filmov

tv

Using The Infinite Banking Concept To Pay Off Debt, Buy Cars, & Plan For Retirement

Показать описание

Discover the truth about infinite banking with Chris Naugle as he joins Ryan Pineda in a conversation debunking misconceptions and explaining the optimal use of Whole Life.

---

If you want to level up, text me at 725-444-5244!

---

Connect with Chris!

YouTube - @TheChrisNaugle

In 2022, Ryan Pineda hosted Chris Naugle, renowned for his infinite banking strategy. For those skeptical about infinite banking, Chris debunked misconceptions and elucidated how Whole Life is intended to be employed for optimal results. The conversation extended to Chris's earlier life as a professional snowboarder, unraveling how he transitioned into the financial realm. They explored his journey into TV with a show on house flipping, a milestone Ryan is yet to achieve!

Chris's multifaceted life and diverse projects made for an engaging discussion. The audience is sure to find their conversation compelling and insightful!

---

If you want to level up, text me at 725-444-5244!

---

Connect with Chris!

YouTube - @TheChrisNaugle

In 2022, Ryan Pineda hosted Chris Naugle, renowned for his infinite banking strategy. For those skeptical about infinite banking, Chris debunked misconceptions and elucidated how Whole Life is intended to be employed for optimal results. The conversation extended to Chris's earlier life as a professional snowboarder, unraveling how he transitioned into the financial realm. They explored his journey into TV with a show on house flipping, a milestone Ryan is yet to achieve!

Chris's multifaceted life and diverse projects made for an engaging discussion. The audience is sure to find their conversation compelling and insightful!

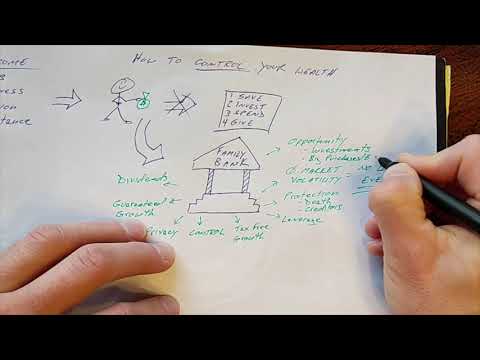

The Infinite Banking Concept explained

The Infinite Banking Concept EXPLAINED! And How To Get Started | Chris Naugle

Infinite Banking Concept: The Pros and Cons You Need to Know

Why Infinite Banking is a SCAM!

How To Use The Infinite Banking Concept

Heated Debate Between Infinite Banker and Dave Ramsey

The Infinite Banking System Explained (Full Breakdown!)

How the Wealthy Pay Off Debt and Buy Cars Without Using Their Own Money

Turning the tide on financial losses with Infinite Banking

The Infinite Banking Concept Explained

The Infinite Banking Concept Made Simple (with Illustrations)

What is the INFINITE BANKING Concept? #velocitybanking #IBC

How I lost $534,000 Through Infinite Banking - The Chris Naugle

Infinite Banking Concept EXPLAINED - Be Your Own Bank!

Infinite Banking With IUL Versus Whole Life

Infinite Banking For Beginners | Wealth Nation

Using The Infinite Banking Concept To Pay Off Debt, Buy Cars, & Plan For Retirement

Infinite Banking Concept Explained (Honest and Unbiased)

Paying Cash vs The Infinite Banking Concept

How to Get Started with The Infinite Banking Concept

This Is Nelson Nash: The Creator of The Infinite Banking Concept

The Infinite Banking Concept for Real Estate Investing

The Infinite Banking Concept, Explained

Got Questions About The Infinite Banking Concepts? Watch This! | Chris Naugle

Комментарии

0:04:27

0:04:27

0:23:07

0:23:07

0:05:38

0:05:38

0:09:17

0:09:17

0:06:34

0:06:34

0:09:34

0:09:34

0:21:22

0:21:22

2:22:21

2:22:21

0:00:47

0:00:47

0:06:45

0:06:45

0:07:29

0:07:29

0:05:15

0:05:15

0:40:28

0:40:28

0:05:37

0:05:37

0:15:47

0:15:47

0:12:50

0:12:50

0:50:29

0:50:29

0:27:02

0:27:02

0:10:42

0:10:42

0:08:46

0:08:46

1:02:06

1:02:06

0:26:03

0:26:03

0:00:16

0:00:16

0:14:27

0:14:27