filmov

tv

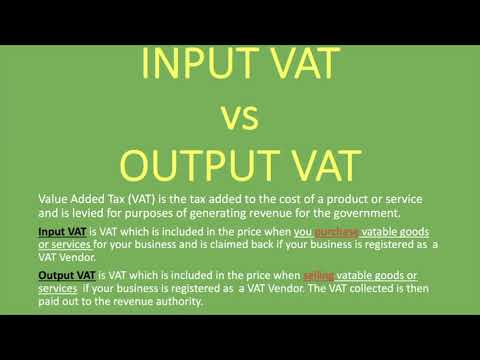

Input VAT vs Output VAT: What's the Difference?

Показать описание

In this video, we'll dive deep into the world of Value Added Tax (VAT) to help you understand Input VAT, Output VAT, and the key distinctions between them. We'll also clarify why Input VAT is treated as an asset while Output VAT is categorized as a liability.

By the end of this video, you'll have a solid grasp of Input VAT, Output VAT, the roles of VAT vendors, and the ins and outs of VAT payments and claims. So get ready to boost your financial knowledge and make smarter business decisions.

🤝 Join our community by hitting the "Subscribe" button and turning on the notification bell so you never miss a money-saving tip.

💬 Share your finance questions or insights in the comments – we love hearing from our viewers!

About Us:

Kountin Koins is here to help you learn about money and make better financial decisions. We explain accounting, finance, and tax strategies in a way that is easy to understand, even if you're a beginner.

Our channel is led by a Director of Finance with over 10 years of experience. We share practical tips, insightful explanations, and expert advice on all things finance, from accounting to budgeting and more.

By the end of this video, you'll have a solid grasp of Input VAT, Output VAT, the roles of VAT vendors, and the ins and outs of VAT payments and claims. So get ready to boost your financial knowledge and make smarter business decisions.

🤝 Join our community by hitting the "Subscribe" button and turning on the notification bell so you never miss a money-saving tip.

💬 Share your finance questions or insights in the comments – we love hearing from our viewers!

About Us:

Kountin Koins is here to help you learn about money and make better financial decisions. We explain accounting, finance, and tax strategies in a way that is easy to understand, even if you're a beginner.

Our channel is led by a Director of Finance with over 10 years of experience. We share practical tips, insightful explanations, and expert advice on all things finance, from accounting to budgeting and more.

Комментарии

0:07:46

0:07:46

0:08:10

0:08:10

0:03:05

0:03:05

0:04:35

0:04:35

0:07:21

0:07:21

0:08:32

0:08:32

0:06:02

0:06:02

0:13:22

0:13:22

0:08:08

0:08:08

0:11:09

0:11:09

0:09:47

0:09:47

0:06:08

0:06:08

0:14:37

0:14:37

0:03:34

0:03:34

0:11:40

0:11:40

0:07:41

0:07:41

0:03:31

0:03:31

0:10:01

0:10:01

0:11:09

0:11:09

0:14:22

0:14:22

0:12:05

0:12:05

0:13:50

0:13:50

0:00:49

0:00:49

0:16:41

0:16:41