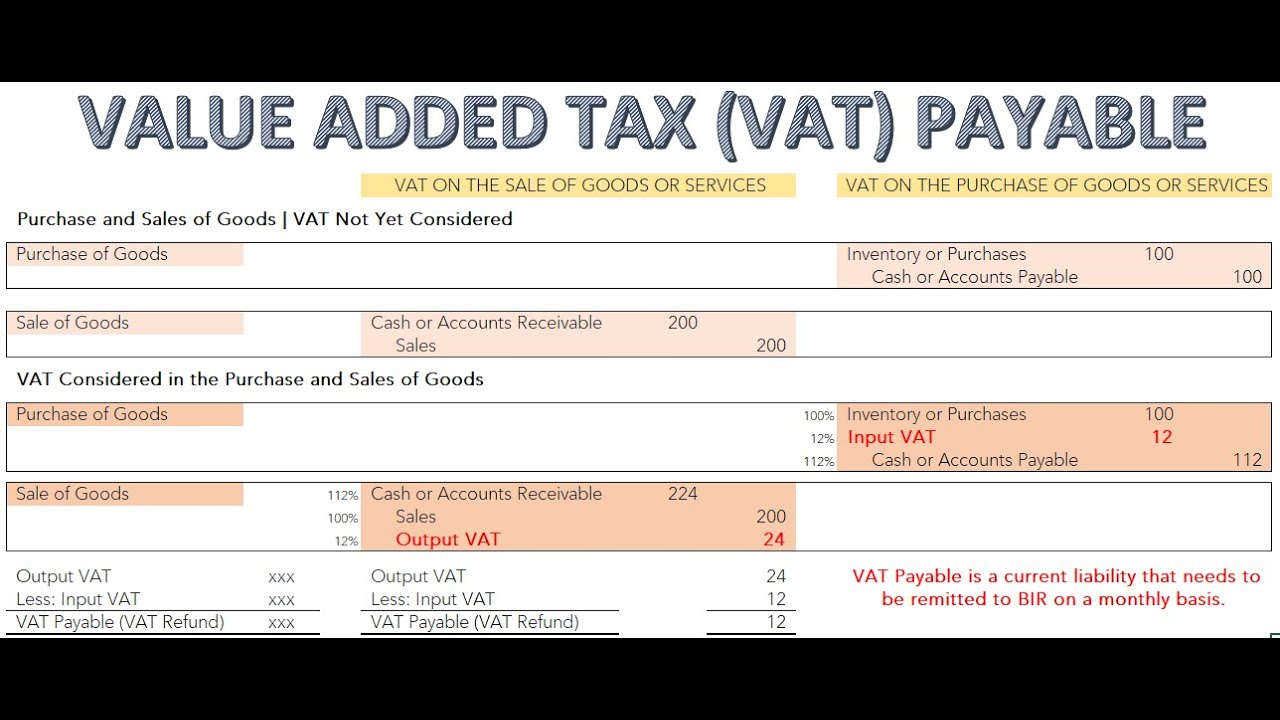

Accounting for VAT Payable | Input and Output VAT

Показать описание

#FAR #IntermediateAccounting #SirATheCPAProf

Input VAT vs Output VAT | Explained

(VAT) Value Added Tax - Whiteboard Animation Explanation

Calculate VAT figures

Accounting for VAT Payable | Input and Output VAT

Accounting: VAT

VAT Inclusive & VAT Exclusive | Calculation Examples

All About VAT & Its Accounting Treatment | Value Added Tax | Accountant Training Series 27 | By ...

VAT Accounting basis

KASNEB BLOCK REVISION 2024

Taxes and VAT | Odoo Accounting

Value added tax practical accounting treatment 2020

Grade 11 Accounting Term 4 | VAT part 2 VAT inputs and output | Paper 2 Exam 2024

VAT Value Added Tax explained

VAT FOR BUSINESS EXPLAINED!

UAE VAT Complete Course | VAT Accounting Tutorial | Value Added Tax Training

Financial Accounting VAT

Accounting 2020: Paper 2 Support: Value Added Tax (VAT)

UK ACCOUNTING & VAT IN 60 MINUTES

VAT (Grade 12 Accounting)

VAT Registration Explained By A Real Accountant - Value Added Tax UK

Input and Output Vat

Accounting Equation with VAT | Explained with Examples

One Accounting - Understanding VAT in 10 simple steps

Peachtree Accounting in Amharic part 8 | VAT system | Peachtree Amharic tutorial

Комментарии

0:07:46

0:07:46

0:04:35

0:04:35

0:07:41

0:07:41

0:14:22

0:14:22

0:11:40

0:11:40

0:11:09

0:11:09

0:31:04

0:31:04

0:05:51

0:05:51

6:48:54

6:48:54

0:06:14

0:06:14

0:09:36

0:09:36

0:12:44

0:12:44

0:07:33

0:07:33

0:08:29

0:08:29

0:23:40

0:23:40

0:08:01

0:08:01

0:12:00

0:12:00

1:47:37

1:47:37

0:05:07

0:05:07

0:06:56

0:06:56

0:08:32

0:08:32

0:30:34

0:30:34

0:35:34

0:35:34

0:09:00

0:09:00