filmov

tv

Infinite Banking With IUL Versus Whole Life

Показать описание

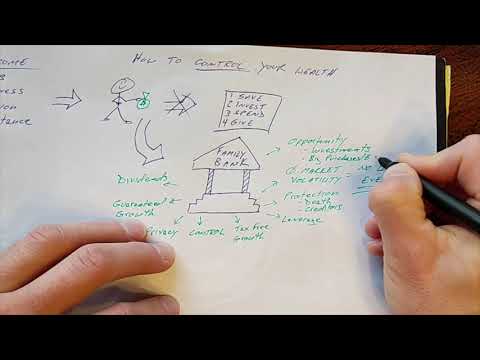

Some people say whole life insurance is way better than IULs while other people say the opposite. In this video, I'll share my thoughts on infinite banking with IUL vs whole life insurance and why one of them is so much better than the other.

To your abundance!

Doug Andrew

Key Moments In This Episode

========================

00:00 Intro & Summary

00:33 About Me

01:16 Two Types of Insurance

04:51 IUL vs Whole Life Insurance

09:42 Two Ways of Borrowing Money

14:12 Get My Book!

What To Watch Next

========================

Is Life Insurance A Bad Investment?

Did you love this video?

Want to learn more wealth and life empowerment lessons from Doug?

Here are some next steps!

========================

How to Diversify and Create the Foundation for a Tax-Free Retirement

How to Lead Your Family/Business from “ME” to “WE”

Visit Doug Andrew’s website:

Music

========================

Song: LiQWYD - Glow (Vlog No Copyright Music)

Music provided by Vlog No Copyright Music

30 Day free trial of TubeBuddy:

========================

Video by Nate Woodbury

#DougAndrew

#3DimensionalWealth

#AbundantLiving

To your abundance!

Doug Andrew

Key Moments In This Episode

========================

00:00 Intro & Summary

00:33 About Me

01:16 Two Types of Insurance

04:51 IUL vs Whole Life Insurance

09:42 Two Ways of Borrowing Money

14:12 Get My Book!

What To Watch Next

========================

Is Life Insurance A Bad Investment?

Did you love this video?

Want to learn more wealth and life empowerment lessons from Doug?

Here are some next steps!

========================

How to Diversify and Create the Foundation for a Tax-Free Retirement

How to Lead Your Family/Business from “ME” to “WE”

Visit Doug Andrew’s website:

Music

========================

Song: LiQWYD - Glow (Vlog No Copyright Music)

Music provided by Vlog No Copyright Music

30 Day free trial of TubeBuddy:

========================

Video by Nate Woodbury

#DougAndrew

#3DimensionalWealth

#AbundantLiving

Комментарии

0:15:47

0:15:47

0:41:21

0:41:21

0:01:01

0:01:01

0:12:33

0:12:33

0:09:17

0:09:17

1:00:01

1:00:01

0:09:48

0:09:48

0:21:13

0:21:13

0:20:49

0:20:49

0:04:27

0:04:27

0:06:29

0:06:29

0:19:07

0:19:07

1:01:04

1:01:04

0:19:21

0:19:21

0:12:37

0:12:37

0:04:09

0:04:09

0:06:55

0:06:55

0:01:30

0:01:30

0:05:48

0:05:48

0:20:18

0:20:18

0:29:21

0:29:21

0:14:38

0:14:38

0:35:05

0:35:05

0:18:46

0:18:46