filmov

tv

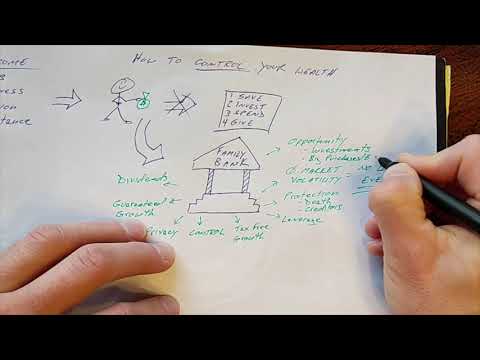

The Infinite Banking Concept for Real Estate Investing

Показать описание

The Infinite Banking Concept for Real Estate Investing

We’ve had many guests on the podcast who have educated us on the Infinite Banking Concept. This is a strategy that uses whole life insurance to create a banking system within your own finances. It’s an incredibly effective strategy, and can be used for purchasing cash flowing real estate.

But for whatever reason, it’s a strategy I have not yet utilized in our personal portfolio. In this video, Natali and I are starting to get our feet wet in the world of investing with life insurance! We’ll give an overview of some of the questions we asked an expert, and how we plan to use this tool in our overall investing strategy.

You'll learn about the value of having whole term life insurance to invest. We’ll share how we started down this rabbit hole, and how we plan to move forward using the Infinite Banking Concept. We'll talk about our initial hesitations about this strategy, and more! If you're interested in making your money work for you, this video is for you!

VIDEOS ABOUT GETTING STARTED IN REAL ESTATE

VIDEOS ABOUT REAL ESTATE NEWS

SUBSCRIBE AND JOIN OUR AWESOME COMMUNITY:

SUBSCRIBE TO THE iTUNES PODCAST:

FOLLOW ME ON SOCIAL MEDIA:

DISCLAIMER: I am not a financial adviser. I only express my opinion based on my experience. Your experience may be different. These videos are for educational and inspirational purposes only. Investing of any kind involves risk. While it is possible to minimize risk, your investments are solely your responsibility. It is imperative that you conduct your own research. There is no guarantee of gains or losses on investments.

AFFILIATE DISCLOSURE: Some of the links on this channel are affiliate links, meaning, at NO additional cost to you, I may earn a commission if you click through and make a purchase and/or subscribe. However, this does not impact my opinion. We recommend them because they are helpful and useful, not because of the small commissions we make if you decide to use their services. Please do not spend any money on these products unless you feel you need them or that they will help you achieve your goals.

We’ve had many guests on the podcast who have educated us on the Infinite Banking Concept. This is a strategy that uses whole life insurance to create a banking system within your own finances. It’s an incredibly effective strategy, and can be used for purchasing cash flowing real estate.

But for whatever reason, it’s a strategy I have not yet utilized in our personal portfolio. In this video, Natali and I are starting to get our feet wet in the world of investing with life insurance! We’ll give an overview of some of the questions we asked an expert, and how we plan to use this tool in our overall investing strategy.

You'll learn about the value of having whole term life insurance to invest. We’ll share how we started down this rabbit hole, and how we plan to move forward using the Infinite Banking Concept. We'll talk about our initial hesitations about this strategy, and more! If you're interested in making your money work for you, this video is for you!

VIDEOS ABOUT GETTING STARTED IN REAL ESTATE

VIDEOS ABOUT REAL ESTATE NEWS

SUBSCRIBE AND JOIN OUR AWESOME COMMUNITY:

SUBSCRIBE TO THE iTUNES PODCAST:

FOLLOW ME ON SOCIAL MEDIA:

DISCLAIMER: I am not a financial adviser. I only express my opinion based on my experience. Your experience may be different. These videos are for educational and inspirational purposes only. Investing of any kind involves risk. While it is possible to minimize risk, your investments are solely your responsibility. It is imperative that you conduct your own research. There is no guarantee of gains or losses on investments.

AFFILIATE DISCLOSURE: Some of the links on this channel are affiliate links, meaning, at NO additional cost to you, I may earn a commission if you click through and make a purchase and/or subscribe. However, this does not impact my opinion. We recommend them because they are helpful and useful, not because of the small commissions we make if you decide to use their services. Please do not spend any money on these products unless you feel you need them or that they will help you achieve your goals.

Комментарии

0:04:27

0:04:27

1:02:06

1:02:06

0:23:07

0:23:07

0:07:29

0:07:29

0:09:17

0:09:17

0:26:03

0:26:03

0:21:22

0:21:22

0:27:02

0:27:02

2:46:26

2:46:26

0:06:45

0:06:45

0:05:15

0:05:15

0:28:52

0:28:52

0:59:33

0:59:33

0:19:23

0:19:23

0:04:08

0:04:08

0:40:28

0:40:28

0:05:37

0:05:37

0:13:43

0:13:43

0:47:24

0:47:24

0:24:00

0:24:00

0:11:07

0:11:07

0:58:29

0:58:29

0:10:42

0:10:42

0:00:16

0:00:16