filmov

tv

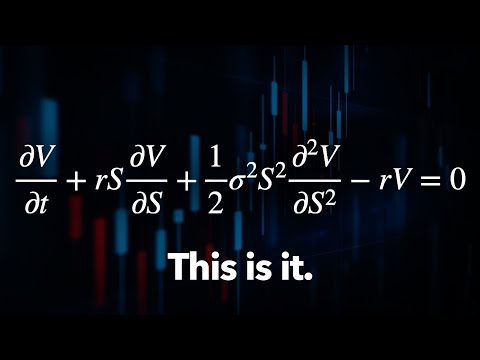

An illustration of Black Scholes’ Delta Hedging

Показать описание

Illustrates using some numeric examples the effectiveness of Black Scholes’ delta hedging argument to replicate the option price.

An illustration of Black Scholes’ Delta Hedging

Warren Buffett: Black-Scholes Formula Is Total Nonsense

Introduction to the Black-Scholes formula | Finance & Capital Markets | Khan Academy

Black Scholes Explained - A Mathematical Breakdown

Black Scholes Formula explained simply

Is the Black Scholes Actually Used in the Real World

The Black-Scholes Model EXPLAINED

Black Scholes Option Pricing Model Explained In Excel

The Easiest Way to Derive the Black-Scholes Model

An intuitive explanation the Black Scholes' formula

Unlocking the Black-Scholes Model: Visualizing the Power of Options Trading in 60 Seconds

The Trillion Dollar Equation

Mastering the Black-Scholes Model: Essential Knowledge for Options Traders

19. Black-Scholes Formula, Risk-neutral Valuation

Black-Scholes Option Pricing Model -- Intro and Call Example

How to interpret N(d1) and N(d2) in Black Scholes Merton (FRM T4-12)

The Normal Distribution Tables and Black Scholes Model (1973)

KASNEB-CPA-Financial Management-BLACK SCHOLES OPTION MODEL

Black-Scholes in Python: Option Pricing Made Easy

What are the deficiencies of the Black-Scholes model? Why is the BS model still used?

Black Scholes model (BSM) and Merton Model Explained! Specially used by traders.

The Black Scholes PDE

Examples of boundary conditions in the Black-Scholes equation

Deriving Black-Scholes Theorem on Live

Комментарии

0:11:38

0:11:38

0:15:54

0:15:54

0:10:24

0:10:24

0:14:03

0:14:03

0:03:40

0:03:40

0:08:29

0:08:29

0:10:40

0:10:40

0:09:23

0:09:23

0:09:53

0:09:53

0:05:48

0:05:48

0:00:59

0:00:59

0:31:22

0:31:22

0:00:59

0:00:59

0:49:52

0:49:52

0:13:39

0:13:39

0:14:12

0:14:12

0:02:27

0:02:27

0:19:31

0:19:31

0:12:22

0:12:22

0:05:37

0:05:37

1:30:19

1:30:19

0:05:56

0:05:56

0:09:25

0:09:25

0:00:12

0:00:12