filmov

tv

The Value Added Tax: A Hidden New Tax to Finance Much Bigger Government

Показать описание

(VAT) Value Added Tax - Whiteboard Animation Explanation

What is VAT? | Back to Basics

VAT Value Added Tax explained

Value added tax (VAT)

The Problems With Value Added Tax | VAT RANT

ANALYSIS: Value Added Tax

VAT Background 1

VAT Value Added Tax Explained - The Basics

NGF Endorses Revised Valued Added Tax Sharing Formula

How a Value Added Tax could spark economic growth

How to Calculate VAT in Excel | Calculate the VAT amount |Calculate Selling Price | value added tax

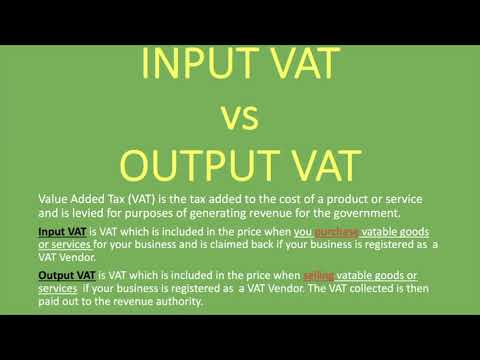

Input VAT vs Output VAT | Explained

VAT Value Added Tax Explained

Value-Added Tax (VAT) | Finance Strategists | Your Online Finance Dictionary

Calculate VAT figures

VAT Inclusive & VAT Exclusive | Calculation Examples

Value Added Tax Summary

PFT - VALUE ADDED TAX [ VAT]

VALUE ADDED TAX - DEDUCTIBLE INPUT VAT

V.A.T Payable

Value Added Tax – VAT (part 1) - ACCA Taxation (FA 2022) TX-UK lectures

Value Added Tax (VAT) in the Philippines

VALUE-ADDED TAX | With Updates in TRAIN Law and RA 11467

VAT - Calculations

Комментарии

0:04:35

0:04:35

0:04:34

0:04:34

0:07:33

0:07:33

0:04:49

0:04:49

0:15:14

0:15:14

0:06:02

0:06:02

0:08:42

0:08:42

0:12:11

0:12:11

0:01:31

0:01:31

0:03:20

0:03:20

0:02:06

0:02:06

0:07:46

0:07:46

0:06:01

0:06:01

0:01:52

0:01:52

0:07:41

0:07:41

0:11:09

0:11:09

0:39:00

0:39:00

0:42:06

0:42:06

0:27:03

0:27:03

0:11:09

0:11:09

0:20:01

0:20:01

0:07:21

0:07:21

1:11:09

1:11:09

0:16:56

0:16:56