filmov

tv

VAT FOR BUSINESS EXPLAINED!

Показать описание

Wondering what 'VAT' is all about? In this video Dan runs you through some examples of how VAT works, and how it affects your business.

Topics include:

How does VAT work

What is VAT

What does VAT mean

When to register for VAT

VAT threshold

Is VAT good for new business

When is it a good idea to VAT register

..... and more!

#selfemployed #VAT #limitedcompany #smallbusiness

If you have further questions - please get in touch below.

You can see more about what we get up to on the following:

Call: 02392 240040

Topics include:

How does VAT work

What is VAT

What does VAT mean

When to register for VAT

VAT threshold

Is VAT good for new business

When is it a good idea to VAT register

..... and more!

#selfemployed #VAT #limitedcompany #smallbusiness

If you have further questions - please get in touch below.

You can see more about what we get up to on the following:

Call: 02392 240040

VAT FOR BUSINESS EXPLAINED!

VAT FOR BUSINESS EXPLAINED!

(VAT) Value Added Tax - Whiteboard Animation Explanation

VAT for Business Explained! Utilise VAT as a Sole Trader or Limited Company!

VAT Registration Explained By A Real Accountant - Value Added Tax UK

UK VAT for small businesses explained

VAT For Businesses - Explained In 60 Seconds - A UK Business Owners Guide

VAT Value Added Tax explained

VAT For Small Businesses - Tips and Advice (VAT Series: Video 4)

How does VAT work in South Africa?

SHOULD I BE VAT REGISTERED?

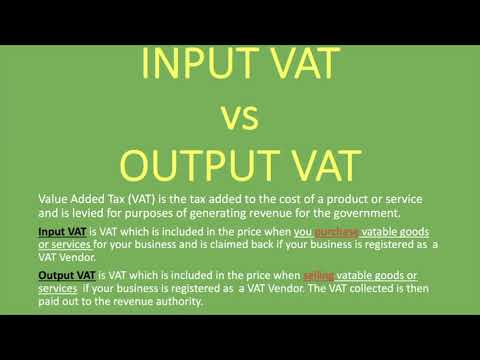

Input VAT vs Output VAT | Explained

VAT Value Added Tax Explained - The Basics

What is VAT in the UK?

VAT Tax Explained

VAT for Irish Businesses

VAT FLAT RATE SCHEME EXPLAINED (BASICS)!

How to complete a VAT return - the basics

US Sales Tax & UK VAT Explained | How they both work? | Enablers

Introduction to Business Tax | Basics of Percentage Tax and VAT

SPLITTING YOUR BUSINESS UP TO AVOID VAT – DOES IT WORK? (UK)

VAT (Value Added Tax) In Kenya - All you need to know | Joe Gachira

Vat (value added tax) On Business Services [Explained!!] UK 2021 (How Does VAT Work?) - Simple

VAT: How to calculate VAT as a business owner

Комментарии

0:08:29

0:08:29

0:25:03

0:25:03

0:04:35

0:04:35

0:04:24

0:04:24

0:06:56

0:06:56

0:04:27

0:04:27

0:00:50

0:00:50

0:07:33

0:07:33

0:06:51

0:06:51

0:19:20

0:19:20

0:06:58

0:06:58

0:07:46

0:07:46

0:12:11

0:12:11

0:10:58

0:10:58

0:38:03

0:38:03

0:18:07

0:18:07

0:09:12

0:09:12

0:02:23

0:02:23

0:06:55

0:06:55

0:06:02

0:06:02

0:08:20

0:08:20

0:10:01

0:10:01

0:01:19

0:01:19

0:03:34

0:03:34